Dominion Energy, Inc., an energy utility company founded in 1983 and based in Richmond, VA, is a leading supplier of electricity and natural gas to consumers, businesses, and wholesalers. Dominion is also involved in interstate natural gas pipelines and underground storage systems. Dominion is expected to announce its 2nd quarter financial report on August 6, 2021 before the market opens.

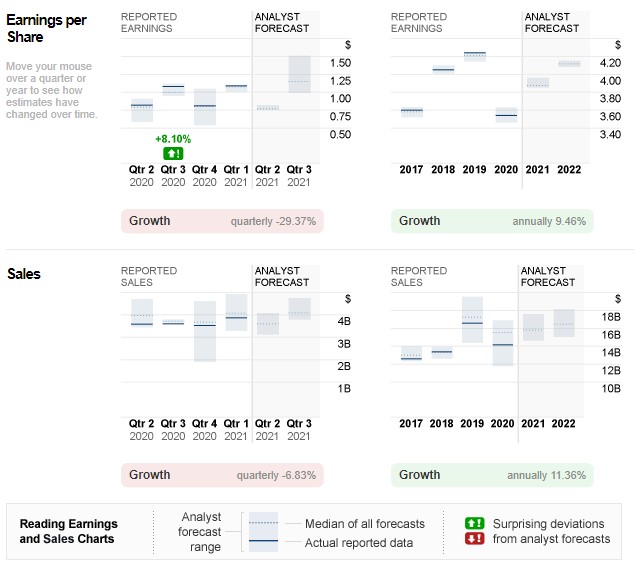

Dominion’s first quarter report last May was rather encouraging, announcing a return on earnings per share (EPS) of $1.09 versus a projection of $1.08. Revenue was recorded at $3.87 billion (projected $3.68 billion), down slightly by 1.7% from the same quarter a year earlier.

Dominion Energy currently supplies energy to more than 7 million customers in 16 states in the United States and the company remains committed to growing their business. The US government is currently in the process of evaluating the environmental impact of Dominion Energy’s proposal for a windmill power project off the coast of Virginia. If the project is approved, it will increase Dominion Energy’s revenue with over 660,000 new houses using the electricity supply from the project. Although the sale of $1.3 billion worth of natural gas pipeline units to Warren Buffet’s Berkshire Hathaway Inc failed to materialize by mutual agreement, it is not expected to affect Dominion Energy’s earnings and share price.

On the other hand, the results of the 2nd quarter financial report will depend on Dominion Energy’s performance after operations disrupted by the Covid-19 pandemic resulted in increased maintenance costs. The increase in borrowing costs is also expected to affect Dominion Energy’s revenue. Zacks Equity Research expects Dominion Energy’s EPS at $0.77 with a -6.1% decline over the last year (y/y), while Revenue is projected at $3.29 billion, down -8.2% y/y. Although the 2nd quarter report is projected to be low, it is a ‘seasonal pattern’ for Dominion, which has shown a similar pattern over the past few years.

On the other hand, the results of the 2nd quarter financial report will depend on Dominion Energy’s performance after operations disrupted by the Covid-19 pandemic resulted in increased maintenance costs. The increase in borrowing costs is also expected to affect Dominion Energy’s revenue. Zacks Equity Research expects Dominion Energy’s EPS at $0.77 with a -6.1% decline over the last year (y/y), while Revenue is projected at $3.29 billion, down -8.2% y/y. Although the 2nd quarter report is projected to be low, it is a ‘seasonal pattern’ for Dominion, which has shown a similar pattern over the past few years.

