Market News

- The Treasury market holds a modest bid except in Australia and New Zealand.

- RBA’s Lowe pushed back against rate hike expectations in a bid to separate QE tapering plans from the outlook on interest rates.

- Australia house price data & Business confidence data came in higher than expected, and coupled with Lowe’s assuring words on rates the numbers still helped the ASX to gain 0.2%.

- Bonds were supported by the strength seen in last week’s 3-, 10-, and 30-year auctions, as well as by expectations the FOMC will not announce a QE tapering next week.

- Equities are mixed with solid 0.76% gains on the USA30 amid strength in energy as oil stocks surged. The USA500 posted a 0.23% increase, while the USA100 was weaker, slipping -0.07% amid declines in Chinese ADRs amid further crackdowns, this time on ANT Group. Japanese indexes are near 31-year highs and JPN225 is also currently up at 0.5% and 0.7% respectively. GER30 and UK100 futures are up.

- The AUD and NZD declined along with yields after Lowe’s remarks. USDJPY lifted to 110.08, amid a largely weaker Yen.

- USOil up to $70.88, as a storm hitting the Gulf of Mexico was upgraded to a Hurricane.

- Today’s UK labour market report presented an unemployment rate down to 4.6% in the three months to July – as expected. Earnings growth eased somewhat, but remained very strong. –Strong numbers that will add to the arguments of the hawkish camp at the BoE as officials ponder strategies to exit from QE.

Today –US inflation numbers today will be in focus for markets and investors are likely to hold back ahead of the release.

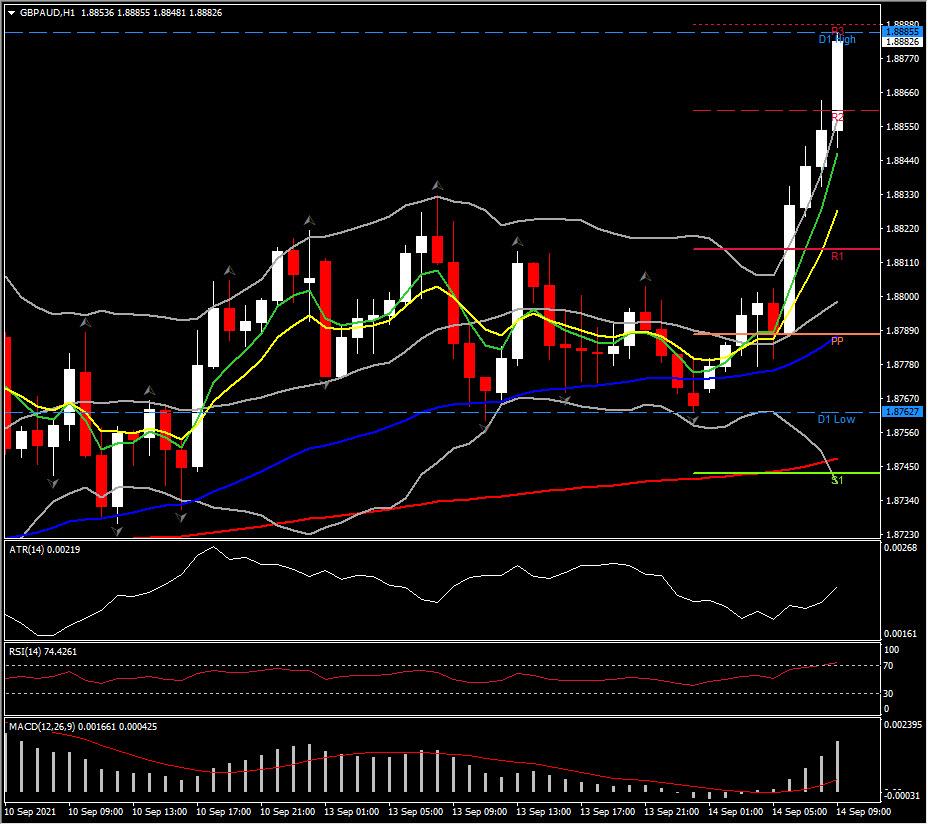

Biggest Mover @ (06:30 GMT) GBPAUD (+0.61%) spiked to 1.8890 from 1.8760. Faster MAs aligned higher, MACD signal lines are positively configured as RSI broke above 70 barrier, suggesting that bullish bias strengthens. H1 ATR 0.0022, Daily ATR 0.01063.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.