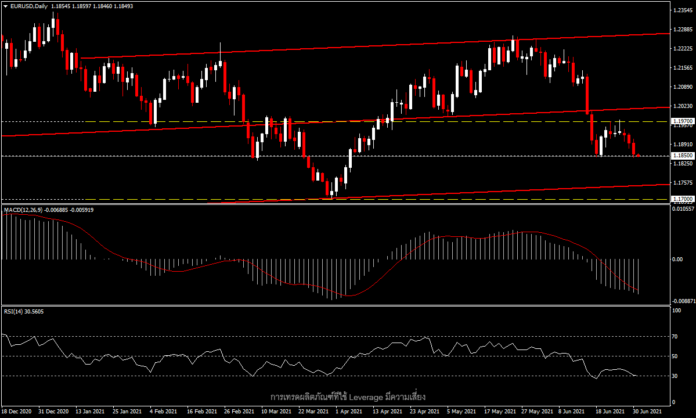

EURUSD, Daily

The pair has dropped to test last week’s low at 1.1850 after the US Dollar appreciated in the last week of the month before the important jobs announcement on Friday. While the ADP job numbers for the month of June came out higher than expected at 692k and home sales in May rose to 8% from -4.4% in April, the Chicago PMI came out below expectations at 66.1.

The EURUSD pair, which had been in a decline since the end of May, moved up last week and then moved down again this week. So there is a possibility that this could become a dead cat bounce pattern, meaning that the price could fall below its current level. Conversely, at the current price level, the pair could turn into a double bottom reversal pattern and retest last week’s high at 1.1970.

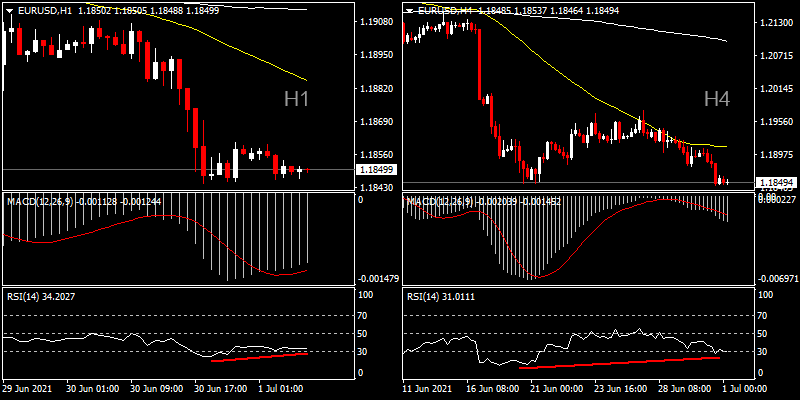

The decline stayed at the low area last week and the pair is likely to continue downward if it breaks through the 1.1850 support, with the next downtrend at 1.1750 around the lower channel line and the 1.1700 low from the end of March. We are beginning to see a bullish divergence trend in the smaller timeframes H1 and H4 where the MACD is narrowing below the 0 line while the RSI is moving higher from the oversold level.

Whether it’s a dead cat bounce or a double bottom, with the rest of this week’s major news and events there is a high probability that the 1.1700 support and 1.1970 resistance frame will be tested. Starting today with the announcement of the PMI (final value) of the Eurozone countries and the US, which includes US weekly unemployment claims that are expected to drop slightly from the previous week to 393k, the market is also keeping an eye on the US Non-Farm Payroll numbers tomorrow.

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.