Market News Today – Treasuries slumped after news President Biden will offer a $6 tln spending plan on Friday. Gilts led a sell off in EGBs yesterday after hawkish leaning comments from BoE’s Vlieghe hinted at the possibility of an early rate hike. Wall Street was generally firmer on reflation trades and the stimulus news, though the major indexes also lost altitude into the close as the administration also indicated it wanted to make the capital gains tax increase retroactive to April. As for the data, the mixed numbers didn’t provided any clear directional clues. The BoJ is reportedly mulling an extension of the pandemic relief program as Japan prepares to extend its state of emergency. Stock markets at least moved broadly higher across the Asia-Pacific region. JPN225 jumped 2.1%, at 29,127.

Today, stock markets are not really spooked and the GER30 and UK100 are up 0.3% and 0.4% respectively, alongside broad gains in US futures. In the meantime, German import prices were released and jumped 10.3% y/y in April, the highest reading since December 2010 and up from 6.9% y/y in the previous month. Base effects from energy prices remain the main driving factor, with oil prices up nearly 200%, prices for mineral oil products nearly 80% and natural gas up nearly 60%.

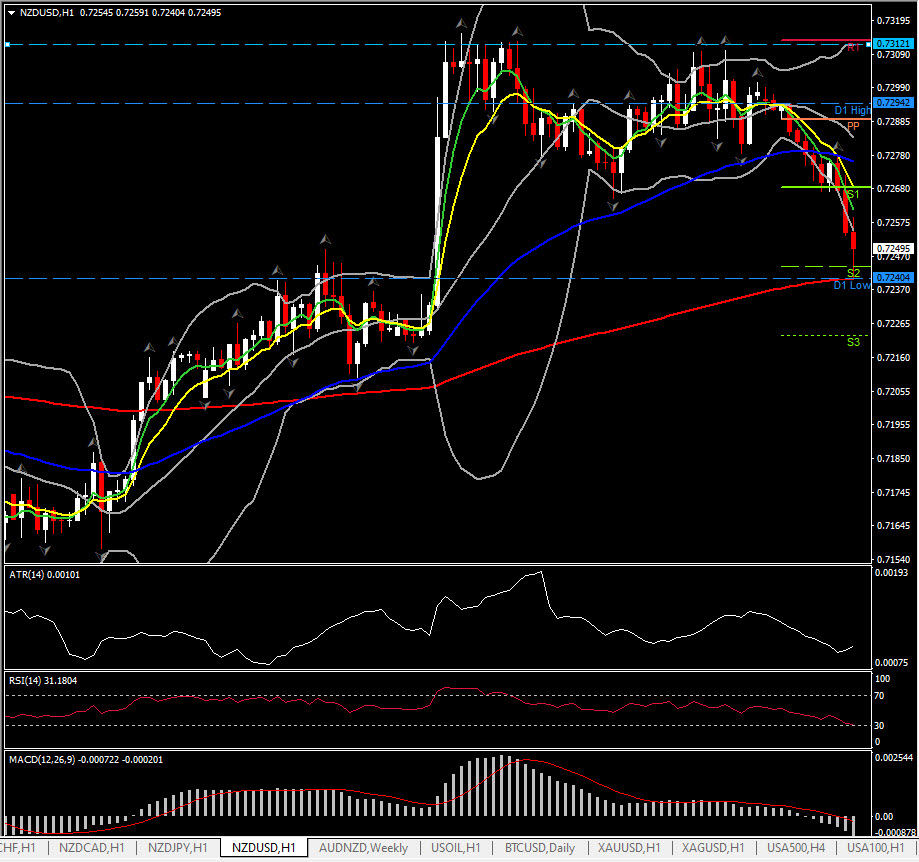

In FX markets, NZD eased across the board, while USD and Yen were sought. NZDUSD is at 0.7240 (200-period EMA). Both EUR and GBP moved lower against the Dollar, with EURUSD at 1.2175 and Cable at 1.4105. USOIL rallied to $67.16. Gold is at $1889.30 ahead of today’s data.

Today: Local data releases today are likely to support the recovery story, with Eurozone ESI economic confidence, and key US data in the PM session, i.e. PCE, Michigan Index and Good Trade Balance. The G7 meeting of Finance Ministers and central bankers may also attract some attention.

Biggest Mover @ (07:30 GMT – NZDUSD -0.65%) NZDUSD dipped to 0.7240. In the 1 hour chart, faster MAs remain aligned lower, RSI 31 and still sloping, MACD histogram & signal line turned below zero. H1 ATR 0.0010, Daily ATR 0.0069.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.