XAUUSD, Outlook H1+

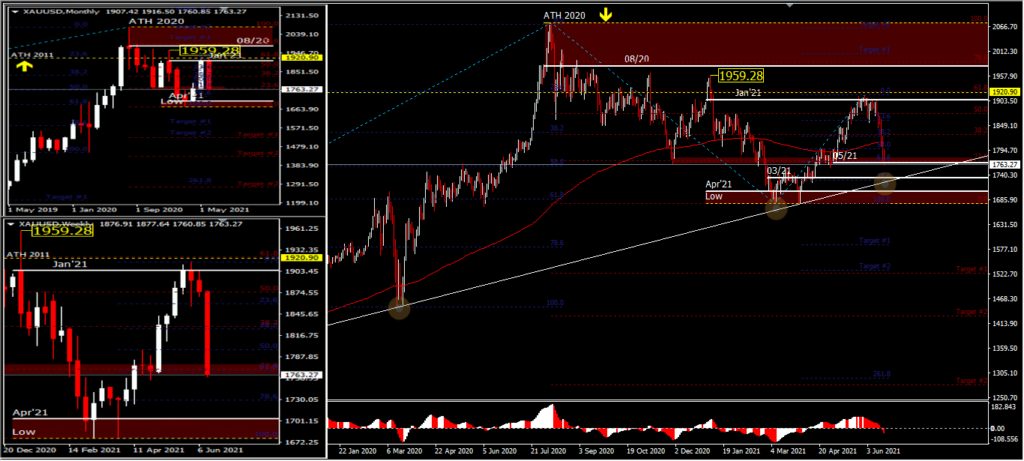

Wednesday’s FOMC meeting and the press conference that followed were in stark contrast to last month. Earlier Fed Chair Powell had calmed investors’ fears, insisting the central bank saw no reason to change policy direction, following the “talk of talking about tapering” at some future point and the dot plots coming back to 2023 from 2024. On Friday, FOMC member Bullard further reinforced this hawkish tone and expects interest rates to be raised as early as next year and much faster than the market currently expects. Gold prices fell this week under the threat of higher interest rates. XAUUSD fell -6.05% last week. Gold investors have been riding on higher inflation hikes over the past three months that have made gold sparkle.

Cost-driven inflation is only one component of the total inflation picture and many classic stories like this repeat over and over, as many commodities have retraced significantly in recent days to epic sell-offs, but underlying price strength is still in place.

Related Article : Emas dan Perak Tidak Terhindar dari Gelombang Kejut FOMC

Technical Levels

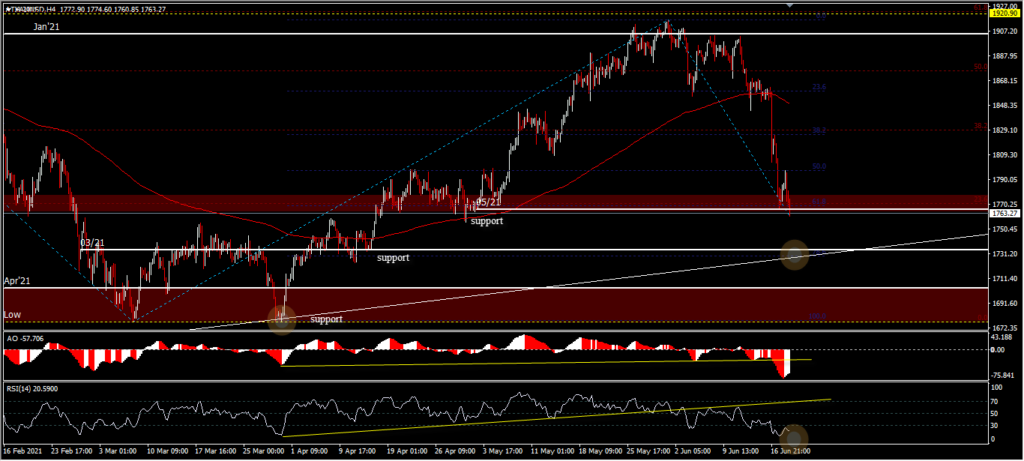

The signal that supports an increase in the price of XAUUSD next week is the up trendline. If the trendline holds, the rebound will again occur amid the OS zone from the extreme RSI on the intraday chart. Cancellation of the gold strengthening option will occur if the up trendline is broken to the downside; this would confirm the continued decline with the nearest target of the March low at 1615 (level 50.0% FR from drawdown 1160.22-2075.08).

