- The Treasury market and the Fed is closed today for Columbus Day, but Wall Street will trade.

- USD (USDIndex hold 94.00), Bonds and Stocks under pressure as the job report kept the door open for the FOMC to potentially announce QE tapering this year, even though it looks unlikely given the weakening in US and global growth due to supply chain disruptions, as well as from the concomitant surge in prices.

- Capitol Hill is likely to still be hotly debating fiscal policies, while more debt limit drama could be in the works for early December.

- Oil prices continued to rise to the highest since 2014, as China’s coal futures jumped as flooding shuttered mines Currently $80.30. Gold back to $1750 area.

- US Yields rising (10-year rising 3.5 bps to 1.616% and 2-year up 1.2 bps to 0.318%)

- Equities are mixed. JPN225 +1.5% (supported by comments from Prime Minister Kishida, who said he isn’t considering changes to the capital gains tax at present), GER30 & UK100 +0.7%, USA500 -0.19% & USA100 -0.5%.

- FX markets – USD remains bid – EURUSD 1.1580 Cable spiked 1.3670, USDJPY higher again at 112.74 ( highest since December 2018)

European Open – The December 10-year Bund future is down -27 ticks, US futures are also in the red, while European stock futures are narrowly mixed. Comments from BoE officials over the weekend backed market bets for an earlier than expected lift off on rates. UK inflation is rising sharply against the background of delivery problems and rising gas prices, which are impacting ever wider areas of the economy. The Eurozone is also struggling with similar problems, although they are much less severe than in the UK, where the fallout from Brexit seems to be adding to the difficult picture. Fueling demand with a very expansionary monetary policy clearly is not helping in this situation and it seems the BoE is gearing up to reduce stimulus earlier than previously anticipated.

Today –ECB’s Lane & Elderson.

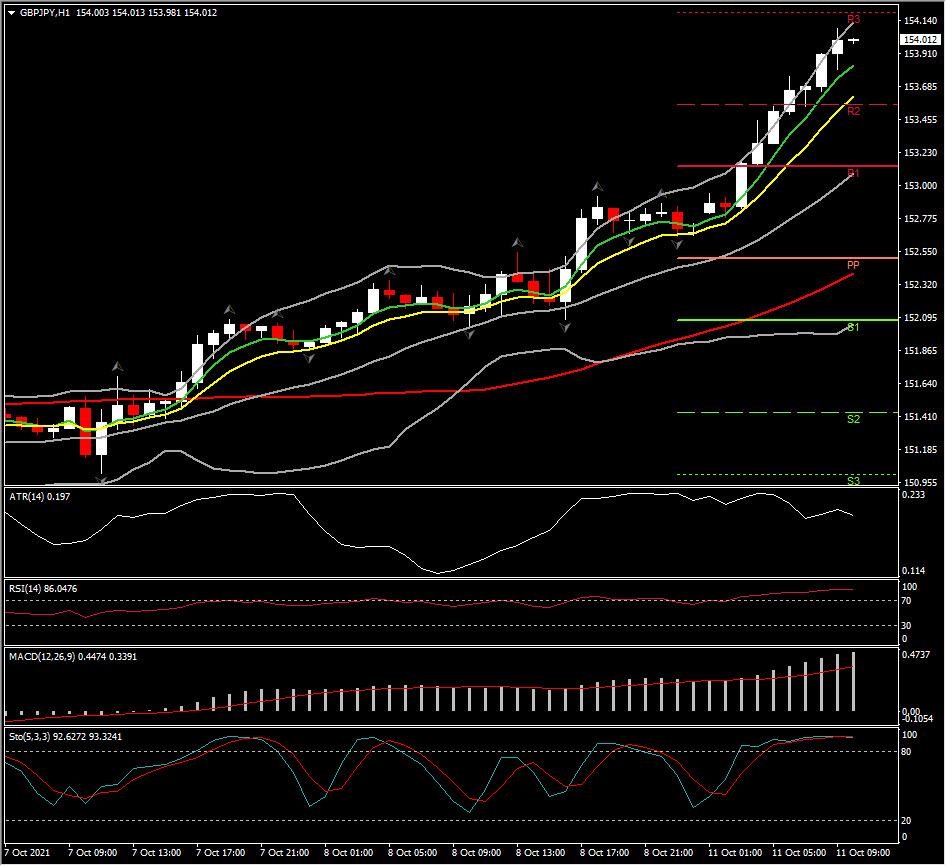

Biggest FX Mover @ (06:30 GMT) GBPJPY (+0.88%) Rallied from open at 152.67 lows to eye 154.08. Faster MAs aligned higher, MACD signal line & histogram trending higher & over 0 line, RSI 83 OB zone & started slowing down . H1 ATR 0.199, Daily ATR 1.312.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.