Market News

- Global central bank officials stuck to cautious optimism at the ECB conference on central banking and data releases overnight were mixed. – Lagarde stressed the “reopening of the economy”.

- Traders are still cautious, while keeping a wary eye on US budget talks, as a deadline to keep running is approaching amid last minute political wrangling in Washington.

- China PMI readings mixed – manufacturing PMI unexpected signalled contraction, while the Caixin PMI came in stronger. Japan production as well as retail sales disappointed, while Australia building permits jumped. UK GDP revised sharply higher in the final reading.

- Yields steadied (US 10-year rate stymied the drop in rates at 1.51%).

- Equities supported by the drop in Treasury yields which enticed buyers back into equities, especially with beliefs the recent declines were overdone. JPN225 down -0.1%, USA500 outperforming at 4398, USA100 slipped -0.24%.

- USOil steadied at the mid of $74 mark.

- “A combination of higher US yields, impending Fed tapering and skittish markets around the debt ceiling have fuelled this move (in the dollar),” as Westpac analysts wrote.

- FX markets – Strong USD, while GBP and EUR selling off sharply yesterday – USDJPY – 112.00, Cable 1.3409, EURUSD 1.1588.

Today – Today’s data calendar is pretty busy and includes German labour market data and the preliminary inflation report for Germany, but key will be the US GDP and PCE number.

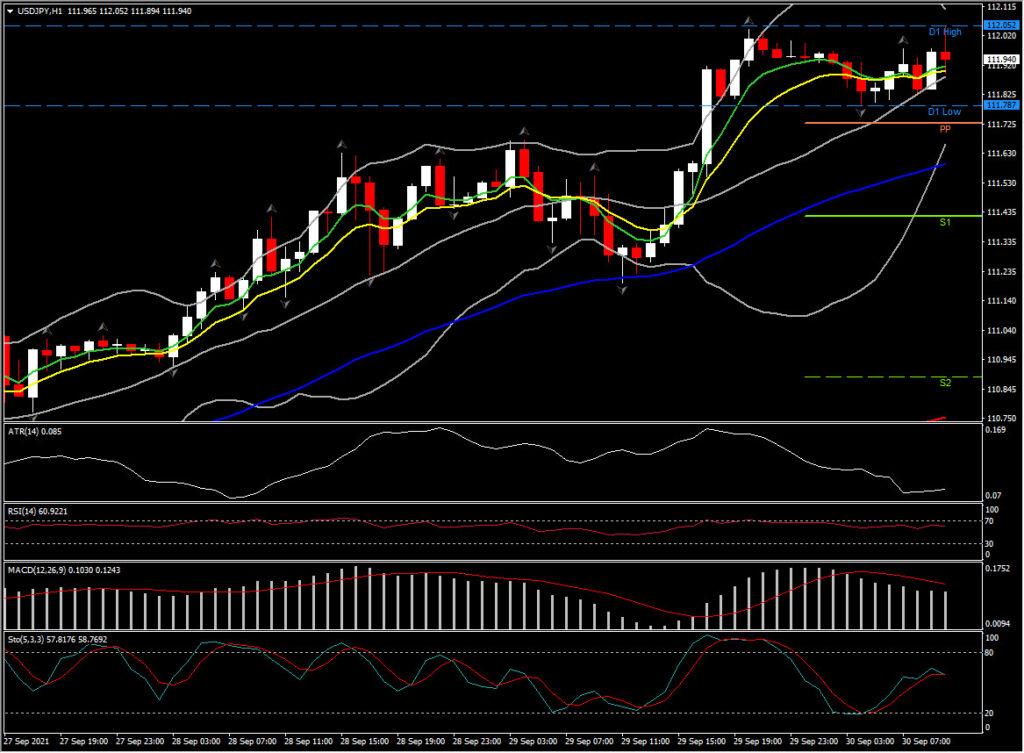

Biggest mover as of 07:45 GMT – USDJPY (+0.48%) Reached 112 for the first time since January 2020. Even though the overall outlook turned positive, intraday consolidation prevails as fast MAs flattened along with RSI and a bearish crossed formed by Stochastic. MACD lines however sustains positive bias. ATR (H1) at 0.085 and ATR (D) at 0.583.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.