Market News

- Yields rose (10yr closed at 1.51% – the highest level since June, with the 30-year testing 2.04%, while the 5-year hit 1.005% before rates retreated from those key areas). Now at 1.447% in Asian trades (highest since March 2020).

- Equities extended losses, but stabilised into this morning. Durable goods added to the bearish bias seen since FOMC’s hawkish pivot last Wednesday. USA500 -51 at 4431 (S1), USA100 -319 at 15095, but currently at 15160. USA30 advanced 0.2% as strength in materials, energy, and financials supported.

- Asian equities trade mixed, – property stocks rallied in Hong Kong after China’s central bank said it will work to safeguard the “healthy” development of the property markets – ASX corrected at -1.4%. VIX rebounded from 20DMA & closed at 20.27.

- USOil rally continues (October 2018 highs) – Brent at 2018 highs, over $80.

- Energy was up over 3.5%, as oil prices approached three-year highs. Financials rose near 1.5% on higher rates, while technology was down near 1% for the same reason.

- FX markets – GBP bid – helped by higher rates. – USD & JPY weaker – USDJPY – 110.30, Cable 1.3700, EURUSD 1.1681.

European Open – The December 10-year Bund future is down 20 ticks, US futures have also sold off and the US 10-year rate has lifted above 1.5% as investors continue to bring forward rate hike expectations. GER30 and UK100 futures are still up 0.2%, US futures are also mostly higher, as China’s central bank tried to calm nerves on the health of the property sector.

Gilts underperformed yesterday and are likely to continue to remain under pressure after BoE governor Bailey re-enforced the bank’s message on the possibility of hiking rates before bond buying has ended. Many are now expecting a rate hike to come in the first quarter of next year, and while Bailey also highlighted the problems the UK economy is facing this winter, he stressed that monetary policy won’t be able to fix those.

Lagarde continues to try and keep rate hike speculation at bay and will likely continue along those lines when she opens the ECB’s annual conference on central banking today.

Today – Data releases are thin on the ground again, but include ECB Lagarde and Chairman Powell speeches and US Consumer Confidence.

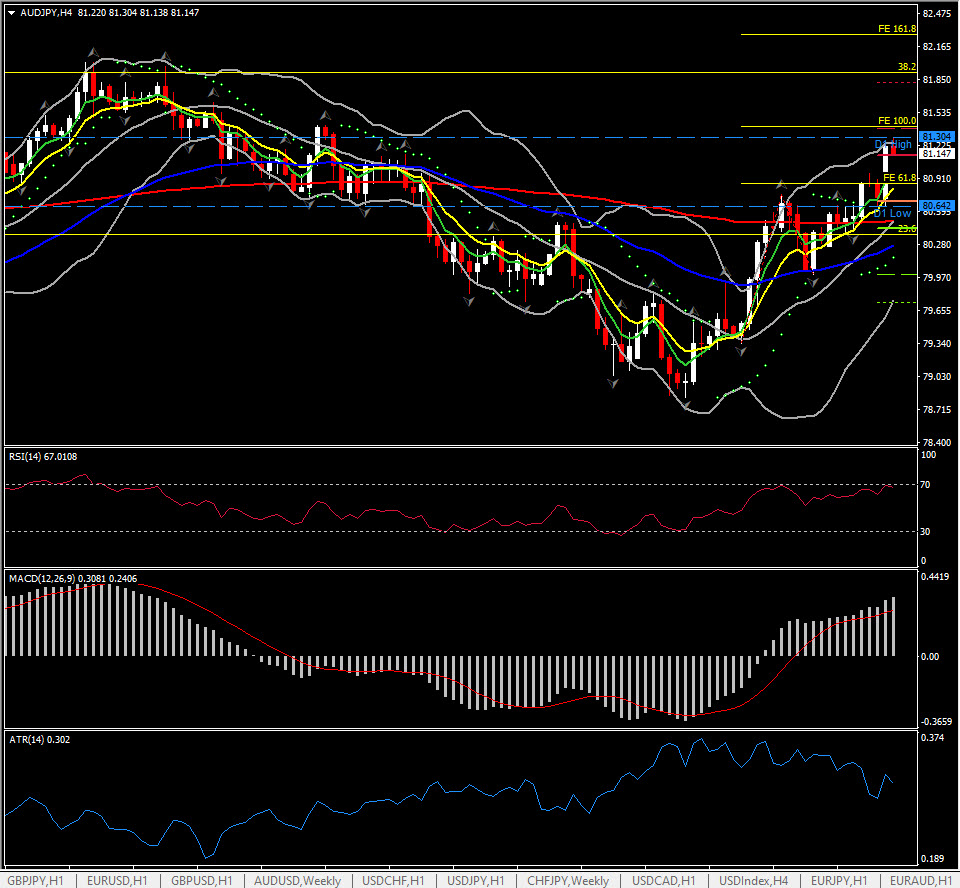

Biggest Mover @ (06:30 GMT) AUDJPY (+0.48%) Broke 81.00 barrier ahead of elections. Next resistance 81.40 & 81.80. Faster MAs flattened, suggesting consolidation, MACD signal line & histogram rallying higher, but RSI turned below 70 and dropping. H1 ATR 0.1300, Daily ATR 0.309.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.