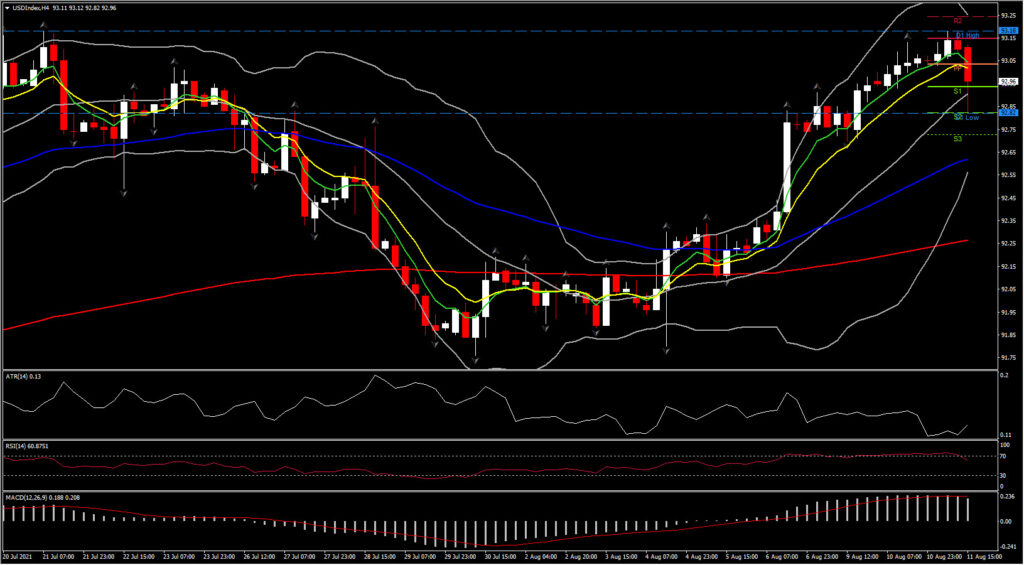

The USD eased following the slightly cooler than consensus CPI outcome, taking EURUSD from under 1.1720 to near 1.1740, and USDJPY to 110.43 from near 110.70. Equity futures continue to indicate a modestly higher Wall Street open, while yields have slipped from earlier highs.

The July CPI numbers take some of the pressure off the FOMC at the margin, to announce a tapering as soon as September in response to the improving conditions in the labor market. While inflation remains high, most of the figures are not as hot as in June. Indeed, moderation in many components support the FOMC’s contention that the surge in prices is temporary and largely a function of the economy’s reopenings and bottlenecks. The cooling in prices will give the Committee more flexibility. However, there is still a persistence in gains in some key commodities visible to consumers, including foods and beverage

US CPI headline rose 0.5% in July with the core rate up 0.3%. For the headline, that compares to respective gains of 0.9% in June and 0.6% in May, with the core posting rates of 0.9% and 0.7%. On an annual basis, CPI posted a 5.4% y/y pace of growth, unchanged from June and holding the 30-year high, with the ex-food and energy component slowing to 4.3% y/y from 4.5% y/y, also just off the 30-year peak. Nearly all components showed moderation, but from very high rates previously. The energy component rose 1.6% in July from 1.5%, with gasoline rising 2.4% from 2.5% previously. Services prices edged up 0.3% from June’s 0.4%. Transportation prices rose 0.6%, way off the 3.6% from June. Used car prices came down to a 0.2% gain from 10.5% previously. New vehicle prices rose 1.7% from 2.0%. Housing rose 0.4% for a third straight month, with owners’ equivalent rent at 0.3%, also for a third month. Foods and beverages rose 0.7% from 0.8%. Apparel prices were unchanged after a 0.7% gain. Medical care prices bounced 0.3% from -0.1%. Recreation jumped 0.6% from 0.2%.

In the medium term however the underlying dollar bid might remain a force after recent hawkish-leaning Fedspeak and the stellar US July jobs report and consequent lift in Treasury yields. Many analysts are now seeing a possible announcement on QE tapering by the Fed as soon as the September FOMC, though November or December seem more likely. EURUSD concurrently printed a spike to 1.1749 from its 4-month low at 1.1706 in what is now the sixth consecutive day of lower lows on the daily bar chart.

Over in the Treasury market, Treasuries erased losses and yields are richer in early action after a tamer than feared CPI report. The belly of the curve is outperforming. The data has tempered angst over the Fed, for now, as the numbers could give the FOMC a little more time on the sidelines before announcing QE tapering. The 2-year yield is down 1.2 bps to bring it back down to 0.227%, having hit an earlier high of 0.244%. The just auctioned 3-year is 1.6 bps richer at 0.454%, now at a profit versus the 0.468% stop yesterday. The wi 10-year is 1.5 bps lower at 1.360% versus 1.395% ahead of the data.

The pandemic situation remains a concern, but key equity indices in both the US and Europe hit new record highs over the last day. The advance in vaccinations in key economies is maintaining investor optimism.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.