Yields continue to dip with the long end leading the way in a bull flattener unwinding the big bear steepener from late last week. The bond market is more focused on the risks to growth from the Delta variant and other factors than potential inflation risks as demand outstrips supply, and amid ongoing massive fiscal and monetary stimulus. The curve is richer on the day even ahead of the upcoming $126 bln refunding auctions. The wi 10 and 30-year yields are 2.5 bps lower at 1.300% and 1.945%, respectively, with the wi 3-year down 1.5 bps to 0.420%.

Meanwhile, the Senate voted to limit debate on the $550 bln infrastructure deal that could pave the way for a vote, and a subsequent reconciliation deal to pass the other $3.5 tln plan.

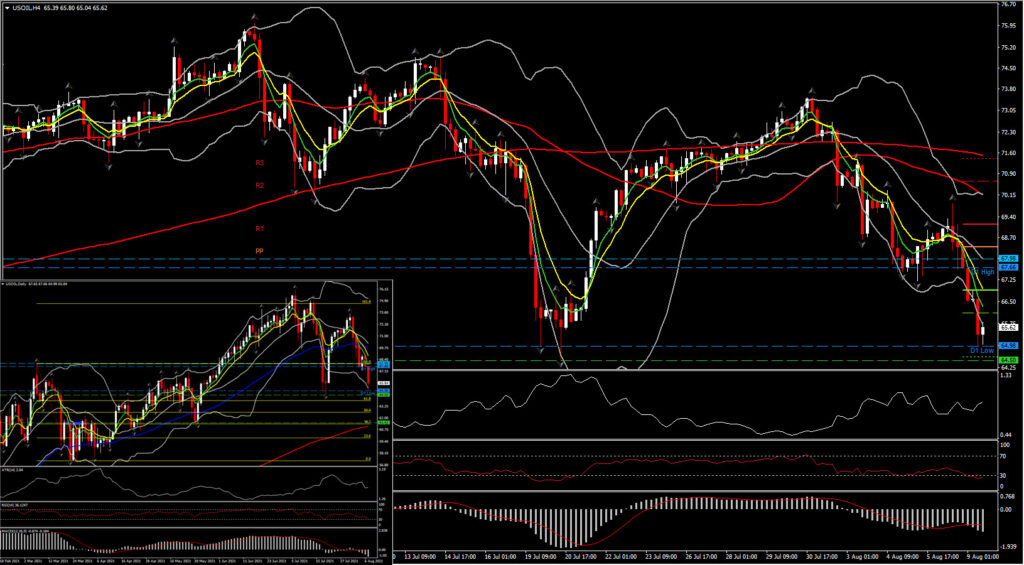

On the other hand, Oil and Gold prices steaded after plunging overnight as China ramped up Covid restrictions. USOIL fell over 4% ahead of the US open, bottoming at $64.98, and down from Friday’s $68.28 low. Ramping up Covid restrictions in China, where cases have been on the rise over the past two weeks have impacted prices, as flights and travel in many parts of the country have been curtailed. Other parts of Asia, including Malaysia and Thailand continue to see cases hit records highs on a near daily basis.

This should continue to keep the demand side of the oil equation pressured, even as OPEC+ continues with its plans to gradually increase production by about 2.0 mln bpd by year-end. Another negative for oil this morning has been a firmer USD, seeing the USDIndex move to better than 2-week highs.

Arguably, and as the sharp drop in oil prices suggests, the impact of the US jobs report might have been more pronounced, with more follow-through positioning, were it not for the pall being cast by Covid. There are some silver linings to the Covid situation; the most obvious being that those with the full dose of vaccination are well protected against anything beyond mild symptoms.

To sum up, the USOIL has created a strong negative movement, entering the lower weekly Bollinger bands area as it extended to a 2-month floor. The aggressive selling started on August 2nd with 20- and 50-day SMA strengthening the selling bias with a bearish cross on August 5th. Momentum indicators in the meantime extending lower with the daily RSI indicator is suggesting further losses, diving into the 30 barrier while MACD is mixed with lines southwards but signal line near to zero.

If the price dips further, immediate support could come from the 61.40 low registered on May 21st and the 38.2% Fib. retracement on the March downleg and the 60.00 low which coincides with 200-day SMA. On the other hand, if the asset regains buoyancy and sustains a move above 65, initial resistance could arise around the 69.00-70.00 area, i.e. 20-day SMA.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.