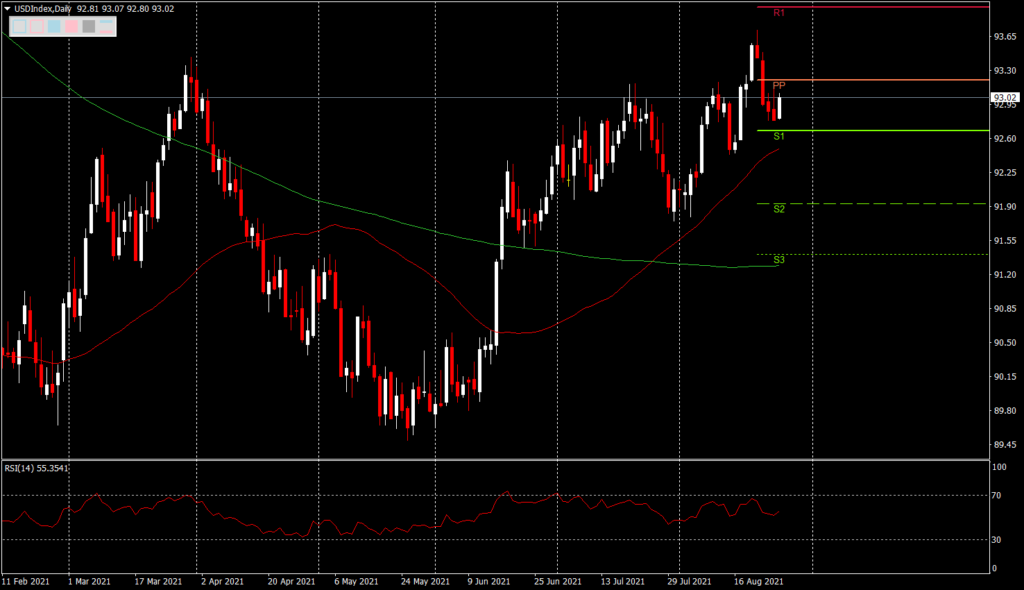

The USD traded positive after a 4-day fall as traders restructured their trading positions ahead of Federal Reserve (FED) Chairman Jerome Powell’s speech at 14:00 GMT. The USDIndex traded above 93.00 towards the end of the New York session, the first uptick for this week. Although US Q2 GDP data failed to hit the target, with growth of only 6.6% (projected 6.7%), FED member James Bullard’s Hawkish comments urging the FED to implement tapering and be more aggressive in controlling inflation clearly helped the USD stay afloat. The USDIndex is now back above 93.00, with the weekly Pivot point slightly above at 93.20. The August high was 93.72. The S1 weekly Pivot level is at 92.68

Meanwhile EURUSD tried to test the weekly R1 Pivot level at 1.1776 today but failed and pressed back closer to the 1.1750 level. It is still traded between the two Mas, namely MA-50 and MA-200. The weekly pivot point is at 1.1720. The publication of the minutes of the ECB policy meeting did not affect the EURO but members were quoted as discussing the need to review how to provide ‘forward guidance’ in setting interest rates.

