Market News Today – Virus developments and China’s regulatory curbs remain the main themes for Asian markets. Chinese internet giants were pressured and chipmakers also struggled. Chinese authorities continue to try and get more control of a large range of industries. The nation suspects private equity funds of raising money to invest in residential property development, which is hitting the real estate sector. At the same time, a virus related partial shutdown of a major Chinese port has revived concern of a repeat of last year’s disruptions in the shipping industry.

In Europe, Gilts led yesterday’s rise in core yields, with the UK 10-year closing 3 bp higher as GDP numbers added to the sense that the BoE will start to phase out stimulus sooner rather than later. Eurozone peripheral stock as well as bond markets remained supported yesterday. Some have pointed out that the richness even in Bunds is not only driven by weekly purchases, which actually dropped in the week ending August 6, but the level of assets the ECB is now holding and that this may have lasting implications. Eurozone peripherals clearly also benefit from the excess liquidity in the system and the hunt for returns.

In FX markets, the EUR was higher against most currencies, leaving EURUSD at 1.1736, GBPUSD is little changed at 1.3807 and USDJPY is at 110.49. GER30 and UK100 futures meanwhile are unchanged on the day and up 0.1% respectively, while US futures have moved sideways overnight, after a slightly higher close on Wall Street yesterday. USOIL meanwhile is at $68.28 per barrel.

Today – Today’s data calendar is unlikely to rock the boat, but includes Eurozone trade data and some final inflation readings for July. In the US, the Michigan Index is tap.

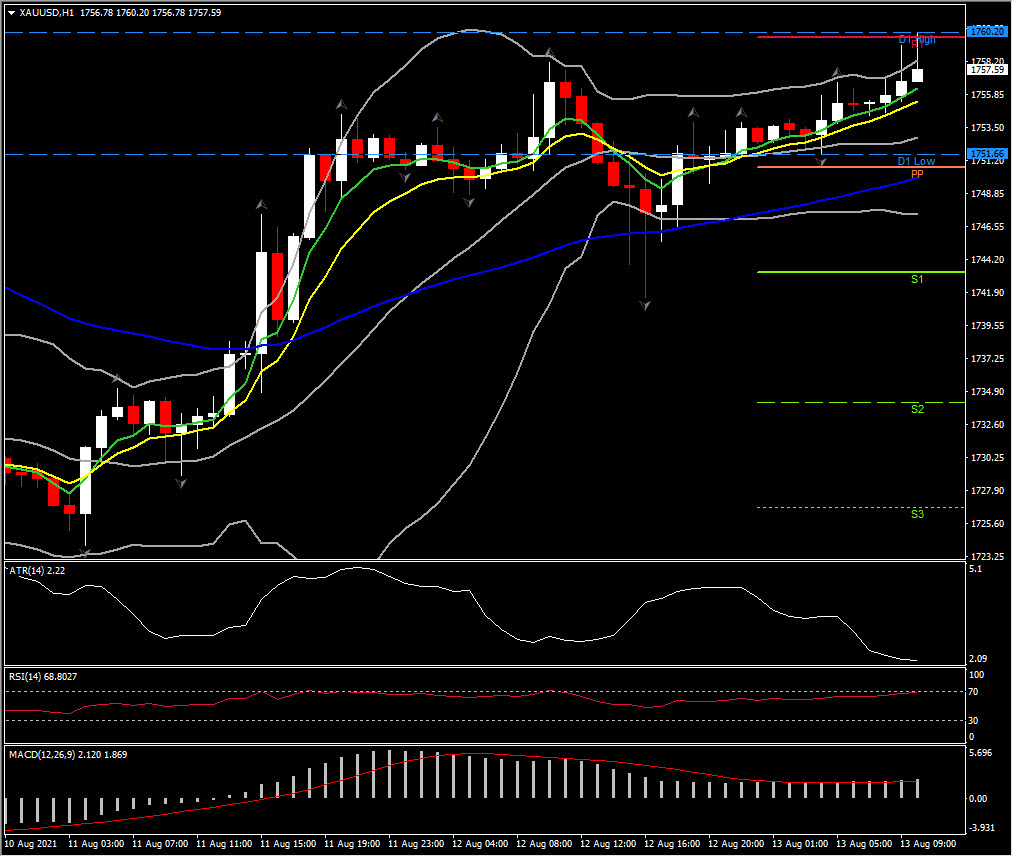

Mover – Gold spiked to 1760 today as risk aversion is keeping back in as virus developments and China’s regulatory clampdown remain in focus, but adverse headwinds to the global recovery will be keeping central banks in generous mode for now. Faster MAs aligned higher while momentum indicators such as RSI and MACD flattened suggesting that the rally might run out of steam. H1 ATR 2.22, Daily ATR 24.64.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.