The monthly price chart may trigger a longer term sell signal, if at the end of the month the price closes below the May opening price, thus forming a bearish engulfing pattern as a reversal formation. However, the story is of course not yet over, amid the dynamics of hot inflation growth and the spread of a much more virulent virus variant.

Support comes from the up trendline near the price level of 1723.63 (78.6% FR) and the low of the previous double bottom pattern at 1677.82. A drop in price below these 2 support levels would confirm a much deeper decline. The moving average price is below the 200 day EMA with the validation of the AO bars below the neutral line. As long as the 1677.82 support holds, the trend will still point to the upside.

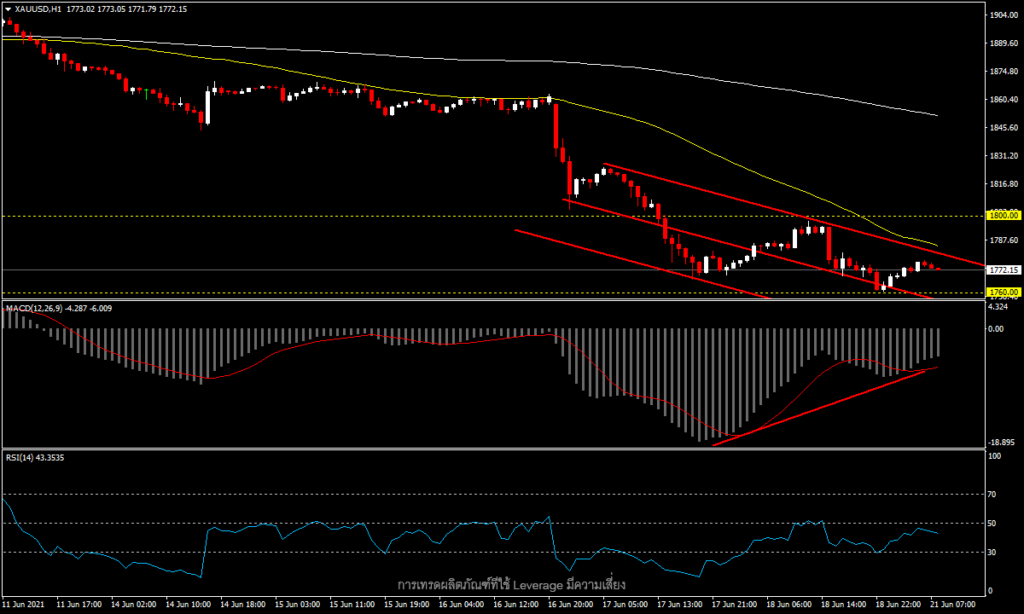

XAUUSD, H1

From a technical point of view, the USDIndex and bond yields counter. As a result, we have started to see a trend reversal of gold prices in the small H1 timeframe where MACD lifted and crossed the signal line but remained below the 0 line with a Bullish Divergence pattern. The RSI moved up from the Oversold zone to the Neutral Zone (44.5). Overall, prices remain in a downtrend in both the short time frames and medium time frames, where the price is still stuck in a bearish channel below the MA50 (and MACD below the 0 line) with the first support at the 1760 low area. Conversely, if the price is able to break through the upper channel line and the MA50 rises first resistance will be at the Friday high area at the 1800 psychological resistance.

For today, gold prices are expected to move in a narrow range along the upper support and resistance line as there is no important information on the economic calendar.

Click here to access our Economic Calendar

Ady Phangestu & Chayut Vachirathanakit

Market Analysts – HF Educational Offices – Indonesia & Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.