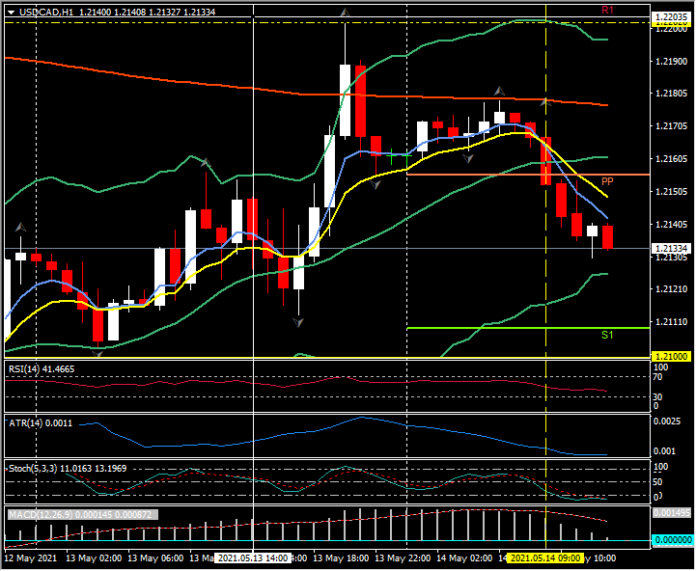

USDCAD, H1

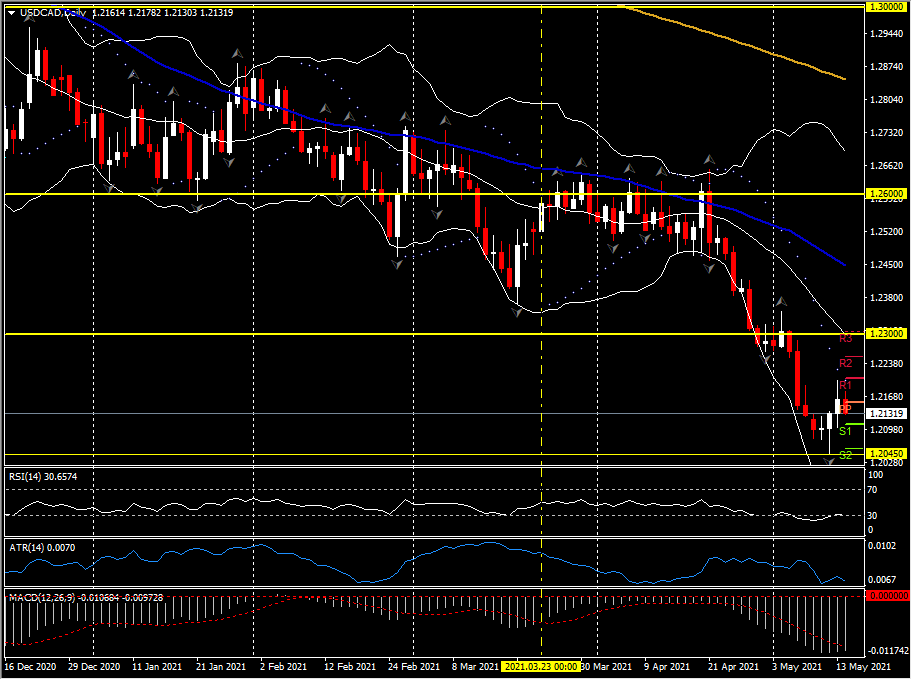

USDCAD’s rebound from the 44-month low that was seen earlier in the week at 1.2045 capped out yesterday at 1.2202, which was an eight-day high. A jump in the US dollar’s yield advantage on longer-dated sovereign debt maturities, as a consequence of the hotter than expected April CPI data out of the US, alongside a drop in commodity and oil prices, gave USDCAD an underpinning. Oil prices remain over 4% down on the highs seen earlier in the week. Today resistance sits at the 20-hour moving average at 1.2165, the 200-hour moving average at 1.2180 and R1, above the eight-day high, at 1.2208. The lower Bollinger band at 1.2125 is first support, followed by S1 at 1.2110 and 1.2100. Today’s S2 is just north of the 44-month low from Wednesday at 1.2056.

The Crossing EMA Strategy triggered lower at 1.2152 today following the rally over the last two days, and the rejection of the 200-hour EMA. RSI is 41 and falling, while the MACD Histogram and Signal line are also falling but remain over the 0 line, currently. The Stochastics moved into the oversold zone earlier today, and remain there. The H1 ATR is 0.0011, the H4 ATR is 0.0038 and the Daily ATR is 0.0070. The fast exponential moving averages (5 & 9) remain aligned lower. The Bollinger band mid line is at 1.2161.

Key US Retail Sales data later, along with the UoM Consumer Sentiment Index, will be vital to where the USD settles this week. Yesterday BoC Governor Macklem reiterated that the bank will continue to support the economy until a complete recovery takes place, explaining that employment needs to be 200k above pre-pandemic levels, firms reinvesting again and a healthy job market for all. He said the economy is 500k jobs below the pre-pandemic level and hence “700k below where we really should be.”

The Canadian dollar remains bullish in the bigger-picture prognosis, given the success of vaccinations and ramping-up global supply capacity for vaccine production, which along with massive global stimulus and the release of pent-up pandemic demand should keep the global reflation trade on track into 2022. The 20-day moving average for the pair sits at 1.2300.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.