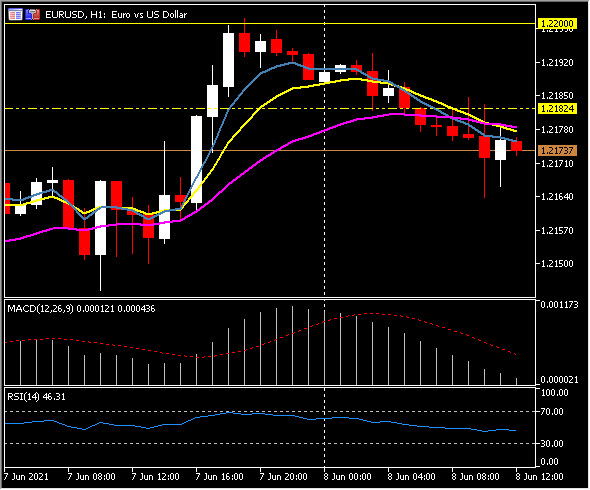

EURUSD, H1

The Dollar has traded firmer, reversing half or more than half of the declines seen yesterday versus its major peer currencies. This comes amid a cautious tone in global asset markets. Stock markets have stalled after the MSCI All Country World index scaled to a new record high yesterday. Oil prices and other industrial commodities are softer.

Regarding the US economy, the markets are continuing to digest the disappointing rise in May nonfarm payrolls amid a backdrop of a robust recovery, albeit with headwinds. The upshot is that Fed tapering worries have been pushed back somewhat. Additionally there’s wrangling on Capitol Hill over additional fiscal support.

Out of Europe, data has been mixed, with an unexpected upward revision to Q1 GDP, to -0.3% q/q from the preliminary estimate of -0.6% q/q, offset by an unexpected dip in the June German ZEW economic sentiment survey and an unforeseen contraction in April German production. There are silver linings to the data disappointments, with the expectations component of the ZEW survey the second highest in the series history (since 2001), while the outlook for production in Germany is good with producers sitting on a growing pile of unfilled orders.

Markets are now focusing on Thursday (June 10), which is when the ECB will announce its decision following its latest policy review and when the US releases May CPI data, which has heightened impact potential on markets given the prevailing focus on the Fed tapering debate. The next FOMC meeting is also looming, next week. The dollar bullish view in the bigger picture, puts weight on the outsized level of fiscal stimulus in the US while anticipating an eventual pivot at the Fed. For now, however, the higher inflation rate in the US relative to peers coupled with investors continuing to buy in to the Fed’s policy stance should keep the greenback on a backfoot. Expectations are that the ECB will drop its explicit reference to purchase targets and focus on the flexible nature of the programme, which may given the EURUSD some upside lift.

Little US data today, ahead of CPI on Thursday; US NFIB dipped 0.02 points to 99.6 in May following the 1.6 point jump to 99.8 in April. It was at 94.4 a year ago. Weakness in the expectations for a better economy, where the percentage of firms reporting such fell to -26% from -15%, while those expecting a positive earnings trend were at -11% from -7%. Those outweighed plans to higher which rose to 27% from 21%, and expectations of higher selling prices to 40% from 36% (the latter was the highest since 1986). Also of note was the record number of firms reporting job vacancies, leading to 33% of small business owners to increase pay. However the uncertainty index slipped to 79 from 80. The report noted the most important problem was the labor force and the quality of such. It was also reported that inflation was “rampant.” The US Trade deficit narrowed 8.2% to -$68.9 bln in April after widening 6.2% to -$75.0 bln (was $74.4 bln) in March, which is the record wide. Exports increased 1.1% to $205.0 bln after surging 7.5% to $202.7 bln (was $200.0 bln) previously. Imports declined -1.4% to $273.9 bln versus the prior 7.1% rebound to $277.7 bln (was $274.5 bln). Excluding petroleum, the trade balance was -$69.5 bln versus -$73.2 bln (was -$72.6 bln). The real trade balance on goods shrank to -$98.6 bln from -$105.8 bln (was -$103.1 bln).¹ Finally the JOLTS Jobs Openings² were firmer at 9.29 million versus expectations of 8.18 million and a revised 8.29 million (was 8.12 million) in May and 7.37 million in April.

Today, EURUSD cooled from yesterday’s test of 1.2200 to 1.2164 lows earlier, representing the 61.8 fib level from yesterday (June 7). The bounce higher took the pair to retrace the 61.8 Fib level from today (June 8) at 1.2188 before dipping back to 1.2175 following the US data.

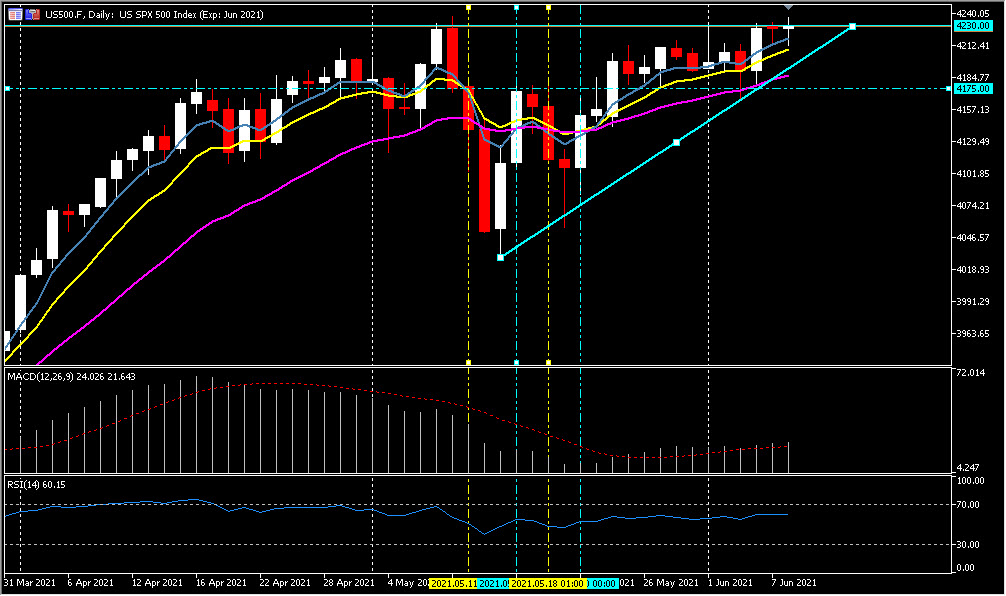

Most stocks have opened higher, USA500 up six points or 0.15% 4232.60, USA100 up 62 points or 0.45% 13943.70 and the USA30 is trading down -30 points or -0.10% 34594.93.

¹https://www.bea.gov/news/2021/us-international-trade-goods-and-services-april-2021

²https://www.bls.gov/news.release/archives/jolts_06082021.htm

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.