Sentiment across Asia remained muted as manufacturing PMI readings out of China and Japan brought downward revisions and added to concerns that virus developments will at the very least slow the recovery. Japan’s Tankan survey improved, but slightly less than hoped, while Australia export numbers were still encouraging. Still, with the spread of the Delta variant, curbs may actually be extended and/or brought back again.

The 10-year Treasury yield is little changed at 1.47% after paring overnight gains, while bonds across the Asia/Pacific region are narrowly mixed. JPN225 is down -0.4%. The ASX lost -0.6%, while Hang Seng and CSI 300 are down -0.6% and up 0.2% respectively. In Europe, stock market sentiment seems to be stabilising, however, and GER30 and UK100 futures are up 0.3%, with US futures also slightly higher.

Concern about the rapid spread of the Delta variant still weighed on risk appetite and investor sentiment overnight, but in countries with higher vaccination rates the evidence so far suggests this wave may slow but not halt re-openings and the recovery.

Forex Market: USDIndex edged up to April’s high, and USDJPY is at 111.13 (15-month high), while the USOIL future is at $73.57 per barrel ahead of OPEC+. The Australian and NZ Dollars are under pressure extending the week and 2-month losses, while the EUR is at 1.1836. The Pound retests the 1.3800 floor again. Gold gains on Delta variant worries ahead of key US jobs data.

Today’s Calendar – Today’s final round of manufacturing PMIs for the Eurozone and the UK should confirm that demand remains strong and the sector is expanding at a swift pace. Wage growth in the UK in particular is the one to watch as the economy fully re-opens as the impact of Brexit is also felt on the labour market and could add to wage growth, especially in the hospitality sector. ECB president Lagarde and BoE Bailey are due to speak at the top of the hour, while the OPEC+ meeting takes center stage. In the US session, ISM Manufacturing PMI and Jobless claims will take place.

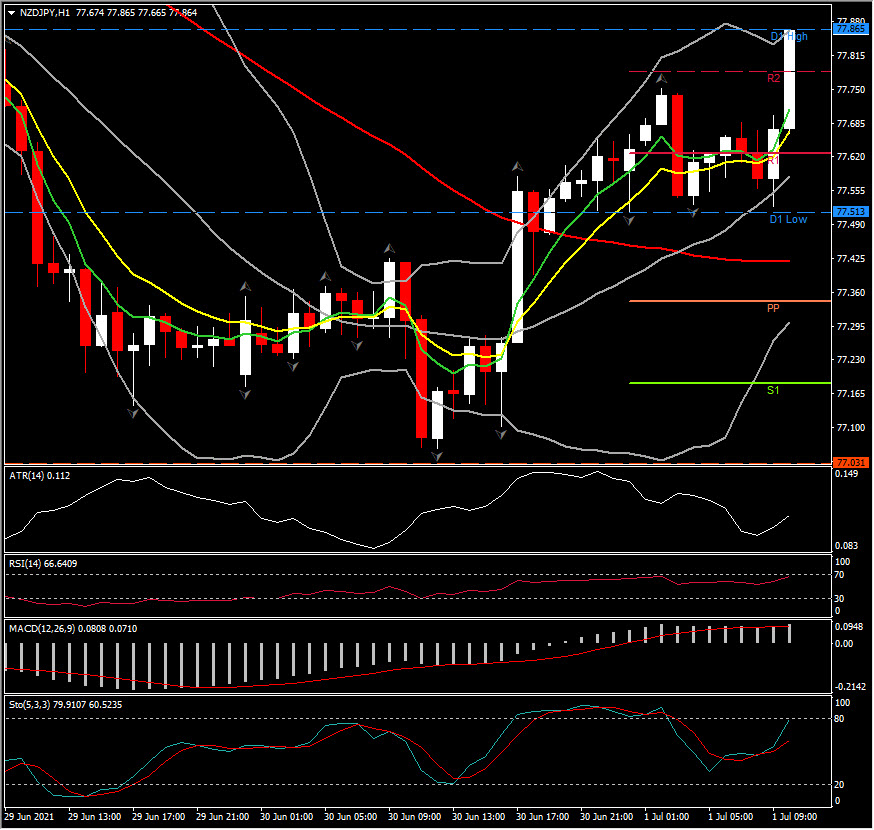

Significant FX Mover @ (06:30 GMT) NZDJPY (+0.43%) rebounded from 77 to 77.88 breaking the R1 of the day. Faster MAs bullishly crossed and RSI at 65 and pointing higher. MACD signal line and histogram are positively configured, while Stochastic turned higher, all suggesting positive bias in the short term.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.