Inflation’s hot potato has led to speculation that the major Central Banks and not solely the Fed might consider tapering, which is the narrative that is developing in the market at the moment. However, in its repeated statements, the Fed has said that higher inflation is temporary and any policy tightening needs review. This means that the clear message conveyed about its ultra-accommodative policy will continue and it will still maintain the current level of QE. However, a stricter policy is unlikely in the short term.

The RBNZ held its monthly policy meeting earlier today. The RBNZ maintained the currency policy at 0.25% (OCR), while the allocation for the LSAP program (NZD 100 billion large-scale asset purchase program) and funds for the Lending Program are also maintained. This is in line with ANZ Bank’s projections in their recent statement that the RBNZ expects to start raising rates in August next year.

Interestingly, the RBNZ projected a policy rate of 0.25% in September 2021, up to 0.31% in June 2022, and projected a rise to 0.49% in September 2022 and 1.78% in June 2024.

In addition, the RBNZ revised its inflation forecast to 1.5% for June 2022 against the previous forecast of 1.4%. The RBNZ insists that they will maintain a loose currency policy until they are confident that the inflation target and labour sector objectives are met. Although the RBNZ was somewhat ‘adjourned’ at this meeting, they also stressed that it will take time and patience to achieve the targets set, and they are also still closely looking at the risks associated with Covid-19.

The outcome of the meeting looks reasonable if we consider that New Zealand data has been quite strong in recent times, although risks remain as price pressures escalate. Employment rose for the second straight quarter in the first three months of this year, pushing the unemployment rate lower to 4.7% and further below the pandemic peak. Upward pressure is also seen in the inflation gauge over the same period, with the headline CPI figure crawling to 1.5% y/y over the same period and to the highest since Q2 2020. Supply congestion and increased demand could push inflation above the RBNZ midpoint target of 2.0% in the coming quarter.

New Zealand is a success story in containing the pandemic, with a rapid reaction to secede from the rest of the world and closing its borders to protect its citizens from external transmission of the virus. Vaccination progress and the uncertainty surrounding the new virus variant and bond sales are still weighing on business and consumption plans.

RBNZ Governor Adrian Orr in a press conference said that economic price pressures are now expected to be only temporary and the business sector is showing signs of increasing investment. He also explained that the RBNZ is confident in using the rate projection (OCR) as a future guide to the market.

New Zealand Dollar

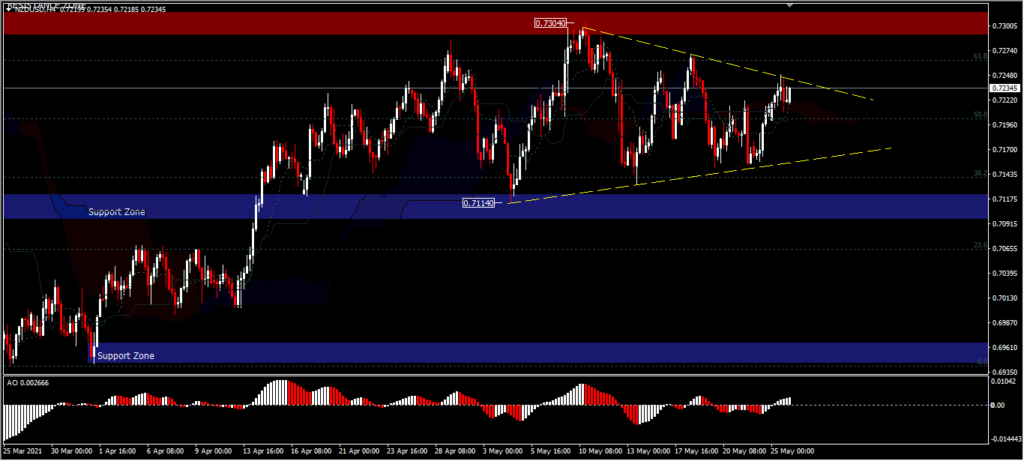

NZDUSD strengthened following the monthly policy meeting by the Reserve Bank of New Zealand (RBNZ) this morning. NZDUSD surged today, and it is now starting to test the resistant level at 0.7315, the highest level since March 2021. If these pars fail to survive, the 2021 high of 0.7465 will be the next target. MA-50 Daily is below that at 0.7141. Based on current sentiment, USD weakness and positive intonation from the RBNZ, bulls are expected to remain in control of the market for the short term.

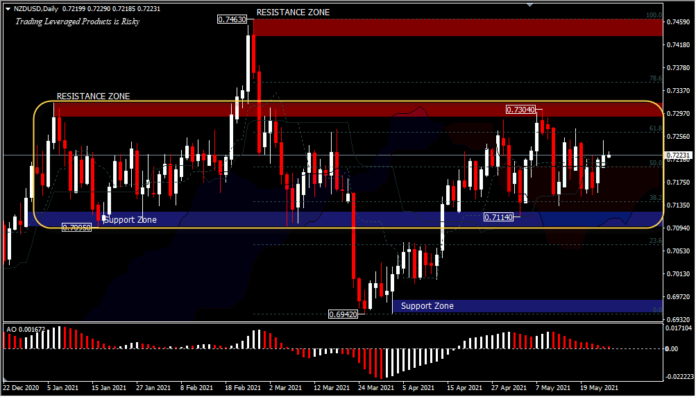

In the last 30 days, the NZDUSD currency pair has been consolidating with a range around 190p (0.7114-0.7304). In Tuesday’s trading, it edged up by 1.25% at 0.7315. The USD was broadly weaker against most majors. Technically, prior to the RBNZ meeting the price range was narrow, while the AO signal is still positive in the buy zone with the average price moving above Kumo. Price movement above 0.7300 will have implications for the price targeting the 0.7463 peak formed last February; as long as this level holds the bias will return to consolidation mode, and if it is strong it will break the support range 0.7114 to target the 0.6942 support.

NZDUSD, H4.

Click here to access our Economic Calendar

Ady Phangestu and Tunku

Market Analysts – HF Educational office – Indonesia and Malaysia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.