Prologis is a San Francisco, California-based real estate investment trust that invests in logistics facilities, with a focus on the consumer side of the global supply chain, and is a global leader in logistics real estate with a focus on high growth markets and high barriers., As of December 31, 2020, the company owned or had investments in the form of wholly owned or through joint ventures, properties and development projects in 19 countries that are expected to total approximately 984 million square feet when completed.. The last time it published its quarterly earnings results was on Sunday, April 18, reporting earnings of $0.49 per share for the quarter, beating the Thomson Reuters consensus estimate of $0.41 to $0.08, with a net margin of 29.47% and a return on equity of 3.73% and with revenues for the quarter increasing 16.3% year over year, according to MarketBeat data .

Within the same earnings report for the first quarter of 2021, Nasdaq reported that Prologis obtained quarterly funds from operations (FFO) of $0.97 per share, beating the Zacks consensus estimate of $0.94 per share, giving a surprise of +3.26% and exceeding the FFO consensus estimates for the fourth time in a row. The company posted revenue of $1.02 billion for the quarter ending in March, while the stock has added about 12.9% since the beginning of the year vs. an 11.4% gain for the S&P 500, so empirical research shows a strong correlation between short-term stock movements and trends in estimate revisions. Therefore stocks are expected to behave in line with the market in the near future, thus estimating the FFO’s consensus on the release of the 2021 first quarter earnings report at $0.98 on $1.01 billion in revenue for the next quarter and $3.95 on $4.09 billion in revenue for the current fiscal year.

For its part, wallstreetZen agglomerated the figures on Prologis’ earnings in the last quarter which reported earnings per share (EPS) for the first quarter of 2021 of $0.50, a year-on-year increase of 28.57%, while the total earnings were $365.82 million; in turn, as of the third quarter of 2021, the company’s earnings have grown by 30.8% year-on-year, amounting to $1.35 billion in the last year. Within the same April 19 report, Prologis reported first quarter 2021 revenue of $1.15 billion, an increase of 17.39 year-on-year, while, as of the third quarter of 2021, revenues have grown 30.31% year-over-year, amounting to $4.61 billion.

Against this background and prior to the company publishing the results of the second quarter on July 19, the president and CEO, Hamid R. Moghadam, mentioned that “the strong demand in the fourth quarter has lasted until 2021 and is as strong as I’ve seen in my career … global supply chains are pushing to keep up with fast-paced economic activity, re-equipping for faster compliance and resilience. With our well-positioned portfolio, differentiated client offerings, and abundant investment capacity, we expect to continue to outperform while providing exceptional customer service.”

Moghadam’s assurance of a strong future for Prologis is supported by data collected by PRnewswire, which shows that during the first quarter Prologis and its joint ventures issued $3.5 billion of debt at a weighted average interest rate of 0.96% and a weighted average term of approximately 11 years, activity that includes $2.6 billion in global bond increases, as well as a green bond of 500 million euros. By the end of March, the debt as a percentage of the total market capitalization was 18.6% and the weighted average interest rate of the company on its participation in the total debt was 1.8%, with a weighted average term of 10.6 years, and in the words of the company treasurer: “Through a few transactions during the first quarter, we lowered the weighted average interest rate by 20 basis points and effectively addressed the maturities of our unsecured bonds through 2026.”

PROLOGIS TECHNICAL ANALYSIS

Prologis has been maintaining an incredibly strong bullish rally since March 2021, when it gave its last test to the support at the base at 94.05, a range in which it had held since July 2020 with resistance at 108, which broke higher, launching the price up to a record high at 127.80 today even though for the moment it has dropped to 127.53, very close to the psychological level of 130.

Support is at the previous all-time highs at 126.29, the psychological level where it has made a double bottom at 120.00, the 50-period SMA at 119.688, Fibo level 38.2% at 113.97 and the range that goes from the Fibo level 61.8% at 106.36 up to the broken resistance that is now support at the psychological level of 110.00. Below this we have the uptrend guideline of the trend and then the range of the Fibo 88.6-78.6% at 97.72-100.95 that encompasses the key psychological level of 100.

