China has signalled that its regulatory shakeup is a long term project. A document issued jointly by the State Council and the Communist Party’s Central Committee said authorities will “actively” work on legislation covering areas such as national security, technology and monopolies, with law enforcement to be strengthened in sectors from food and drugs to big data and artificial intelligence. The 5-year blueprint says that the people’s growing need for a better life has put forward new and higher requirements for the construction of a government under the rule of law. “It must be based on the overall situation, take a long-term view, make up for shortcomings, forge ahead, and promote the construction of a government under the rule of law to a new level in the new era”.

After this announcement, it is clear that the clampdown is far from over.

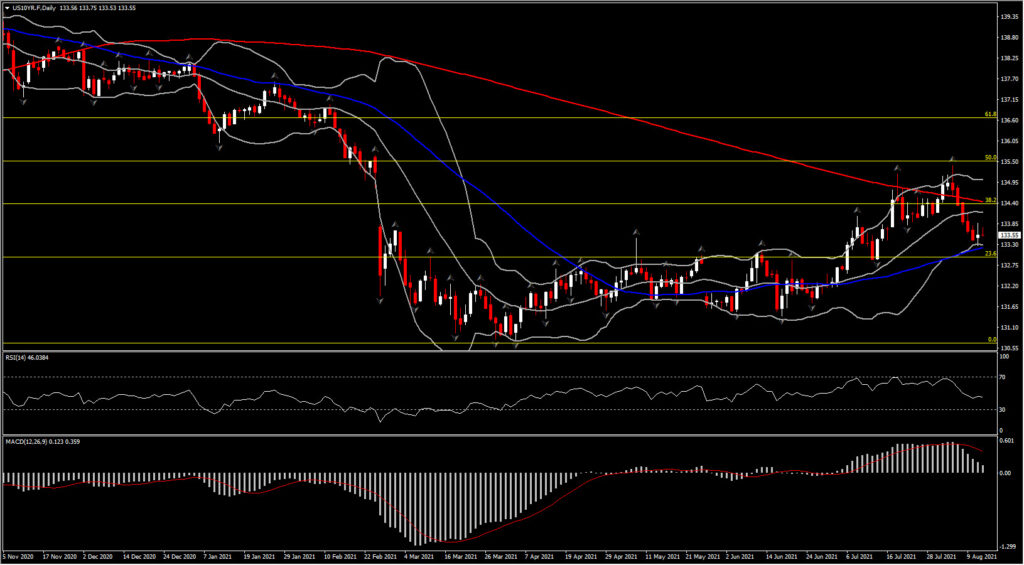

Asian bonds rallied amid virus concerns and China’s regulatory clampdown. The JGB richened by 1.2 bps to 0.019%. US equity futures are modestly firmer, with USA30 leading the way upwards as it has currently posted a fresh high at 35,520, while the USA100 lags. The Treasury 10-year yield was up 1 bp at 1.359%, after posting a post-data low yesterday at 1.315%. However, Treasuries extended early losses after the much stronger than expected PPI data, and as jobless claims continue to shrink. The belly and longer end are underperforming modestly, but selling pressure is already abating, suggesting that in the bond market the momentum is staying with bond sellers for now, something that could support the US Dollar.

US headline PPI popped 1.0% in July with the core rate up 1.0% as well, much hotter than expected, and both equaling the 1.0% jumps in June for each. US initial jobless claims fell -12k to 375k in the week ended August 7 following the prior week’s -12k drop to 387k (was 385k).

The CME’s Fedwatch Tool shows that market positioning is implying a probability for a 25 bp Fed hike at the December FOMC of 41.4%, which is near unchanged from yesterday, before the release of the CPI data.

The USD has lost upside momentum in the wake of the sub-forecast July CPI data out of the US, which has quelled what had been rising market expectations for the Fed to announce a QE tapering schedule as soon as the September FOMC. The narrow trade-weighted USDIndex has ebbed back from 4-month highs to levels back under 93.00, while EURUSD has settled to a narrow range under yesterday’s rebound high at 1.1753, which marked a near half-a-big-figure recovery from the four-month low at 1.1705. USDJPY has been plying a narrow range near the 110.50 level after posting a 5-week high at 110.80 yesterday before the US inflation numbers were released.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.