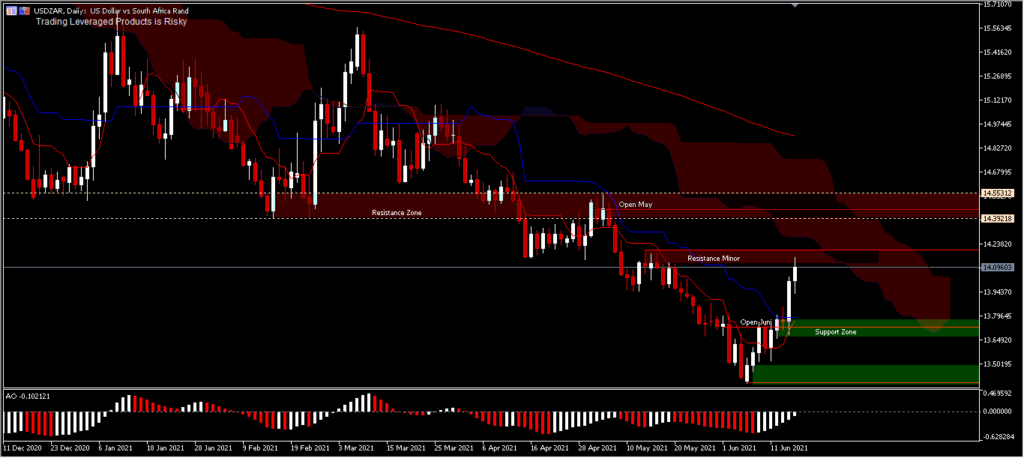

The South African Rand has shown resilience since early 2021 by gathering strength at 8.5% against the US Dollar and registering an annual low of 13.3823. And from this low, the USDZAR pair has rebounded in the second week of June, and coupled with the hawkish FOMC effect, made this exotic pair break away from the 14.0000 round number and move towards 14.2000.

Some consolidation above the current price level would be a barrier to the recent rebound, between 14.1946 and 14.5397. The intersection of Tenken Sen and Kinjun Sen has occurred below the Kumo; in general this condition is still read as a weak buy signal. Ideally for the continuation of this rebound, it still needs a retest or at least form a higher low to support technical reasons. AO narrows to the neutral zone and to validate the rebound into a reversal still needs some price acceleration. On the negative side, as long as the resistance at 14.5397 holds, some correction might occur for the price at 13.9332 or 13.6816.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.