Market News Today – It was all about Treasuries again as yields continue to drop, and despite the rates tumbling to the lowest since March 3, ahead of the CPI data there was stellar demand for the 10-year auction.

10-year Treasury yields have dropped back a further -1.0 bp below 1.50% for the first time since March. Bearish positioning in Treasuries seems to be more extreme than initially thought. Bond markets across the Asia-Pacific region also found buyers, leaving the 10-year JGB rate down -0.1 bp at 0.060% and Australia’s 10-year rate down -8.9 bp at 1.48%.The September 10-year Bund future is up 7 ticks, while in cash markets the 10-year Treasury yield has dropped -1.2 bp to 1.48%.

Short covering and technicals remained big factors behind the move as bond bears threw in the towel on bearish inflation and Fed tapering bets.

Stock markets have been more cautions but benefited from the drop in yields, and indexes are mostly higher, while today the stocks are still in green with GER30 and UK100 futures up 0.1% and 0.3% at the moment and US futures also posting fractional gains, with indexes already at very high levels. JPN225 has gained 0.3%, the ASX is up 0.5% and Hang Seng and CSI 300 are 0.4% and 0.9% higher on the day.

Today – The ECB meeting takes center stage. The ECB is expected to keep the overall policy framework unchanged on Thursday, but review monthly purchase volumes under the PEPP program, which were “significantly” enhanced through Q2 as Europe fought with another surge of infections and a slow vaccine rollout. The US calendar will be of interest today, with the key May CPI report due.

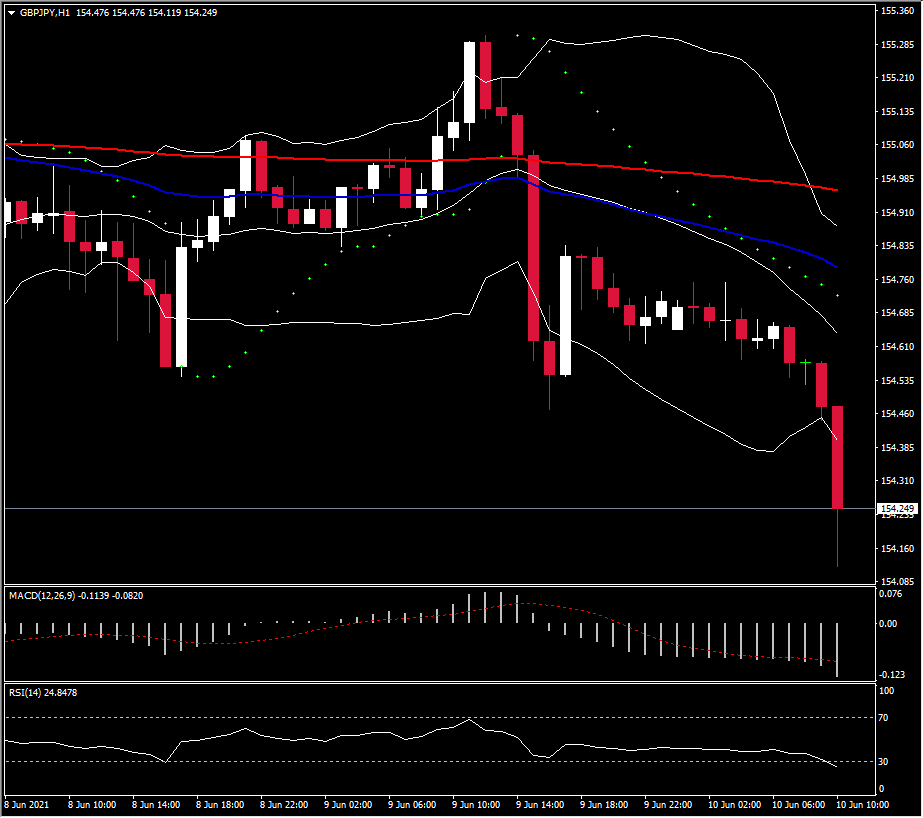

Biggest FX Mover – GBPJPY drops to the 154 level, after it opened the day below the 20-day MA. It has posted a reversal from 156 highs since the end of May. Next key Support is at 153.45, which is a confluence of May’s floor and lower BB pattern.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.