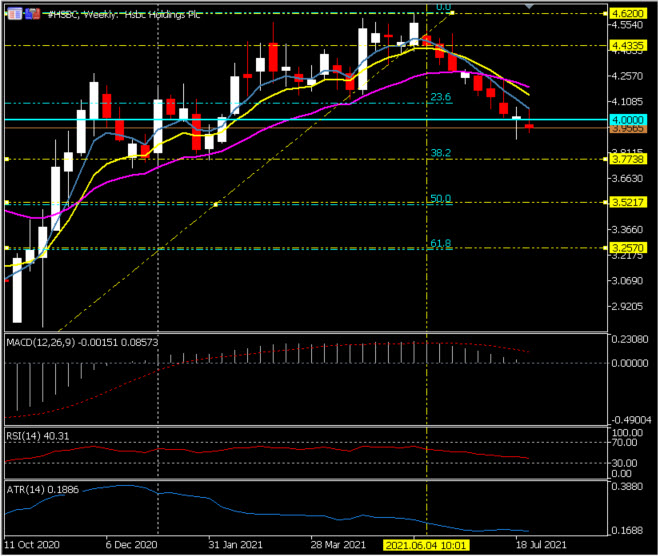

HSBC, Weekly

HSBC Group is considered the largest European bank by assets; however, in recent months it has been affected and under pressure from the tensions it maintains with China and the United States, after apparently declaring itself to be in favour of the Hong Kong security law that seeks to contribute to a stable environment for businesses and strengthen the confidence of investors. Just today, the first Hong Kong resident has been jailed for 9 years for “terrorist activities and inciting secession”♦. The long-term outlook for the city’s legal and financial framework remain very much in focus.

Given the statements of the president of HSBC where he assured the bank would resume the payment of dividends as soon as possible, the bank’s shares rose 4%. He also said the yield could help to obtain positive returns with a meager dividend of $0.22, offering yields of around 4% at current prices. This positive outlook for the bank could be linked to the increase in the participation of its main shareholder Ping An Asset Management, which has been active since September last year.

For its part, and due to the transition that many banks have decided to initiate towards online banking due to the Covid-19 pandemic, the bank has mentioned that it plans to gradually reduce its investment banking operations and significantly revise its operations in the United States and Europe which would see the headcount reduced by 35,000 with further focus on its main Asia businesses.

This week peers in Europe (Lloyds¹, Barclays², Nat West and UniCredit) have reported good numbers, with HSBC due to report on Monday August 2. Market expectations are for HSBC to follow, although the share price has been in a tailspin for some time. 7 of 21 analysts have the stock as a Buy or Strong Buy with 5 of 21 recommending an Underperform or Sell option. Target prices range hugely and the share price reflects that wide range. The 52-week range has been down to 2.40 and as high as 4.62 following the Q1 job cut announcement. Today (July 30) the shares opened lower at 3.96.

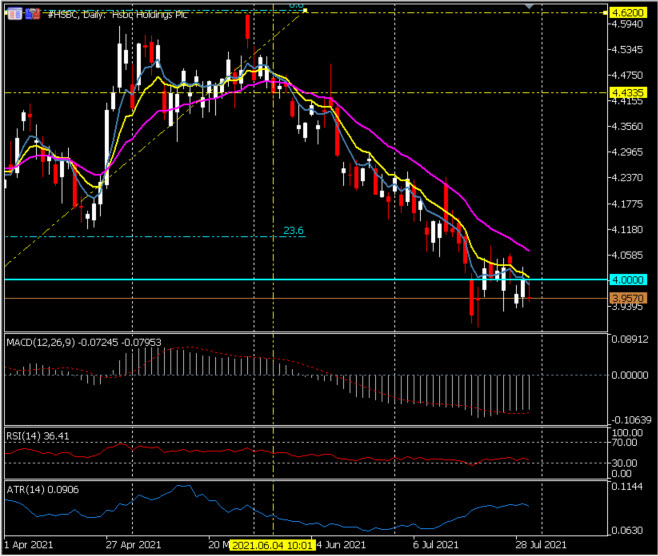

Technically, the share price has been trending lower from the last 2 months, breaking the 21-day EMA on June 4 at 4.434 and breaching the key 4.00 level July 17, and has struggled to hold this level in the subsequent 9 trading days ahead of the Earnings release. News flow has been negative too over the last few weeks, not helping to investor sentiment³. Should the important psychological 4.00 level not hold then the next major support levels sit at 3.75, 3.50 and 3.25, round numbers and the key 38.2, 50.0 and 61.8 Fibonacci levels. If 4.00 proves support the resistance will be found at 4.07 (Daily 21 EMA) 4.20 (Weekly 21EMA), 4.35 and the 2021 high at 4.62.

¹https://uk.finance.yahoo.com/news/lloyds-bank-hy-q2-profit-revenue-dividend-embark-071527699.html

³https://uk.finance.yahoo.com/news/hsbc-faces-questions-over-disclosure-150005127.html

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.