Week’s releases so far turn the market into a pretty much risk-on environment, with FOMC the major catalyst and SNB and Eurozone inflation unable to hinder the current momentum.

USDJPY hit an 11-week peak at 110.82, driven by the spike in US yields relative to JGB yields following the Fed’s hawkish tilt. Meanwhile, our interest turned on the sharp decline of CHFJPY to 120.95 from 122.75. Despite their safe-haven characteristic, with both CHF and JPY depreciating against USD and both countries having stable economies, the CHFJPY is in a big sell-off due to the yields differentials, with Japanese yields having a bigger appeal over Swiss ones.

Hence, the fact that the SNB earlier today affirmed its ultra-accommodative policy stance, added further pressure on CHF especially after the FOMC’s hawkish shift, which weighed on Treasuries even though any policy shift is still a long way away. However, it seems clear that the tide is slowly turning. The Swiss National Bank kept the policy rate at -0.75% and once again re-iterated that it will use forex interventions if necessary. Inflation forecasts remain comfortably below the SNB’s target, despite the fact that the economy will be reaching pre-pandemic levels of output in the middle of this year. After the ECB maintained its policy stance at last week’s meeting, the SNB can afford to wait until September to review the current stance.

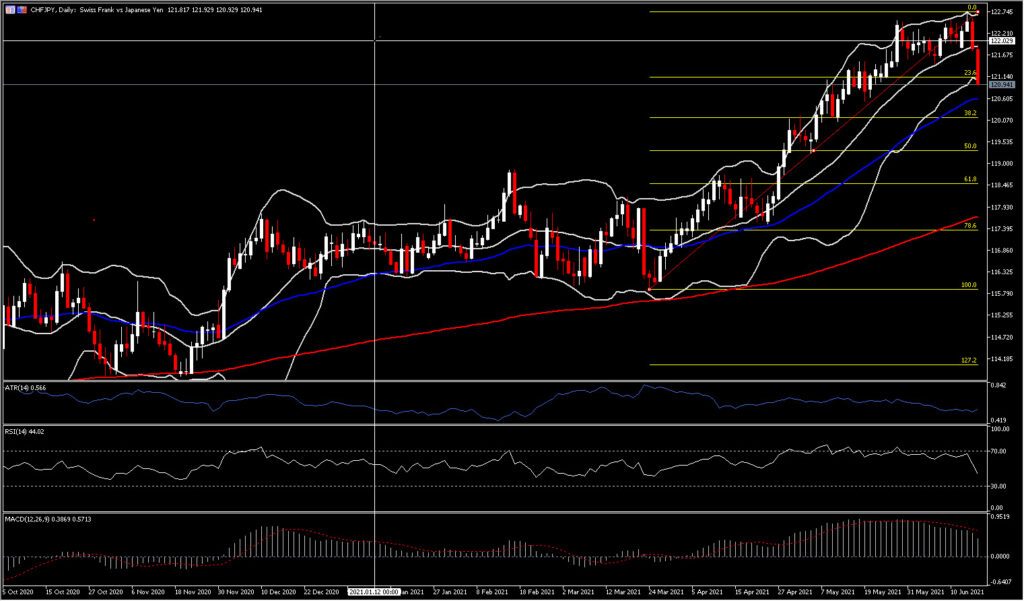

The CHFJPY, as stated above drifted by nearly 200 pips, reversing around 50% of 2-month gains. Negative pressures could persist in the short and medium term as the asset turn below 20-DMA and it is currently outside the daily BB. Meanwhile, negative bias increased as the MACD is growing bearish below its signal line (but still above zero line), while the RSI is at 44 sloping harshly lower while it has yet to reach its 30 oversold level. A second bearish nearly full body daily candle today could gain extra ground for sellers towards the 200-day EMA, at 120.50 and the next Fibonacci level at 120.10 (38.2%).

On the flipside, an upside correction cannot be excluded as the overall outlook remain bullish with pair traded at 5-year highs and the MACD sustaining within the positive territory. A bounce above the 121.90 and the 20-day SMA could prompt a continuation of the bullish extension seen since May.

Nevertheless, CHFJPY has another key event to face by the end of the week, as the BoJ has started its two-day policy meeting today. A 6-month extension of its pandemic relief measures, as reported by the Nikkei newspaper this week, is expected. Growth and yield differentials are strong supports for the Dollar over the Yen, and Yen over the Swissy although any sharp decline in global stock markets has the potential to underpin the safe haven demands.

The Yen is a low yielding currency of a surplus economy, and tends to weaken during risk-on phases in global markets, and strengthen during times of pronounced and sustained risk aversion. It should be of no surprise that the Yen has been the weakest performing of the G10+ currencies during the reflation trade. The Japanese currency, for instance, is registering a loss of over 40% against the Australian Dollar from levels seen at the height of pandemic panic in global markets, in March 2020.

Hence, safe havens and more precisely Yen will remain in markets spotlight for the next few days.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.