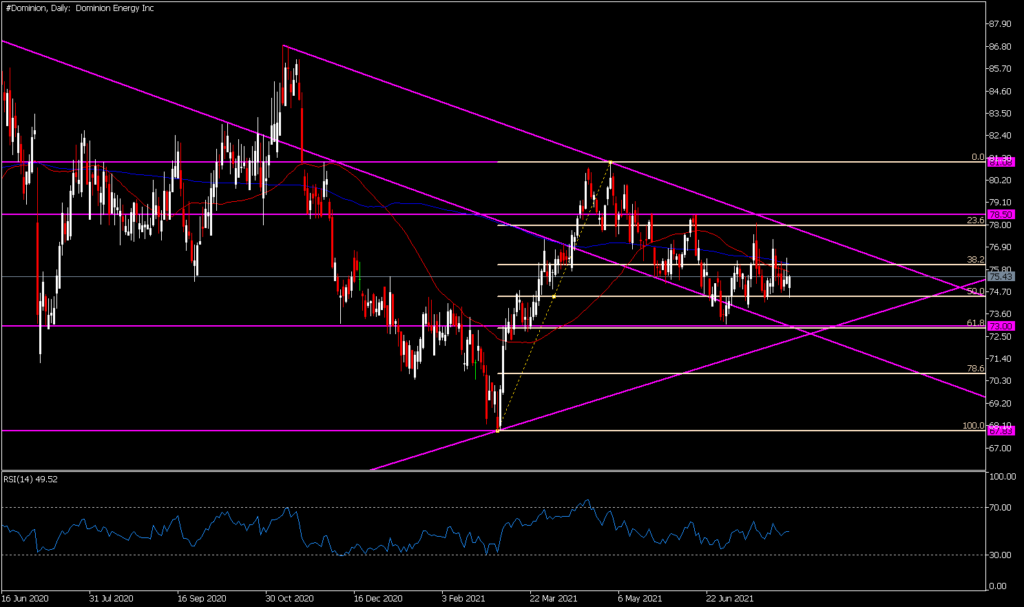

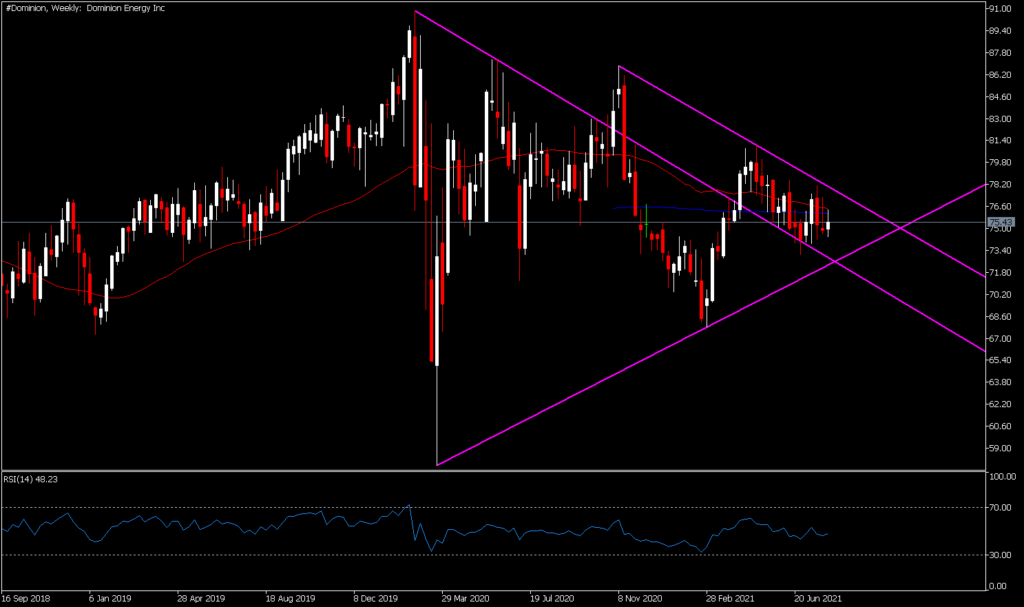

The #Dominion stock is currently trading at $75.43 after closing on Wednesday, not much changed compared to the price at the 2021 opening at $75.00, but has fallen -6.3% compared to the stock price in the last 12 months. The stock has been moving in a relatively small range since June 2021 where it moved between $78.50 and $73.00. The June high of $78.50 is the closest resistance and any breakout will activate the May 2021 high of $81.08 (2021 high). The $73.00 level is the nearest support level and the 2021 low at $67.83 is the next support. The movements of MA-50 and MA-200 are now close to each other and also close to the current stock price, while the RSI-14 is currently in a neutral phase near the 50 reading, indicating that the #Dominion stock is currently in a short-term consolidation phase.

The #Dominion stock is currently trading at $75.43 after closing on Wednesday, not much changed compared to the price at the 2021 opening at $75.00, but has fallen -6.3% compared to the stock price in the last 12 months. The stock has been moving in a relatively small range since June 2021 where it moved between $78.50 and $73.00. The June high of $78.50 is the closest resistance and any breakout will activate the May 2021 high of $81.08 (2021 high). The $73.00 level is the nearest support level and the 2021 low at $67.83 is the next support. The movements of MA-50 and MA-200 are now close to each other and also close to the current stock price, while the RSI-14 is currently in a neutral phase near the 50 reading, indicating that the #Dominion stock is currently in a short-term consolidation phase.

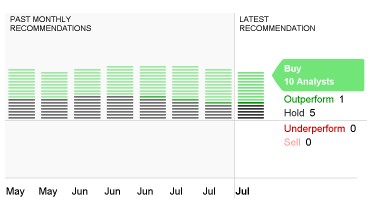

Analysts (CNN Money) still put Dominion Energy stock (MT5: #Dominion) among the potential stocks where 10 analysts put the stock in the Buy category, 5 analysts put it in the Hold category and 1 analyst put this stock as outperform. The median price projection for the #Dominion stock is currently placed at $85.00, +12.6% from the current price.

Click here to access our Economic Calendar

Tunku Ishak Al-Irsyad

Market Analyst

HF Educational Office – Malaysia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.