Intel Corporation (INTC), the largest semiconductor chip maker in the world by revenue, develops advanced integrated digital technology products, primarily integrated circuits, for industries such as computing and communications. The California based tech giant with a market cap of 220.944 billion supplies semiconductor chips to the largest PC makers in the world – Lenovo, HP and Dell -with Apple, having being reliant on Intel’s chips for about 15 years just starting to shift to using its own processors. Intel Corporation is expected to report its third quarter earnings on October 21, 2021 after market close.

Zack’s current earnings per share estimate sits at $1.11 – the same as its most accurate estimate – which means analysts expectations have not changed from the year ago quarter and more importantly is the fact that the estimate is lower from Q2, 2021 which printed at $1.28. Revenue is expected to come in at $18.22 billion according to Zacks’ estimate which is also down from its Q2 revenue report which printed at $18.50 billion and down from the year ago report which was around $18.33 billion, earning it a #4 sell rating on Zacks.

Considering that #INTC has beat estimates over the last 3 quarters, we cannot rule out a beat in this quarter especially after the company raised its 2021 guidance by $1 billion in adjusted revenue to $73.8 billion and full year earnings to $4.80 citing the boom in computer sales that started during the pandemic being likely to continue as people return back to offices and schools but concerns still linger over supply constraints and costs relating to building chips with new process technology. The weak expectation for earnings and revenue is not a surprise given the downtrend in earnings all year for Intel and the $4.79 EPS estimate for 2021 which is also lower than the EPS for the last 2 years, reflecting market sentiment and outlook for the #45 ranked largest US corporations by total revenue according to 2020 Fortune 500 list.

Quarterly EPS History and Forecast

Quarterly EPS History and Forecast

Yearly EPS History and Forecast

Yearly EPS History and Forecast

Intel Corporation is battling with competition from Advanced Micro Devices, Inc (AMD) -its CEO, Patrick P. Gelsinger suggested that AMD’s server chips may be winning over customers, compounding their woes after Apple replaced Intel’s processors with its own processors which provide longer battery life causing some analysts to believe that Intel has fallen behind in manufacturing as concerns were also raised that some of its recent 11th generation core processors -even though they are little faster, run much hotter and consume more electricity than some of the older models.

In as much as these factors do not bode well for the tech giant, the chip industry is battling chip shortage as a result of supply chain disruptions caused by restrictions from the COVID-19 pandemic, US sanctions on some Chinese firms who then resulted to stockpiling more than enough of the high in-demand chips trying to navigate the storm, further tightening the market and general increase in demand for micro chips. These should help drive sales, revenue and by extension earnings and could see #INTC beat estimates once again as the company announced earlier in March that it intends to spend $20 billion on two new chip plants in Arizona and now seeks to help build up Europe’s chip manufacturing capacity which should help spur further growth.

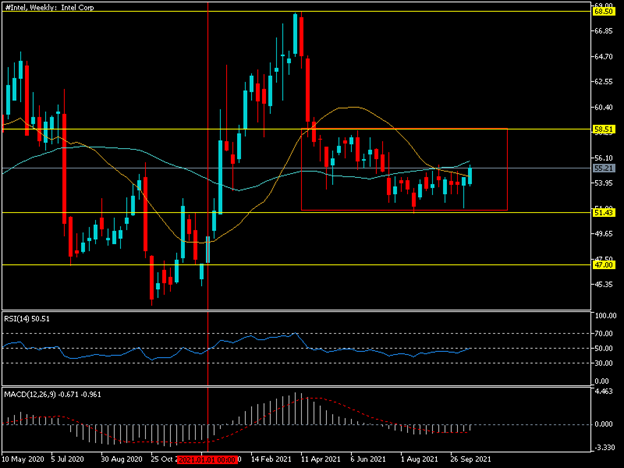

#Intel Weekly

Since trading close to ATH in April around 68.50, #Intel has consistently pushed lower, falling about 25% till it found some support around 51.43 –2021 lows and has since remained in a range capped at 58.50. The death cross of the 20-and 50-week SMAs along with the MACD trading below the zero line highlight the bearish trend. Although, over the last 3 months, the stock price has failed to break lower than 51.43 and with the RSI poking back above the halfway point, starting to show signs of life, we could see buyers jump into the driver’s seat if we get a good beat in both earnings and revenue with the next point of resistance coming in at the top of the range around 58.50. A miss in the earnings release could be the catalyst to break the year lows with the next obvious support coming in around 47.00.

Click here to view the economic calendar

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.