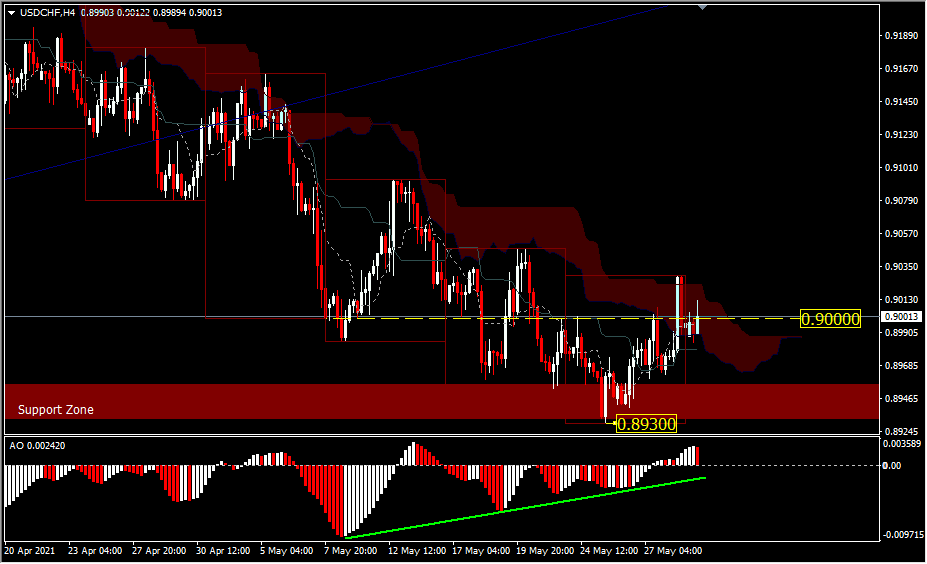

USDCHF, H4

The Dollar majors have been directionally unambitious, with both UK and US markets out for public holidays today. The Yuan saw some action, however, falling back after the PBoC fixed the currency at its highest level against the Dollar since May 2017. An ex-PBoC official, in an interview with the state-backed Xinhua news agency over the weekend, said that the recent rapid appreciation of the Yuan is unsustainable.

In data, preliminary May inflation data out of German states came in higher than expected. Asian data were mixed, including strong retail sales combined with slightly weaker than anticipated production readings out of Japan, while China’s official PMI numbers were also mixed, with the manufacturing PMI disappointing, flagging a slowdown in the pace of expansion, while the non-manufacturing reading improved. As for the Dollar, we expect the prevailing downside bias will remain in force, with the USDCHF a case in point.

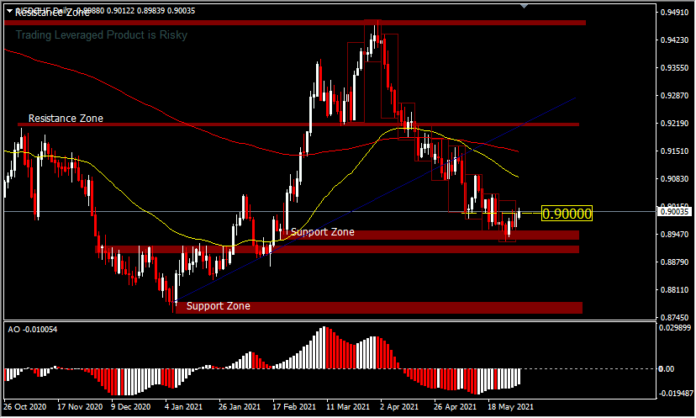

The intraday bias remains neutral enough to consolidate above 0.8930. Further decline will take effect as long as the resistance at 0.9046 remains intact. On the downside, a break of 0.8930 should extend the 0.9471 decline, to retest the 0.8756 low. However, on the upside a break of 0.9045 will show a short term bottom. The intraday bias will return to the upside for a stronger rebound. For now, the price is consolidating at the psychological level of 0.9000. The divergence bias is clearly visible, but the intersection of Kinjun Sen and Tenken Sen is below Kumo, not yet a positive confirmation for a valid reversal; this cross will only be positive if it occurs above Kumo. However in that direction, the price needs to go beyond Kumo, as the rebound wave that was formed last week has not completely surpassed the last bearish wave.

Click here to access our Economic Calendar

Ady Phangestu

Analyst – HF Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.