USA500 futures gained some strength in yesterday’s trading, as markets are bullish on stocks on the JOLTS report and ahead of the release of key inflation data later today. JOLTS Job Openings hit a series high of 9.3 million on the last business day of April, the US Bureau of Labor Statistics reports. Recruitment was little changed at 6.1 million. The hire rate was steady at 4.2%. Hiring was led by leisure at 1,424k. Layoffs declined -81k to 1,444k from -198k to 1,525k (was 1,480k) with the rate at 1.0% versus 1.1% (was 1.0%). Quitters increased 384k to 3,952k versus the 185k jump to 3,568k (was 3,508k). The quit rate rose to 2.7% from 2.5% (was 2.4%). The report reflects the anecdotes of huge demand for workers as the economy more fully reopens.

Treasury Yields moved lower initially which means that bond traders remain confident ahead of the inflation report. The 10-year Treasury yield is at 1.53%, down from 1.57%, while the 30-year is at 2.21%, down from 2.25%.

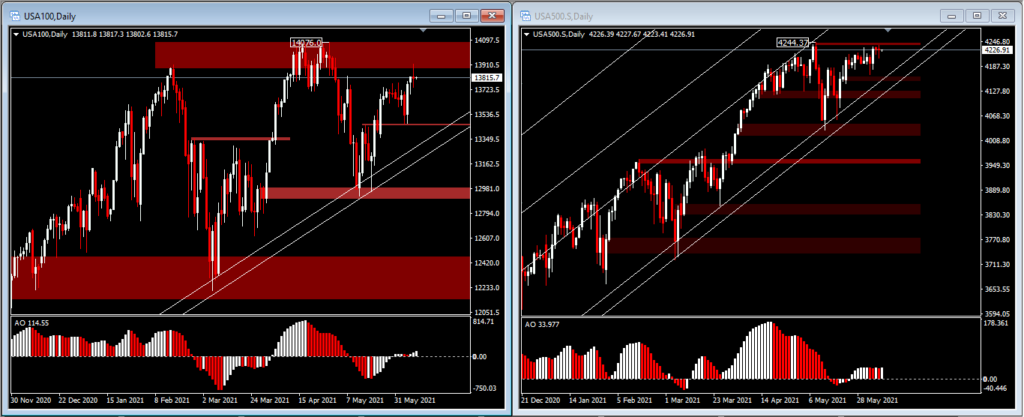

Lower yields usually mean bullishness for tech related stocks, which indeed moved higher with the USA100 forming the right shoulder in yesterday’s trading, although the recent G7 tax deal targeted the tech giants. This may weigh on their share prices in the future.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.