Market News Today

Trading should remain quiet and confined in the lead up to the employment report. The markets were mixed to open September with the USA100 extending gains to another record high. Longer dated Treasuries also rallied while the front end of the curve cheapened fractionally. The data were mixed and didn’t provide any strong direction. Additionally, limiting action were concerns over the spike in the Delta variant, increased mitigation measures, slowing in growth, high valuations on Wall Street, rich Treasury yields, and angst over monetary policy amid increasing hawkish talk from various Fed officials and now from some ECB members.

- China tech stocks gain for 4 days straight – “Buying the dip” sentiment from months of sell off despite China firing fresh regulatory Salvo.

- Biggest tech stock rally in record – Tech stocks power USA100 to record highs.

- Tesla’s China output halted for days last month on chip shortage – lack of key chips , electric control devices for vehicles.

- Treasury futures are also fractionally higher, while in cash markets the US 10-year rate has lifted 0.2 basis points. GER30 and UK100 futures are down -0.2% and -0.1% respectively, USA100 at new record highs, Topix and JPN225 are up 0.03% and 0.19% respectively.

- Australia’s trade data was a positive surprise with the trade surplus reaching a record high in July, but there are concerns that activity will correct in Q3 thanks to Covid measures, after better than expected Q2 data yesterday. If the RBA doesn’t postpone planned tapering it could further hit the economy.

- USD (USDIndex 92.45) extending 12-day decline.

- USOil declined to $68.00 after OPEC+ alliance agrees to return more barrels.

- Gold steadied to 1,810-1,817.

Today – Data releases today includes data for Switzerland and Eurozone PPI inflation and weekly jobless claims,July trade report and factory orders from the US.

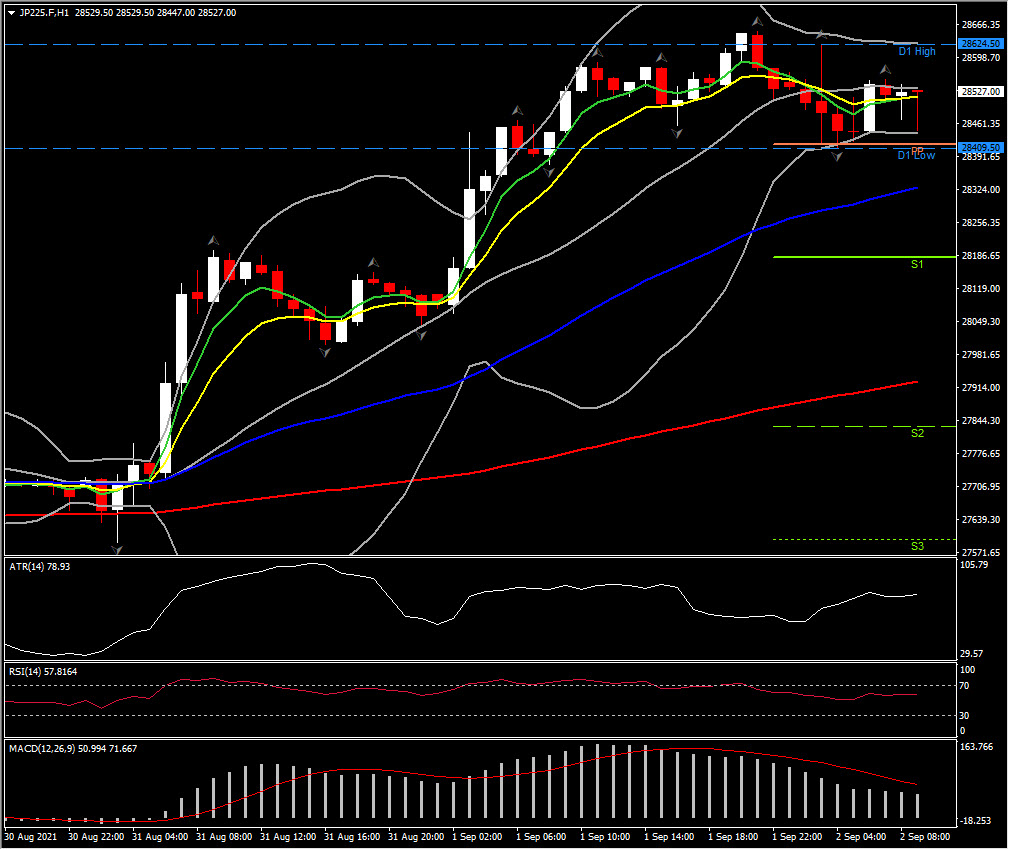

Biggest Mover @ (06:30 GMT) JPN225 (+0.19%) Crossed 20-DMA, reversing more than 40% of 2021’s decline this week. Faster MAs flattened suggesting consolidation in the short term. The MACD signal line & histogram are falling lower since yesterday’s peak and RSI steadied at 56. H1 ATR 77.68, Daily ATR 398.75.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.