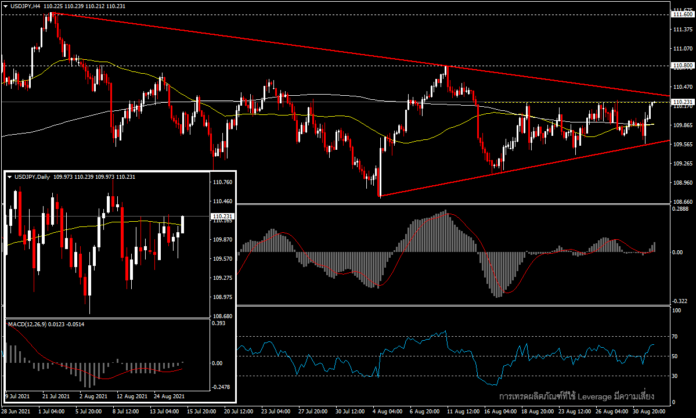

USDJPY, H4

Most of the Japanese economic data reports this week were better than expected, but did not stand out significantly. The most recent August manufacturing PMI was revised higher to 52.7 from 52.4 in the first reading and 53.0 for the previous month’s reading. This marks the seventh consecutive month of growth in the manufacturing sector amid the outbreak and restrictions of Covid-19.

When compared to US economic data that has been reported for this week, the reports are overall disappointing. However, the data on the US economic calendar for the rest of this week will become a key highlight of the market, starting tonight with the ADP and ISM-PMI Employment Figures, Manufacturing Sector Unemployment Claims tomorrow and the non-farm employment and the unemployment rate on Friday.

Japan and the United States, two major economies, are facing a major outbreak of the Delta variant. So far, more than an estimated one million Americans have taken a COVID booster, even though none have been authorized¹ , while Japan’s vaccination program has been struggling, with contaminants found in several batches of the Moderna vaccine. As for central bank moves in September, both the Fed and the BoJ will have a meeting to decide interest rates simultaneously on September 22.

As for the movement of the USDJPY pair, trading has started to gain momentum after a rather quiet Monday. In the H4 timeframe, a triangular pattern is visible within the high-low frame of August, and now the price is testing a two-week high zone. If broken, the next resistance will be at the August high zone at 110.80, while if the price continues to swing within the triangle there will be a first support at the MA50 and MA200 lines at 109.90. Overall this week, there is a bias towards the uptrend. This is because in the Day timeframe, the price is breaking above the MA50 line as it breaks into the positive zone of the MACD.

¹https://fortune.com/2021/08/12/covid-boosters-americans-cdc-the-capsule/

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.