IBM

Another company ready to report its second quarter earnings report on July 19 is IBM. Having grown 16.6% since the end of 2020, its shares appear to be above their short-term potential, and after the publication of first quarter 2021 earnings its shares grew as the company beat consensus market estimates for both revenue and earnings, posting revenue at $17.7 billion, up 1% year-over-year, while operating income posted at $905 million, compared to $-45 million in the same period of the previous year. Earnings fell to $1.07 for the quarter compared to $1.31 in the same quarter of the previous year, so IBM’s revenue is expected to exceed $74 billion by 2021, plus its net income is likely to increase to $11.2 billion, which will increase its EPS figure to $12.66 in 2021, which together with the P/E multiple of 11.1x will drive the company’s valuation to $140, which is 5% lower than the current market price, according to Forbes data .

Seeking Alpha does not see much change for the $125 billion cap company ahead of its earnings report as IBM has seen its revenue slowly decline for most of the last decade, despite having made strategic moves towards Hybrid cloud, artificial intelligence and security markets. While many technology companies managed to experience strong growth in 2020 during the pandemic, IBM underperformed and saw its revenues fall 5%, and profits per non-GAAP share also decrease from $12.81 to $8.67, a 32% decrease, even though in the first quarter the company reported encouraging results. Overall revenue decreased by 2% when adjusted for currency and non-GAAP earnings fell to $1.77 from $1.84 in the first quarter of 2020.

Significantly, IBM has exceeded the estimated EPS consensus in each of the past four quarters. For the quarter ended March 2021 it had revenues of $17.73 billion, beating the consensus estimate of Zacks by 1.65%, compared to year ago revenue of $17.57 billion. IBM shares have also added about 6.1% since the beginning of the year compared to the 11.4% gain of the S&P 500; for its part, the EPS estimation consensus for the first quarter results were $2.43 over $18.31 billion in revenue for the next quarter and $11.15 over $74.35 billion in revenue for the current fiscal year. In terms of ranking of in the Zacks industry, computer-integrated systems are currently in the bottom 37% of 250 industries, while research shows that the top 50% of industries ranked by Zacks outnumber the bottom 50% by one factor more than 2 to 1, according to Nasdaq data.

At the beginning of the month, IBM shares took a hit when James M. Whitehurst announced his departure from the position of president, causing the information technology and consulting giant’s shares to fall 4.6% to close at $140.02 on July 2. Before this Earnings Whispers reported that earnings per share and consensus income are set at $2.25 and $18.29 billion respectively, while the target price is $151.74, implying a potential upside of 8.4% at current levels. Recognizing that the shares have gained 16.5%, over the past year, CEO Arvind Krishna, who took over the helm of the company, said: “As the world begins to reopen, IBM has a unique opportunity to position itself for an exciting new era of growth, continue to accelerate the rate and pace of execution of our strategy and strengthen our customer-centric culture and our ability to provide technical expertise,” reports Yahoo! finance.

Thus some of the risks that IBM faces include continued competition in the markets in which they compete, as the hybrid cloud, artificial intelligence and security markets are highly competitive with many niche players hyper-focused on specific areas of the industry. In the marketplace, the reduction of dividends could also be another risk, as investors could view the historically consistent dividend cuts as a concern about the company’s ability to generate enough cash flow to reinvest in the business.

