Global recovery expectations continue to firm while inflation worries have abated, for now. The employment reports are the hot topic of the week, since after encouraging employment in the Eurozone and Germany, next on tap are US Non-Farm payrolls and the Canadian employment release. The latter however is expected to disappoint for May as the unemployment change is expected to increase. Canadian employment is projected to post a -40.0k drop for April amid increased restrictions as infections ramped higher, while the unemployment rate should come in at 8.2%.

In April, Canada employment fell -207.1k after the 303.1k surge in March, leaving a decline that was a bit stronger than expected but well within the large forecast range for this release. Full time employment declined -129.4k after the 175.4k gain while part time positions shrunk -77.8k following the 127.8k rise in March. The unemployment rate rose to 8.1% from 7.5%. The participation rate eased to 64.9% from 65.2%. The average hourly wage rate of permanent employees fell -1.6% y/y after a 2.0% gain in March, with the annual decline during April driven by a difficult comparison (April of 2020 saw an all-time high growth rate of 10.5%).

The report revealed the roughly as-expected contraction in the labour market amid increased restrictions (Ontario was shut down, other regions were impacted) that came alongside a jump in infections during the month. Even though the base case remains for a return to labour market growth this is expected to be seen later this year as vaccinations take hold and restrictions are eased.

The Canadian Dollar has been experiencing and is expected to continue experiencing an overall bullish movement for more than a year now as the country vaccinated more than 50% of the population in 5 months, reaching the government’s goals, even though its vaccine roll out lags the US and UK. The Canadian economy is recovering fast, as housing investment continued to grow at a strong pace, supported by very favorable financing conditions and the recovery in the job market. Meanwhile the sizable pop in the latest CPI – which was close to what was expected by analysts and the BoC – increased worries that the BoC and other major central banks will have to trim emergency measures sooner than had previously been expected, which weighed on stocks globally, and that spilled over to Canada’s equity market. The BoC will probably raise its current key interest rate of 0.25% in late 2022 and this will result in a stronger Loonie.

Nonetheless, the BoC is likely to look through the slump/limited growth in Q2 as vaccinations have ramped up and restrictions returned in April and May, consistent with a resumption of the recovery in the second half of this year.

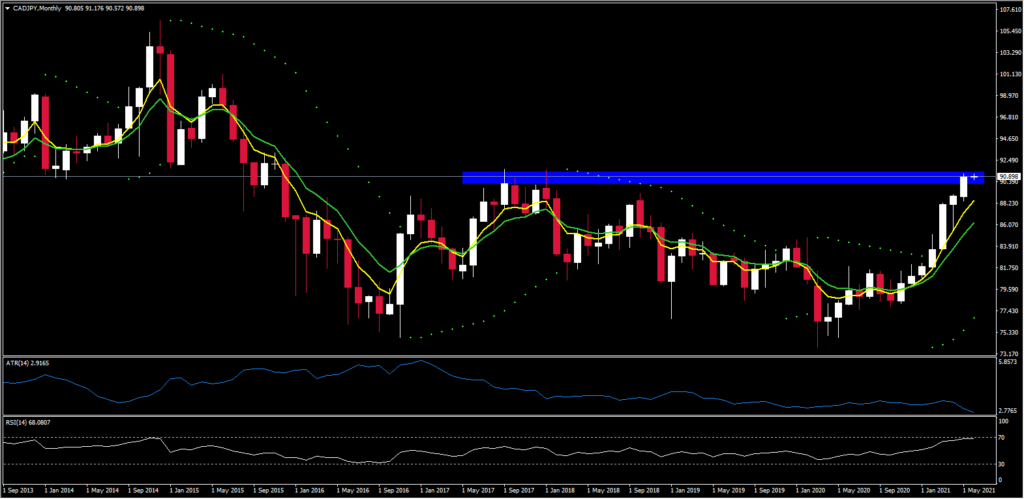

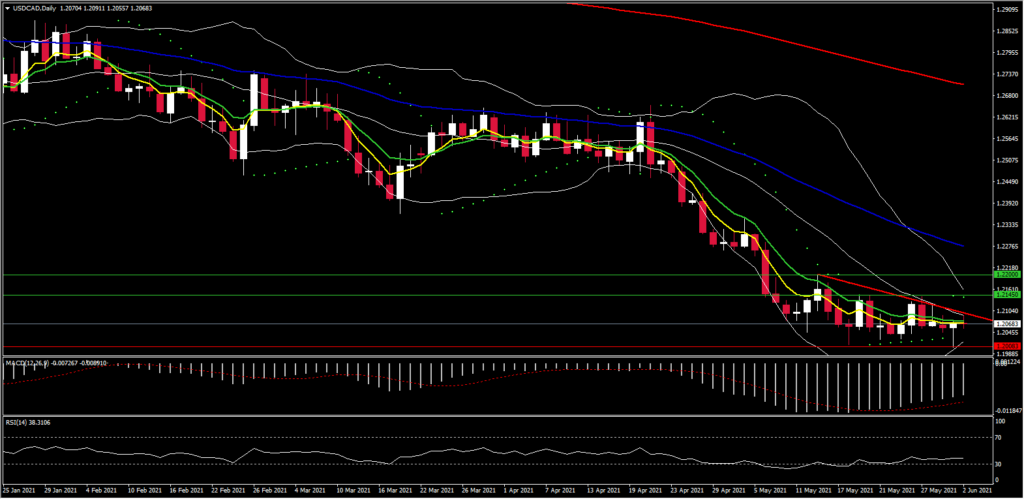

However the last couple of days the Canadian Dollar has been seen settling lower ahead of Friday’s releases from the US and Canada. USDCAD is modestly higher today, at the 1.2070-1.2080 area after printing a 6-year low at 1.2005 yesterday. At the same time, the CADJPY cross, which we have been bullish on for nearly a year as well, has settled slightly lower after hitting a new 41-month high.

If on Friday, the Canadian labor report misses forecasts and presents low jobs growth and a rising unemployment rate, then this could weigh on the Canadian Dollar, and USDCAD could be seen extending higher. Immediate Resistance levels fall at the 20-DMA and 12-day high, at 1.2093 and 1.2145 respectively. Further buying pressure above this level could lift the asset to 50-DMA at 1.2280.

On the contrary, an encouraging jobs report could benefit Loonie against Greenback, and could drive USDCAD to the 1.2000 psychological level which provides initial support, though sell-stops are reported parked under the figure. A break there would bring the May 2015 low of 1.1920 and 2013 highs into view.

Firmer commodity and oil prices should continue as the global recovery continues, which along with massive global stimulus , the success of Covid vaccinations and ramping-up global supply capacity for vaccine production should keep the global reflation trade on track into 2022 and should keep the CAD on a firmer footing.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.