Market News Today – US Markets closed at record highs (USA500 4255) and Asian stocks followed but closed mixed after key markets returned after long weekend. Dollar holds on to gains (USDIndex 90.40). EURUSD (1.2125) and Cable (1.4115) little changed. JPY holds the break of 110.00. Yields off 3-mth lows and up to recover 1.50%. USOil rallied again to $71.35 before cooling under $71.00 and the Gold collapse spiked as low as $1845, back to $1865 now. Copper off -2% yesterday too. Overnight – AUD Housing inflation steeper than expected, Bailey talked digital currencies & US passed the grim 600k Covid deaths milestone. Strong UK Jobs data, Claims, Earnings and Unemployment all beat expectations.

Week Ahead – All eyes on Wednesday’s (18:00 GMT) FOMC Announcement & Press Conference. Markets expecting more dovishness with “talk about talking about Tapering” not expected to happen until the July or even September meeting. BOJ & SNB also on the stump. Biden meets Putin Wednesday after NATO summit.

European Open – DAX and FTSE 100 futures are up 0.4% and 0.3% respectively, US futures are posting gains of around 0.1%, after another record on Wall Street yesterday. Investors seem to be putting inflation concerns aside for now although mutterings that there could be more lasting shifts in prices are getting louder. For now though the focus is on the FOMC announcement tomorrow. The U.K. pushed out the date for the full lifting of Covid restrictions to July 19.

Today – Empire State Manu. PPI, Retail Sales, Industrial Production, ECB’s Lane, Panetta, BoE’s Bailey, Government supply from the UK, Germany & US.

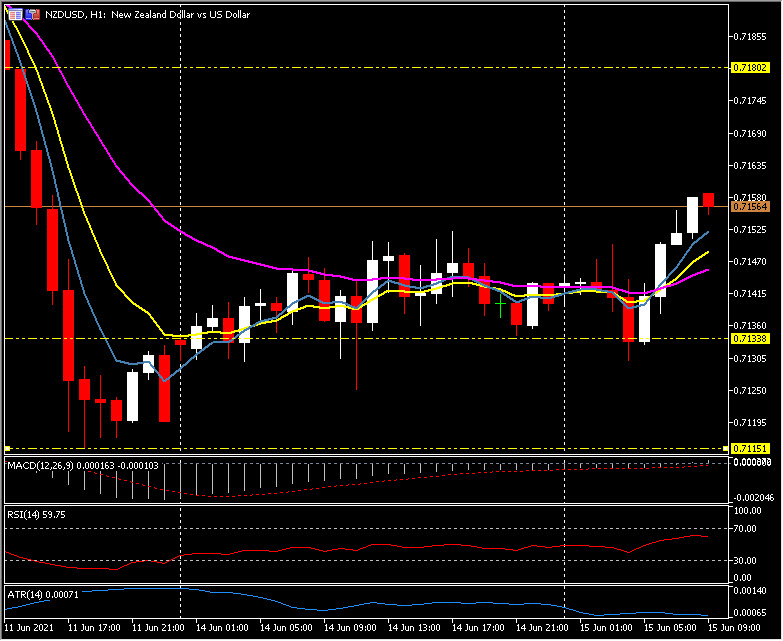

Biggest FX Mover @ (07:00 GMT) USDNZD (+0.26%) has bounced from a big down day on Friday, at 0.7115 and a floor yesterday at 0.7130, to move over 0.7150 and clear of the 20-hr MA. Next resistance 0.7180. Faster MAs remain aligned higher, RSI 58 and rising, MACD signal line and histogram rising and testing 0 line. H1 ATR 0.00072, Daily ATR 0.0060.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.