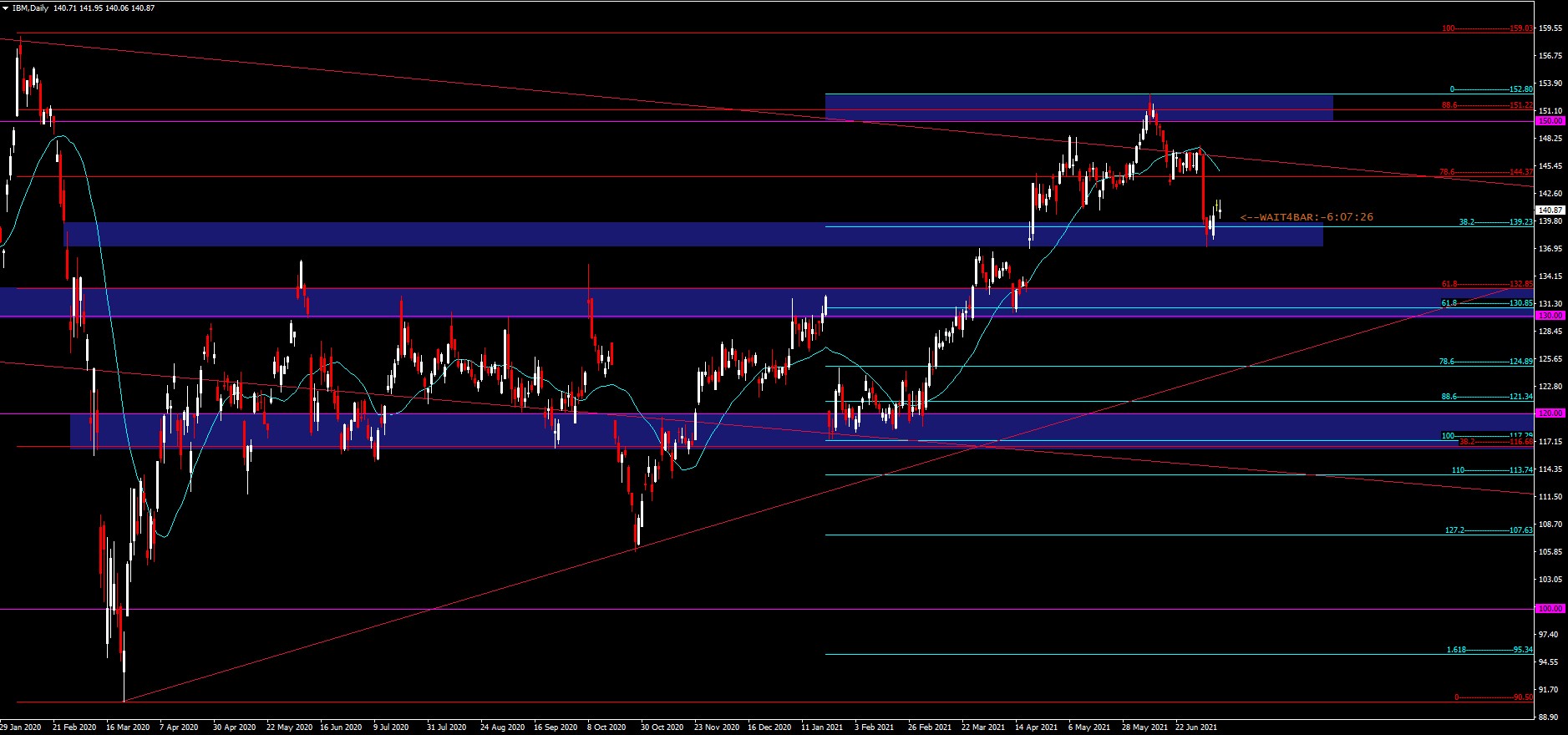

TECHNICAL ANALYSIS IBM

IBM has been in a bullish rally since it left lows at 90.50, a price that has not been seen since 2009 and where it marked support in March of this year when it fell from the highs of 2020 at 159.03. The current bullish rally has left a maximum at 152.80 just above the channel’s bearish guideline and the 88.6% Fibo of the last drop at 151.22. It is currently testing support at the 21-period W1 SMA along with the 38.2% Fibo at 139.23 and joining the 140 psychological support.

Resistance is at the 78.6% Fibo at 144.37, the 21-period SMA at 144.87, the channel’s bearish guideline, the range that goes from the psychological level of 150 to the maximum marked at 157.80, and the psychological level of 160 that would test the 2020 highs. Immediate support is at the 38.1% Fibo already mentioned above followed by the range that goes from 132.85 to the psychological level of 130 which is close to the upward guideline of the current rally followed from the 78.6 level at 124.89, the 88.6 at 121.34 and the psychological level at 120.

Click here to access our Economic Calendar

Aldo Weidner Z.

Market Analyst – HF Educational Office – LATAM

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

References:

- https://www.marketbeat.com/instant-alerts/nyse-pld-options-data-report-2021-06-2-3/

- https://www.nasdaq.com/articles/prologis-pld-q1-ffo-and-revenues-top-estimates-2021-04-19

- https://www.wallstreetzen.com/stocks/us/nyse/pld/earnings

- https://www.prnewswire.com/news-releases/prologis-reports-first-quarter-2021-earnings-results-301271430.html

- https://www.forbes.com/sites/forbes-personal-shopper/2021/07/09/apple-tv-4k-review/?sh=7e5beb2430ec

- https://seekingalpha.com/article/4438174-ibm-stock-good-yield-but-nothing-to-be-bullish-about

- https://www.nasdaq.com/articles/ibm-ibm-beats-q1-earnings-and-revenue-estimates-2021-04-19

- https://finance.yahoo.com/news/ibm-shares-fall-5-president-064630217.html