As explained in a recent article, the Canadian Dollar has been experiencing and is expected to continue experiencing an overall bullish movement for more than a year now.

The employment reports are the hot topic of the week, since after encouraging employment in the Eurozone and Germany, next on tap are US Non-Farm payrolls and the Canadian employment release. The latter however is expected to disappoint for May as the unemployment change is expected to increase. Canadian employment is projected to post a -40.0k drop for April amid increased restrictions as infections ramped higher, while the unemployment rate should come in at 8.2%.

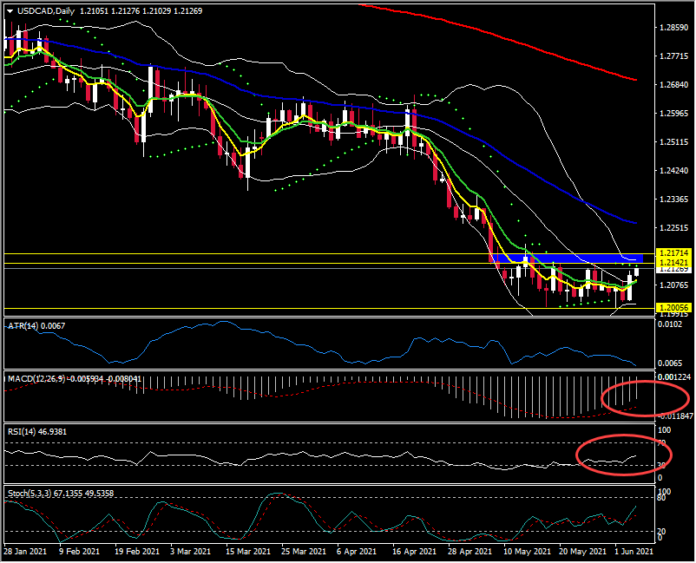

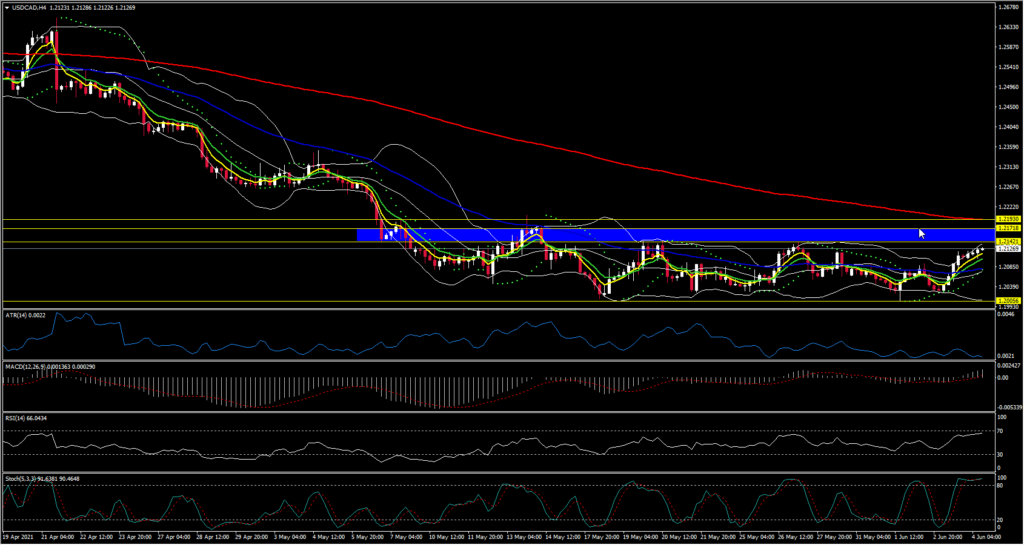

Meanwhile, with a few hours left before the release, USDCAD has extended the pair’s rebound to an 8-day high at 1.2128. The broadly stronger US Dollar and the imminent labour market reports out of both the US and Canada have inspired profit taking/position trimming. This has overridden the influence of higher oil prices.

USOIL yesterday printed a 32-month high at $69.40 following EIA data, which marked a near 5% gain on the week thus far, and has since remained underpinned. The EIA inventory data showed a 5.1 mln bbl fall in crude stocks. The Street had been expecting a 2.0 mln bbl draw, though the API reported a 5.4 mln bbl draw after the close on Tuesday. Meanwhile, gasoline supplies, seen down 1.5 mln bbls, actually rose 1.5 mln bbls, while distillate stocks were up 3.7 mln bbls, versus expectations for a 1.0 mln bbl increase. A neutral report overall.

Nonetheless, the spike higher remains supportive to oil correlating currencies, such as the Canadian Dollar. Crude markets have been underpinned by the OPEC+ group agreement this week to maintain production quotas — ie maintain supply at sub-capacity levels — despite improving global demand projections. As for the Canadian jobs data, it is likely to contrast the US jobs report, which is likely to paint a more robust picture, although there are still pandemic-era anomalies that are curtailing labour supply. Canada also released Q1 productivity and the April Ivey PMI reports. Hence the overall bullish outlook for the Canadian Dollar in the bigger-picture remains with or without a beat on jobs data today, given the success of Covid vaccinations and ramping-up global supply capacity for vaccine production, which along with massive global stimulus should keep the global reflation trade on track into 2022.

If the Canadian labor report misses forecasts and we see USDCAD extending higher then immediate Resistance levels fall at the May highs, at 1.2145, 1.2180 and 1.2193 (200-period EMA in 4-hour). Further buying pressure above this level could lift the asset to 50-DMA at 1.2280.

On the contrary, an encouraging jobs report could benefit Loonie against Greenback, and could drive USDCAD to the mid of its 2-week range, at 1.2070 (also 20-period SMA on the 4-hour chart). A break below the latter could retest the 1.2000 psychological level which provides strong support, though sell-stops are reported parked under the figure. A break there would bring the May 2015 low of 1.1920 and 2013 highs into view.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.