Market News Today

European bond markets and Eurozone peripherals in particular sold off yesterday, as more ECB officials flagged the possibility of a tapering announcement next week and it seems pretty certain now that the ECB will start to take the foot off the accelerator as it revises its growth forecast upwards once again. Activity is now expected to reach pre-crisis levels as soon as the end of this year, and fiscal support should increase, which reduces the need for central bank support to some extent at least. Central bank officials will stress the very dovish guidance on the rate outlook though in order to avoid a taper tantrum.

- Bonds in Australia and Zealand underperformed and sold off sharply as traders assess the economic outlook against the background of virus developments.

- Australia Q2 GDP beat most estimates. GDP numbers have prompted some to ditch expectations that the RBA will postpone planned moves.

- Japan’s Markit manufacturing PMI was revised higher and continues to signal expansion.

- USD (USDIndex 92.75) strengthened.

- Equities are mixed as GER30 and UK100 futures are currently up 0.5%, alongside gains in US futures, which is encouraging. China’s tech stocks shake off risks.

- EURand Sterling are lower against the Dollar, but it is the CHF that is mostly under pressure this morning.

- USOil is trading at $68.92 as traders assess the prospect for an easing of output restrictions ahead of the OPEC+ meeting today. (Saudi struggling to increase supply, Shrinking US stockpiles, a rebound in Indian demand China’s outbreak.

- Gold steadied to 1,810-1,817.

European Open – German retail sales corrected -5.1% m/m in July, a much more pronounced correction than anticipated, largely related to the ebb and flow of virus developments and restrictions.

Today – Data releases today are unlikely to change the outlook, and focus on final manufacturing PMI readings for the Eurozone and the UK. Eurozone unemployment data for July are also due. In the US, we have ADP and ISM data.

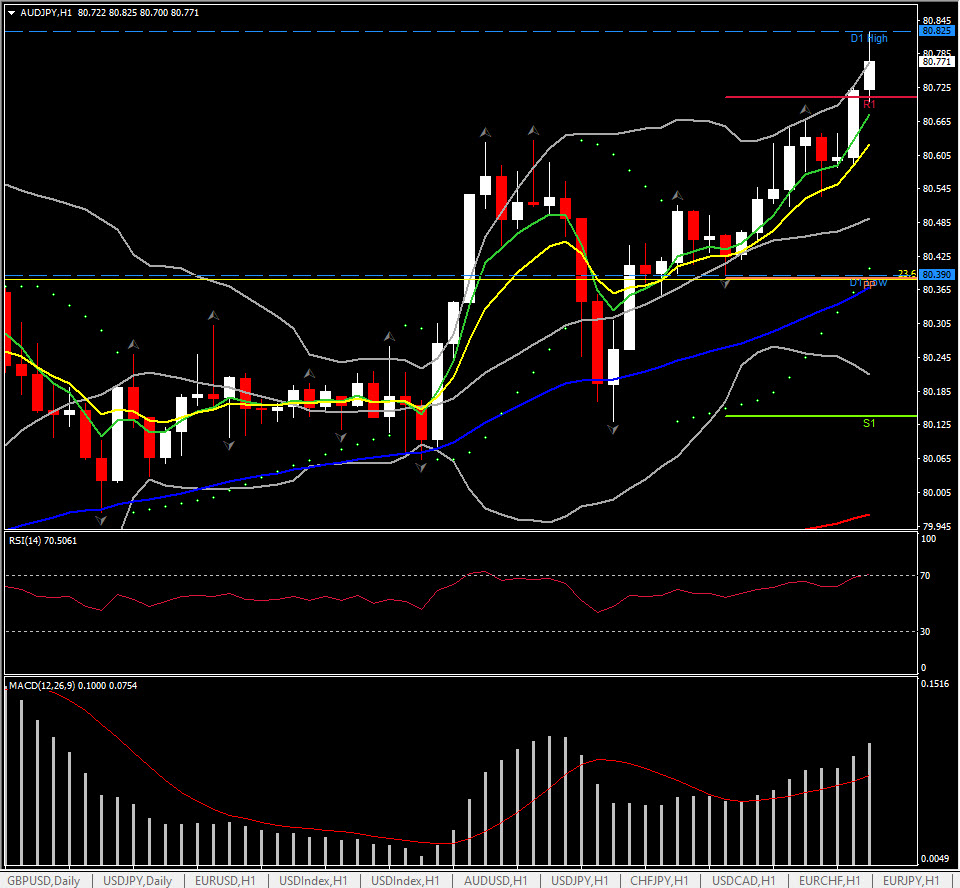

Biggest Mover @ (06:30 GMT) AUDJPY (+0.41%) Spikes to 2-week highs to 80.82 from 78.00 lows. Faster MAs aligned higher. The MACD signal line & histogram are rising strongly. RSI at 70 and rising. H1 ATR 0.096, Daily ATR 0.733.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.