Narrow ranges prevailed across asset classes yesterday and there wasn’t too much of a reaction to yesterday’s Fed announcement. The Fed provided some buying impetus and both stocks and bonds closed with modest gains in tandem with Treasuries and Wall Street. Overnight, the Treasury yields lifted 0.3 bp to 1.24% as Chinese shares led a broad rebound in Asian stock markets.

- Like the ECB, the Fed signalled progress on the recovery, but also effectively signalled a cautious wait and see stance over the summer.– The FOMC signalled patience on tapering.

- Chinese officials stepped up efforts to reassure investors, with state run media questioning whether the correction in equities was overdone and reports suggesting China will continue to allow local firms to go public in the US.

- China’s central bank boosted cash injections by adding 30 billion Yuan.

- Australia import and export prices came in higher than anticipated, which left local bonds paring earlier gains.

- Topixand JPN225 are currently up 0.2% and 0.6%.

- GER30and UK100 futures are down -0.1% though and US futures narrowly mixed, as investors wait for US GDP data.

- Weekly US inventory data showed a 4.1 mln barrel draw on stockpiles, more than the median forecast for a 3.43 mln draw.

- A Reuters reporthighlights analysts are expecting a quicker-than-is-being-anticipated plateau in summer oil demand across the northern hemisphere due to the impact of new restrictions in the face of the Delta variant driven spike in new Covid cases.

- Proposed US infrastructure deallooks to higher taxes on crypto for part of the funding.

- Pfizer Inc. in Q2 2021 jumped 92% on the year to $19 billion, exceeding analyst expectations.

- Nissan Motor and some semiconductor firms (Advantest, Screen Holdings, TDK) delivered surprisingly strong earnings.

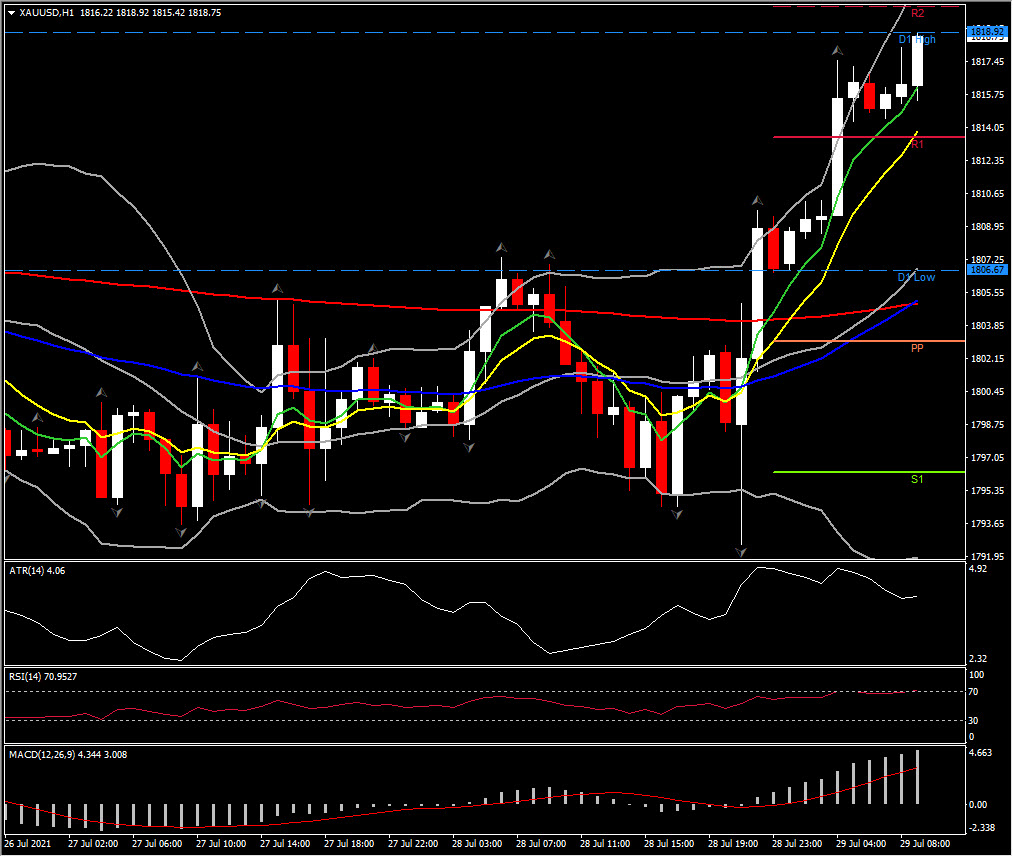

In FX markets: Both the EUR and the Pound have moved higher against a largely weaker USD, with EURUSD now at 1.1863 and Cable at 1.3936. USDJPY dropped back to 109.66. USOIL meanwhile is trading at $72.20 per barrel. Gold prices spiked to 1819 as the US Federal Reserve chairman struck a dovish tone after the policy meeting.

Today: The European calendar is busy today with German HICP inflation and labour market data alongside the Eurozone ESI economic confidence reading. Markets are also waiting for US GDP data.

Biggest FX Mover @ (06:30 GMT) XAUUSD (+0.72%) – Spiked to 1819.81 breaking 20-, 50- and 200-day EMA. Currently the fast MAs are still aligned higher as MACD signal line & histogram point northwards and RSI extended to 71.60 suggesting that the positive bias increases.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.