Market News Today – USD pressured again (USDIndex struggles @ 92.00) on weak data yesterday & virus surge in Southern low-vaccination states. JPY & CHF benefit – Yields lead – down again; 10yr 1.51%, lows – closed at 1.74%. Equities flat into close (USA500 4387). Oil dumps -3.5%, CAD sinks.

RBA more Hawkish than expected – AUD rallied – September taper looks set though cautious undertones remain amid concerns over housing market & virus & vaccination situation. Chinese & Asian stock markets very mixed after more Chinese clampdowns (this time on Gaming) and virus surge in China. Fed’s WALLER (Hawk) suggests September taper announcement. Overnight data mixed; better CPI for Tokyo, weaker Housing approvals for AUD. Gold holds at 1808 but USOil down significantly to test 70.00, yesterday and only 70.30 now.

European Open – September 10-yr Bund future fractionally higher, US futures marginally lower, while in cash markets 10-yr Treasury rate is struggling at 1.176%. The real 10-yr Treasury yield remains close to record low. DAX & FTSE100 futures down -0.2% & -0.1% respectively, US futures up 0.2-0.3% after a largely weaker Asia session. With little on the European calendar to distract markets those will likely also be the themes for the European AM session, alongside earnings reports. The BoE decision tomorrow is also coming into view with the UK expected to join Fed & ECB & signal cautious patience for now.

Today – US Factory Orders, Fed’s Bowman, – Earnings: Generali, Societe Generale, BMW, Infineon, BP, Standard Chartered, Alibaba, Phillps 66, Eli Lilly, ConocoPhillips.

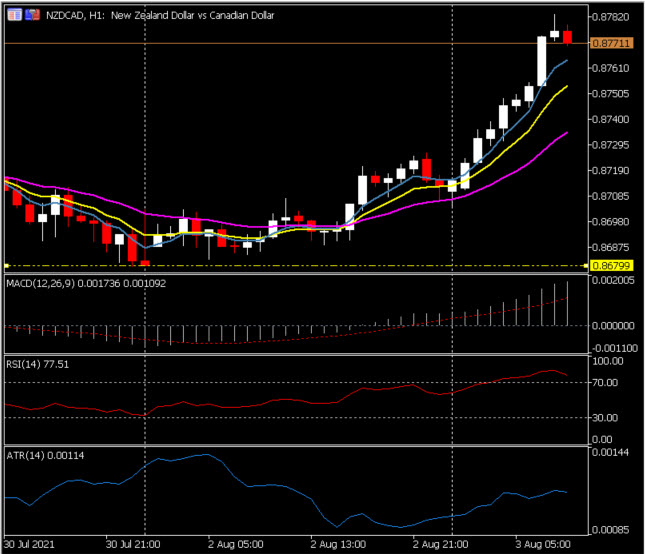

Biggest FX Mover @ (06:30 GMT) NZDCAD (+0.19%) Has moved up from 0.8680 (14 day low yesterday) as Oil prices tumbled and NZD got a lift from Hawkish RBA. Significant breach of 21 EMA yesterday, Faster MA’s aligned higher, MACD signal line & histogram over 0 and moving higher, RS 78 and well into OB zone. H1 ATR 0.0011, Daily ATR 0.0060.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.