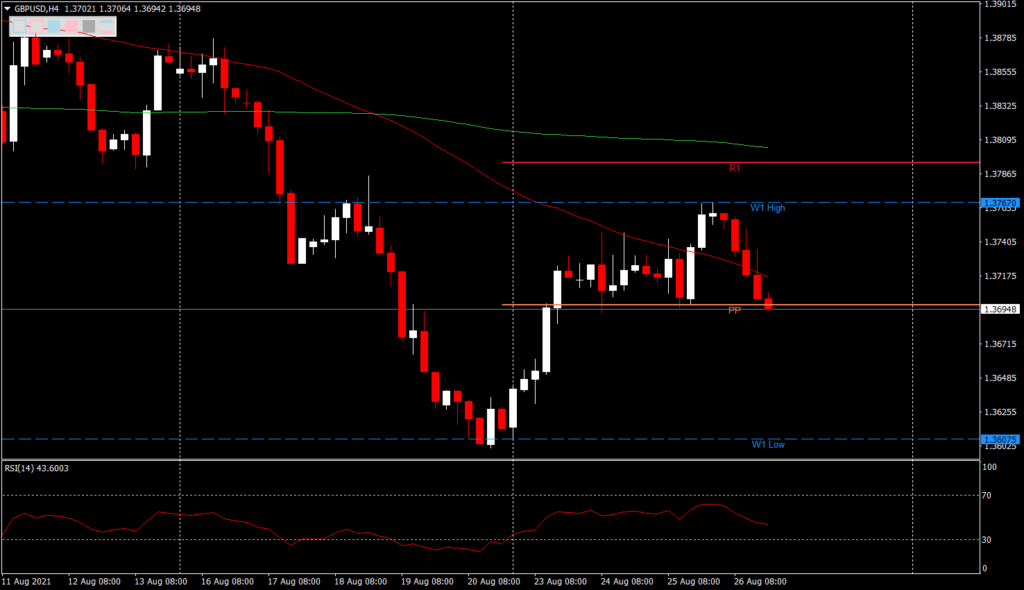

GBPUSD continued to decline. The combination of the strengthening USD and investor concerns about food chain supply disruptions ahead of Christmas following Brexit is clearly depressing the GBP. GBPUSD fell below the psychological level of 1.3700 and is now below the MA-50. It is also the area of the weekly Pivot point support level. Continued pressure could allow GBPUSD to test its weekly low at 1.3607 in the event of a Hawkish Powell later, while the MA-50 has become an important resistance at 1.3716 followed by this week’s high at 1.3767.

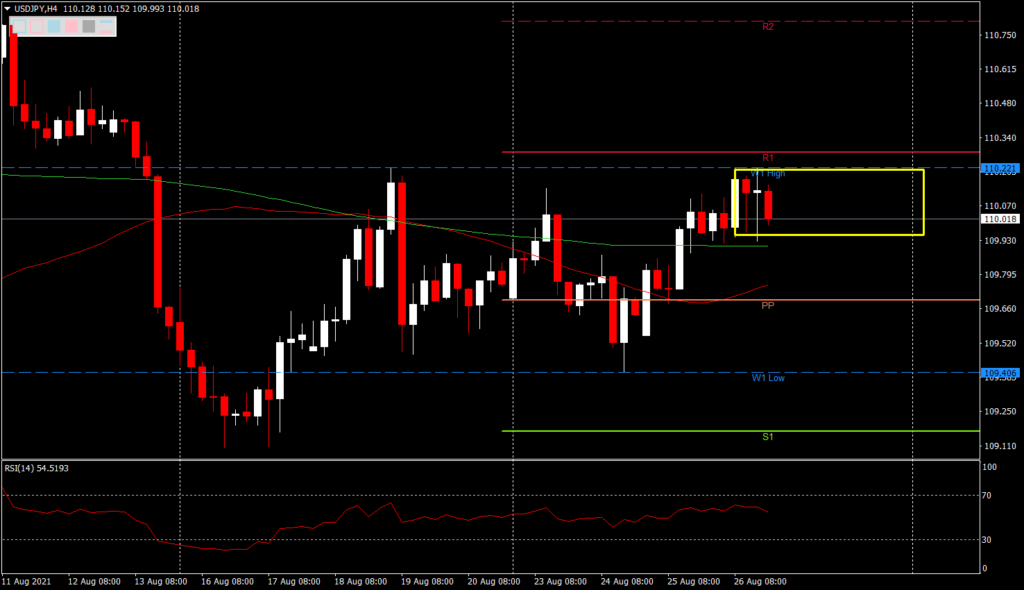

USDJPY broke the 110.00 level by testing 110.20 repeatedly this week but is still struggling to close daily above 110. The MA-200 has been flat for some time, indicating the momentum is currently in a state of consolidation in a small range. Inside bar or harami formations have been formed. The nearest support is the weekly pivot point which is at 109.70 followed by the weekly low at 109.40. A resistance cluster has formed in the 110.22-110.28 zone which is close to the R1 pivot.

Click here to access our Economic Calendar

Tunku Ishak Al-Irsyad

Market Analyst

HF Educational Office – Malaysia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.