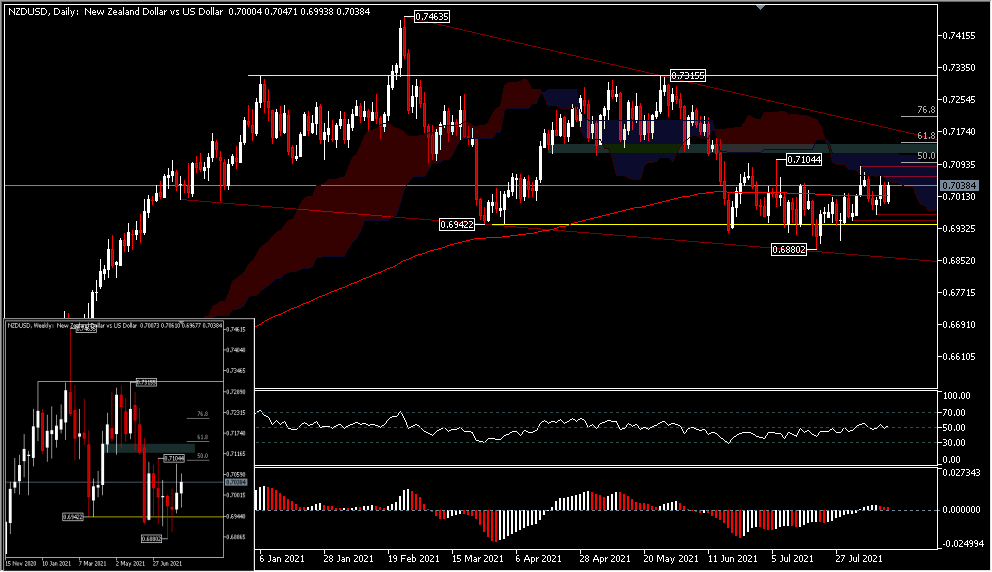

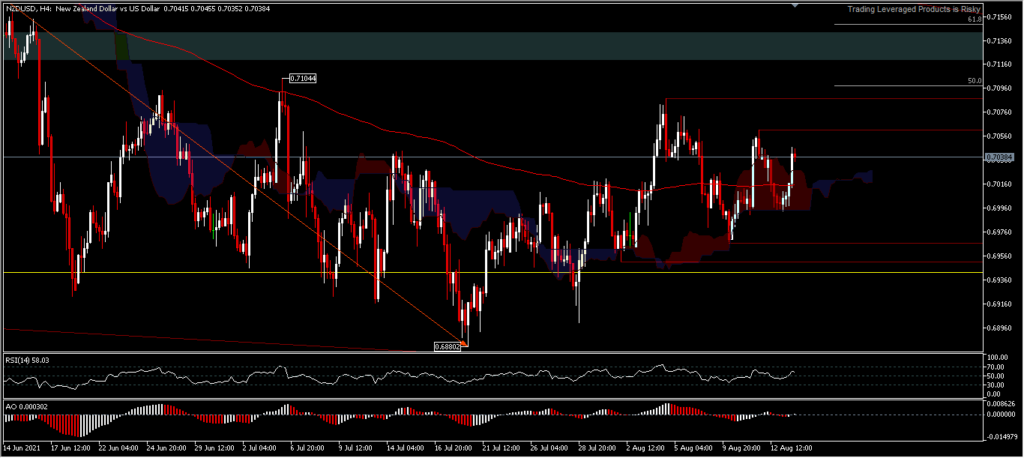

NZDUSD, Daily & H4

China’s two largest container ports in Shanghai and Ningbo Zhoushan are facing severe congestion, even the Meidong Ningbo container terminal which handles containers for the China-Europe, China-Middle East routes as well as the OCEAN Alliance route has been closed due to Covid-19 detection. This is not good news, as it will further tighten international supply chains, as well as serve as a warning to investors that the pandemic has not yet resolved its disruption to global supply chains. As a result, of course, the price pressure will strengthen the global inflation rate which is likely to benefit the US dollar and will last longer than expected. Shipping rates have increased from usual ahead of the shopping season in the second half of this year.

US inflation is currently heating up well above the Fed’s 2.0% target, due to a combination of global supply problems and a strong economic rebound. Meanwhile, data released this week showed inflationary pressures were becoming more widespread. The inflation theme is very dominant for the market this year and if it lasts any longer, it will force the Fed to move forward the timing of the rate hike. Markets continue to position themselves to approach the normalization of Fed policy and risk aversion could lift the global reserve currency to outperform.

RBNZ meeting to be held on Wednesday (August 18), the central bank is widely expected to raise interest rates. There are clear signs that New Zealand’s economy is overheating, so it’s time for BC to hit the brakes. Economic growth has been impressive lately, unemployment has returned to pre-crisis levels, inflation is high and rising, and the housing market is booming. Therefore, the market has fully priced in a 0.25-point rate hike at this meeting, and has also set a 20% probability for a 0.50-point rate hike. But in the bigger picture, the outlook for this currency is very bright. The economy is strong and the kiwi will soon enjoy higher interest rates, making it more attractive for carry trades, especially against low interest rate currencies.

NZDUSD last week gained 0.44% to close at 0.7038 above the key round number of 0.7000. The pair is holding in a daily consolidation that has lasted for 8 weeks and is tied in a range between 0.6880 – 0.7104, moving alongside the 200-day EMA, RSI is flat in the middle and AO is positive but the histogram is signaling diminishing momentum, ideal conditions to draw a consolidation that does not yet have a clear direction. A move above 0.7104 will target 0.7315 and as long as the resistance at 0.7104 holds, the price structure will follow the falling wedge pattern before determining the direction. A break of 0.6880 would imply a deeper retracement towards the 38.2% level at 0.6702.

.

The intraday bias is likely to be neutral first, a positive move will try to test the immediate resistance at 0.7061 before continuing to test 0.7087 and 0.71044. Upward support comes from moves above the 200 EMA and above the Kumo, the RSI is not overbought and the AO is already above the neutral area. On the downside the price will test immediate support 0.6993 and 0.6967 and if strong 0.68802. Broadly speaking, the consolidation is not over yet, as traders are still waiting for the RBNZ’s decision signal on Wednesday.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.