USDZAR, Daily

The risk sentiment and the SARB rate decision will be the main drivers of USDZAR today (Thursday), amid the domestic strife. It is likely that the central bank will keep its current repo rate as the country is still in recovery mode.

The Reserve Bank of South Africa unanimously voted to keep its benchmark repo rate unchanged at a record low of 3.5% during its May 2021 meeting, as widely expected. Policymakers said the overall risks to the growth outlook are balanced while the overall risks to the inflation outlook appear to be increasing.

USDZAR trades lower after higher-than-expected inflation data. The country’s consumer prices rose 4.9% in June on a year-on-year basis, lower than the previous month’s 5.2%, but beating the 4.8% forecast. Excluding volatile food and energy components, core CPI rose 0.3% compared to the 0.2% MoM forecast.

Nonetheless, the currency pair remained under pressure as the US Dollar traded near its highest level since early April. At the time of writing, the dollar index, which tracks the Greenback against a basket of currencies, was down. The USDIndex was down around 0.18% to close at 92.77. The Greenback’s safe-haven appeal has increased as the aggressive spread of the Delta coronavirus variant increases the risk-off.

Technical Levels

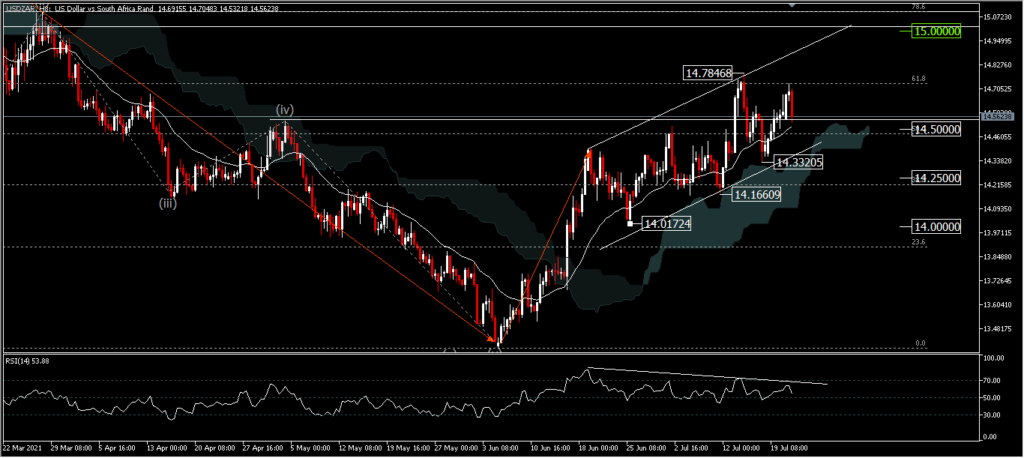

The USDZAR rebound of 13.3823 was still stuck at the 61.8% retracement level at 14.7846 and yesterday retested that level, but closed lower at 14.5623, with a total increase of only 0.09%. The intraday bias still tends to the upside, considering that the price movement is still above the Kumo average.

On the upside a break of the minor resistance 14.7846 will extend the retracement to the 78.6% level or around 15.0000 and if strong will test the top of the 15.5674 wave. On the downside, as long as the golden level holds, the downside will target support at 14.3320 and could reach 14.1660 or 14.0000 if strong.

Ady Phangestu

Market Analyst

Click here to access our Economic Calendar

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.