Market News Today – Stock market sentiment faltered amid widening virus restrictions in Australia and China’s regulatory clampdown. Australia and New Zealand yields outperformed, as did stocks, as Canberra went into lockdown. Japan PPI inflation came in much stronger than expected and hit the highest rate in 13 years. In Europe, bond markets moved higher with Treasuries yesterday in the wake of the inflation report and a strong auction, and bonds remained supported overnight, as Asian stocks struggled. Treasury futures are also off earlier highs, but still slightly higher, while in cash markets the US 10-year rate has corrected -0.3 bp to 1.35%.

The UK economy bounced back in the second quarter as restrictions were lifted. Activity expanded 4.8% q/q, which was in line with expectations and a strong come back from the -1.6% q/q contraction in Q1. Most worryingly perhaps, gross fixed capital formation contracted for a second quarter, albeit to a lesser extent than in the first quarter, but still with a negative impact on the quarterly growth rate, although business investment improved. Not a balanced picture, although of course developments in virus measures are the main culprit. The monthly GDP number for June meanwhile was a positive surprise, with an acceleration in growth to 1.0% m/m from 0.6% m/m in May.

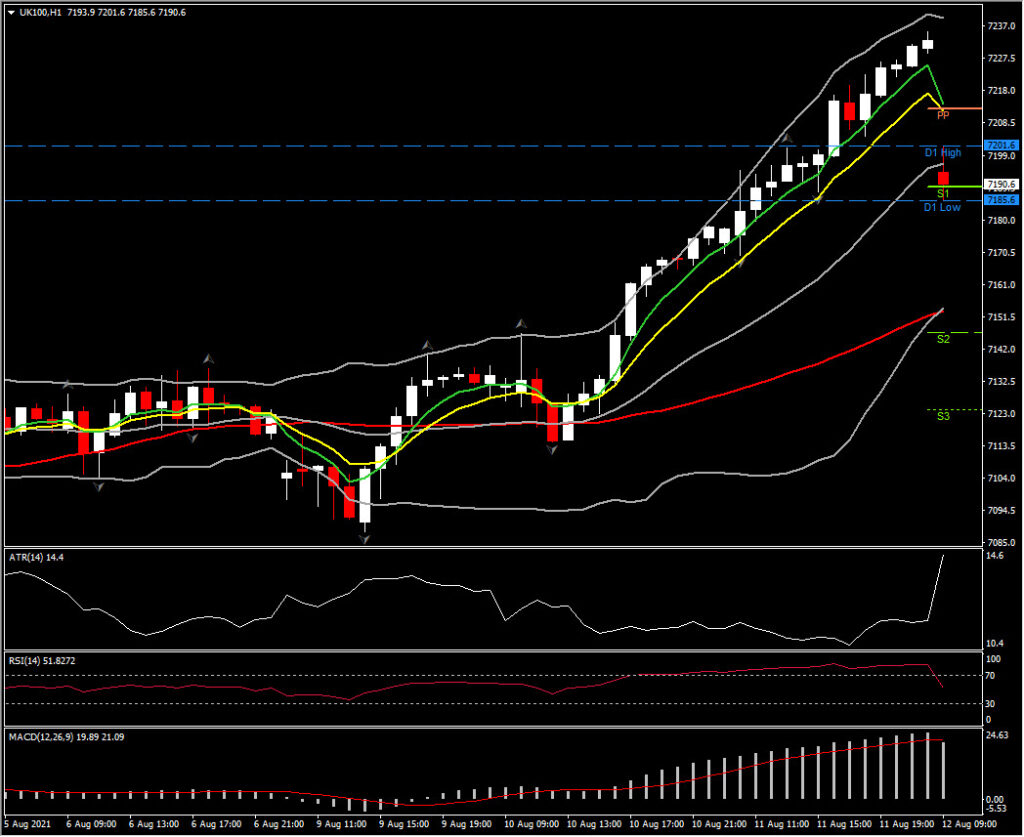

In FX markets EUR and GBP are little changed against the Dollar at 1.1743 and 1.3872. GER30 and UK100 futures meanwhile are up 0.9% and 0.1% respectively, while US futures are fractionally lower. The aerospace supplier Meggitt sky-rocketed on a new $9.7 billion takeover offer, while the UK100 ended at an 18-month peak on gains. USDJPY is little changed at 110.40. USOIL meanwhile is trading at $69.26 per barrel.

Today – US PPI & Jobless Claims, Fedspeak remains in focus amid tapering speculation & virus development concerns in Asia Pacific.

Big Mover – Yesterday aerospace supplier Meggitt skyrocketed on a new $9.7 bn takeover offer, boosting the UK100 to end at an 18-month peak on gains. Today UK100 gapped down to 7185 from 7349 on profit taking. Faster MAs already flattened implying the gap down was limited. H1 ATR 14.0, Daily ATR 59.6.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.