Market News

• USD (USDIndex 92.75) up as the rise in inflation and recovery in risk appetite weighed on bonds and as the policy outlook lifts US Treasury Yields, hence supporting USD. There have been a string of voices calling for Fed tapering to begin sooner rather than later, even if Covid-19 cases are surging. But as the ECB showed, one can wrap a taper in dovish guidance on rates and thus prevent a taper tantrum.

• Equities struggled again, with China’s tech sector once again hit hard by the country’s regulatory clampdown amid a report that officials want to break up Ant Group Co’s Alipay. Online platforms have also been told to protect the rights of workers.

• JPN225 down (-0.30%). But US equities up for the day, with USA500.F bottomed at the 4470-4477 area. USA100 declined -0.87%, along with the USA30.

• Toyota downgraded projections for this year’s vehicle production numbers and China issued warnings that the chip shortage could last a while which will all add to the arguments of those saying ultra-accommodative monetary policies are only adding to existing imbalances between demand and supply that are pushing up prices at the moment.

• Apple down – follows “unfavourable” court ruling related to its app store, just days before it unveils the new iPhone line up. Alphabet down, with Google Play revenue also in doubt.Tesla down to 735.11 low.

• Yields down again, with 10-year -1.4 bp at 1.33%.

• The CHF is lower to start the week, EUR and GBP have also dropped back against a largely stronger US Dollar.

• USOil up to $70.17, supported by growing signs of supply tightness in the US as a result of Hurricane Ida. About 3/4 of the US Gulf’s offshore oil production has remained halted since late August.

• Yesterday – SNB vice-president Zurbruegg said over the weekend that negative interest rates remain necessary to keep a lid on the currency, which suggests a steady hand announcement for Switzerland. In the US, Democrats are set to float 26.5% Corporate Tax.

Today – A cautious start to a week that will bring key inflation data for the US and the UK ahead of next week’s central bank announcement. The SNB decision is also coming into view.

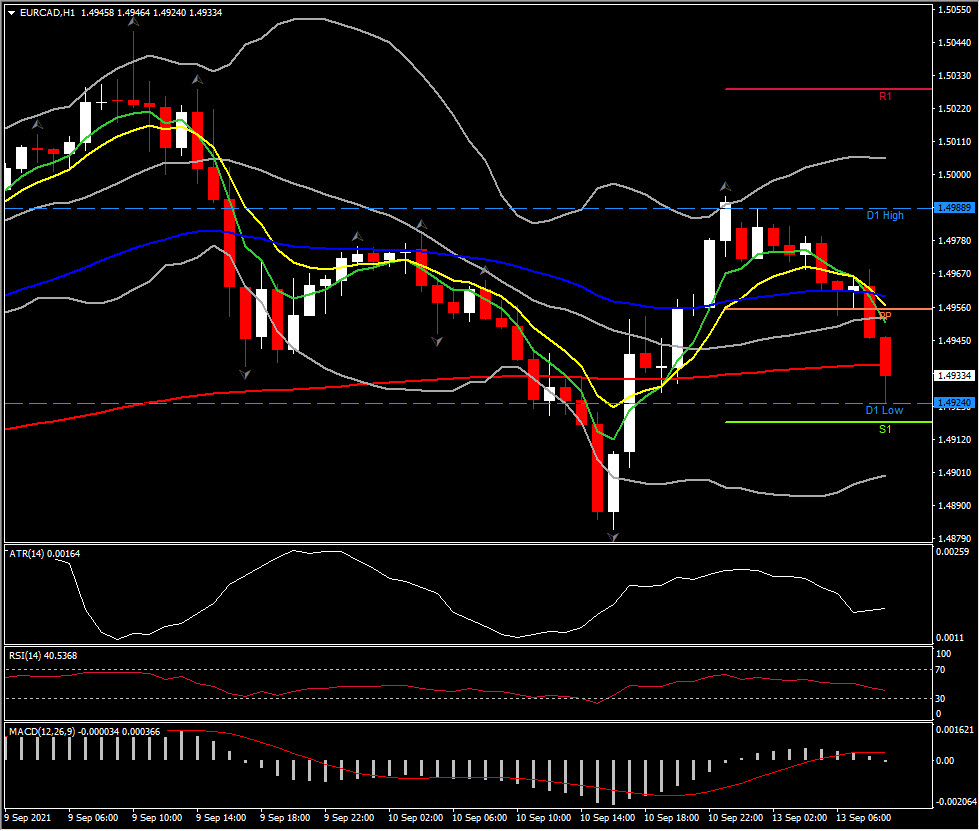

Biggest Mover @ (06:30 GMT) EURCAD (-0.38%) dip from1.4990 to 1.4924. Faster MAs aligned lower, MACD signal lines steady at 0, implying indecision, but RSI at 41. H1 ATR 0.0015, Daily ATR 0.00839.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.