Market News Today – Markets closed flat to higher on Friday close to ATHs. Dollar rose into close and holds its bid today. EURUSD is little changed at 1.2106, Cable at 141.13 and JPY 109.70. Yields fell to 3-mth lows at 1.428% on Friday. Many Asian markets closed today; no data in the US calendar and Eurozone releases focusing on April production data. G7 proposed 1 billion vaccine doses for LIC, a global infrastructure plan to rival China’s Belt & Road 25 yr scheme, a charge against human rights and more talk on the climate crisis ahead of COP26 in November. USOil rallied to test $71.00 and Gold collapse continued down to $1858.

Week Ahead – All eyes on Wednesday (18:00 GMT) & the FOMC Announcement & Press Conference. Markets expecting more dovishness with “talk about talking about Tapering” not happening until the July or even September meeting. BOJ & SNB also on the stump. Biden meets Putin.

European Open – DAX and FTSE 100 futures are up 0.1% and 0.2% respectively, and US futures are also posting gains of around 0.1-0.2%. The G7 rebuke to China was met with a quick rebuttal. The U.K. meanwhile is set to push the full lifting of virus restrictions back into July against the background of a fresh rise in case numbers. ECB President Lagarde meanwhile is quoted by Politico as saying that its too early to debate the end of PEPP as officials need to really anchor the economy. The results of the ECB’s strategic policy review meanwhile are hoped to be on the table by the end of summer.

Today – EZ Industrial Production, ECB’s Schnable and BoE’s Bailey

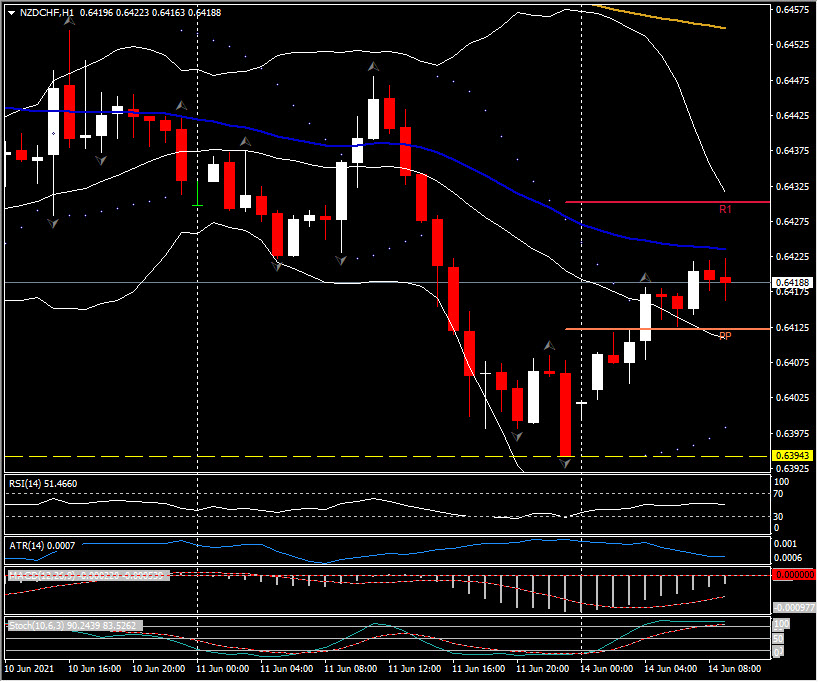

Biggest FX Mover @ (07:30 GMT) NZDCHF (+0.40%) has bounced from a big down day on Friday, a close below 200-day MA at 19-week low 0.6395. Breached 0.9400, Pivot Point and 20-hr MA today, 50-Hr MA at 0.6425. Faster MAs remain aligned higher, RSI 52 still neutral, MACD signal line and histogram rising but remain below 0 line from last week. Stochs. still moving higher and into OB zone. H1 ATR 0.0007, Daily ATR 0.0063.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.