Market News Today – USD off 3-month highs, as Bonds, (US 10yr down to 1.25% before big bounce to 1.345%) JPY and CHF get a bid and then squeezed, AUD and NZD slip. Equities closed lower, USA500 (-0.86% -37pts to 4320). ECB fixed the inflation target at 2% with acknowledgement that an overshoot is likely, unemployment claims missed again and Virus worries, along with Chinese tightening the regulation screw all added to weigh on sentiment. Asian equities down again as serious spikes in Virus outbreaks and low vaccination rates hit home. USDIndex fell to 92.25, back to 92.40 now, EUR back over 1.1800 to 1.1830, JPY back to 110.00 from 109.50 lows & Cable under 1.3800 at 1.3775. Gold holds $1800, down from $1818 yesterday, USOil up from a test of $70.00 yesterday to $72.30.

Overnight – Chinese CPI weaker than expected, (1.1%) but PPI holds at highs (8.8%), GBP data dump misses led by MAY GDP misses significantly (0.8% vs 1.5% & April revised lower to 2.0% from 2.3%.) Industrial production & manufacturing also weaker than expected. US to blacklist more Chinese companies – RTS & Daly warms Delta variant a threat to global recovery – FT.

European Open – Sentiment started to stabilise overnight and 10-year Treasury yields have moved up 3.3 bp to 1.33%, while Bund yields have lifted 0.3% bp to -0.306%. With risk aversion fading somewhat, markets will continue to digest yesterday’s announcement of the new ECB strategy, that formulates a clearer inflation target of 2% over the medium term, but also vows to take the cost of owner occupied housing more into account.

Today – ECB Minutes, Lagarde, Bailey, the Canadian labour market report and G20.

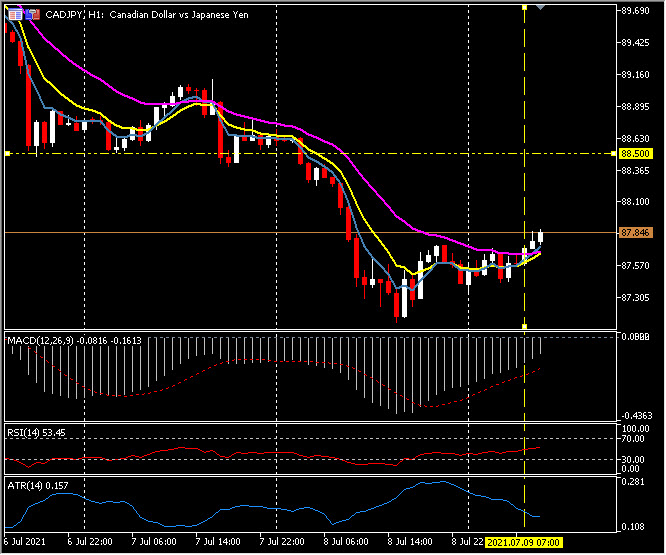

Biggest FX Mover @ (06:30 GMT) CADJPY (+0.35%). Bounced from week+ decline from 90.00 on weaker Oil prices and strong JPY at 87.15 to 87.85 now. Next key resistance 88.50. Breached 21EMA earlier, faster MAs aligned higher, RSI 53 but rising, MACD signal line & histogram remain below 0 line but rising. H1 ATR 0.157, Daily ATR 0.76.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.