USDJPY, Daily

USDJPY hit a new 15-month high at 111.62 yesterday (July 1), its highest level since March 2020, after a consistent bullish rally since early May 2021. USDJPY also posted a lot of gains in the last week of June. Although current market sentiment is somewhat gloomy and a bit ‘risk-off’ following investors’ concerns in the case of the rapidly rising Covid variant Delta around the world and the strengthening of the JPY as a safe-haven currency, it still failed to help the bears in pushing the USDJPY down again. The strengthening of the USDJPY is largely supported by the strengthening of the US Dollar where the USDIndex recorded its best performance in June and is currently at its highest level since March 2021.

The change in tone by the US Federal Reserve (FED) in their FOMC policy meeting clearly supported the increase in treasury yields, thus contributing to the rise of the USDJPY (USDJPY is a currency pair that moves in line with treasury yields). The FED is seen to be getting hawkish after projecting two rate hikes in 2023. Comments by Dallas FED President Robert Kaplan (Hawkish and voter), who said high inflation will last until next year and he wants the FED to taper earlier, are clearly supporting the Bull sentiment in the USDJPY movement.

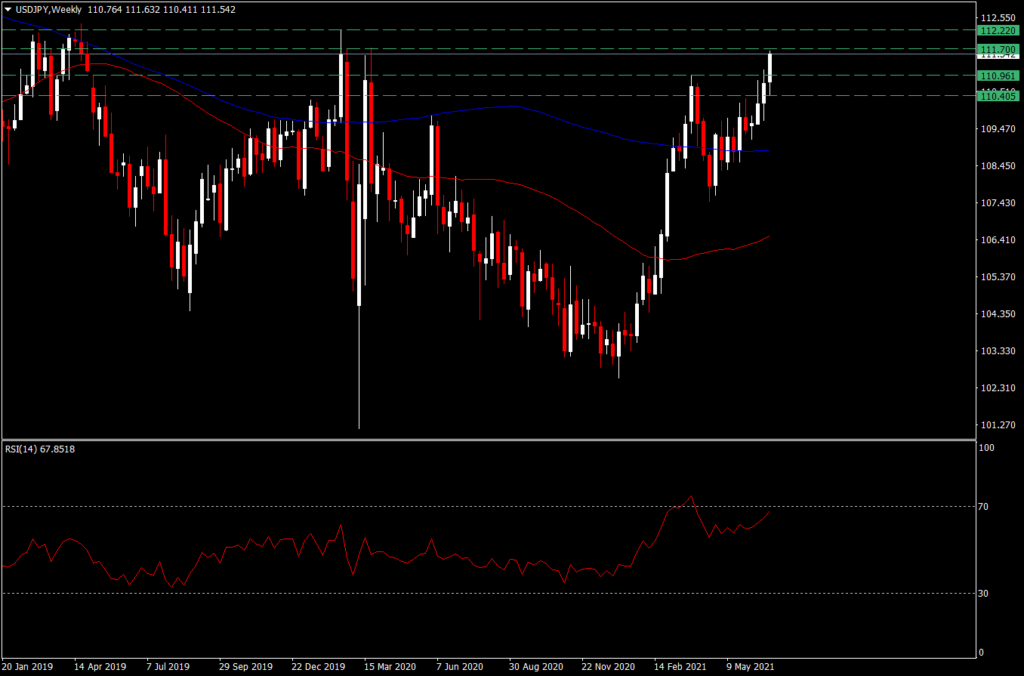

USDJPY is currently trading around 111.50, down slightly from Thursday’s high of 111.62. The nearest resistance is now at 111.70, followed by the 112.22 level, and the nearest support is now at 111.10. While the movement of MA-50 and MA-200 H1 shows an upward movement, the RSI-14 is currently in the overbought zone, and the price movement has yet to indicate any possible retracement.

Investors are also seen optimistic in June NFP data ahead of the release of the NFP monthly report later today (Friday). This Labor sector report will be the next determinant of the USDJPY’s direction in the short term.

Click here to access our Economic Calendar

Tunku Ishak Al-Irsyad

Market Analyst

HF Educational Office – Malaysia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.