Facebook Inc. (#Facebook) is a social networking company with a market capitalization of over $900 billion, known for its products such as Facebook, WhatsApp, Instagram, Messenger and Oculus. It plans to publish its quarterly report ending September 2021 after the market closes on October 25.

As one of the FAANG companies, Facebook’s recent performance has not disappointed market participants. In the previous quarter, the company reported total revenue of $29.08 billion, an increase of 11% from the previous quarter and a 56% increase in the same period last year. Most of its revenue comes from advertising, and the average price of each advertisement and the number of advertisements placed have recorded annual growth rates of 47% and 6%, respectively.

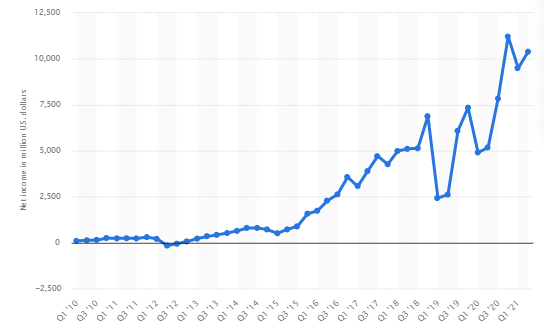

Figure 1: Facebook’s net income from the first quarter of 2010 to the second quarter of 2021. Source: Statista

Net income was $10.39 billion, which recorded a quarterly growth of 9.4% and an annual growth of 101%. With the improvement of operating income, its operating profit margin has increased to 43% (32% in the same period last year). Diluted earnings per share (EPS) was $3.61, an increase of 9.4% from the previous quarter and a year-on-year increase of 101%.

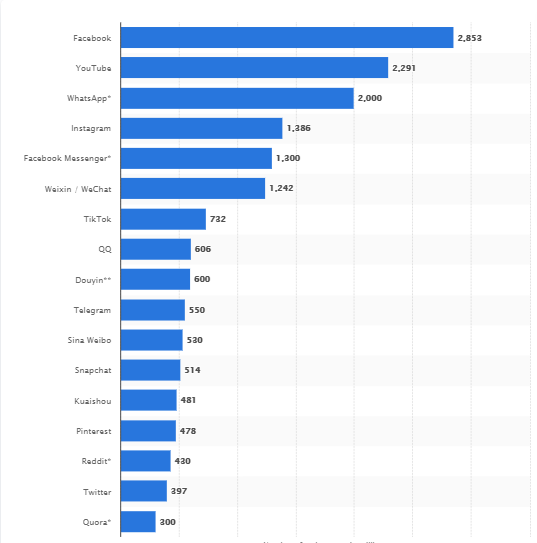

Figure 2: As of July 2021, the world’s most popular social networks ranked by the number of active users (in millions). Source: Statista

Overall, as of June 30, 2021, Facebook reported that its daily and monthly active users reached 1.91 billion and 2.9 billion respectively, an increase of 7% compared to the same period last year. We can also see from the latest data (Figure 2) that Facebook ranks among the top social networks in the world. It is in comparison with other products (such as WhatsApp, Instagram, Facebook Messenger) and its competitors (such as Alphabet (YouTube), Tencent (WeChat, Compared with QQ) etc., its active user base is larger. Therefore, the data reflects that the company has a great advantage in the field of social media.

Figure 3: Facebook’s quarterly reported sales and earnings per share. Source: money.cnn

For the forthcoming Q3 earnings report, the market generally expects sales of $29.6 billion, a quarter-on-quarter increase of 0.02% and a year-on-year increase of 37.67%. As for earnings per share (EPS), it is expected to reach $3.19, a decrease of 13.17% from the previous quarter but an increase of 17.71% year-on-year. The company’s chief financial officer, David Wehner, previously commented that after experiencing gradual and steady growth, a significant deceleration is expected in the second half of 2021. Despite this, 34 out of 51 analysts maintain a buy rating on the company.

From a fundamental point of view, advertising positioning facing headwinds, Capitol Hill intervention, increasingly stringent regulatory review, increased security spending, and transparency issues may all become negative factors that drag down the company’s development. On the bright side, in addition to having a huge consumer base, accelerating digital transformation through new initiatives may enable companies to better and faster adapt to the changing environment. One of the company’s long-term and future visions is to create a meta-universe – a digital platform where individuals can communicate through digital avatars in virtual and reality through the use of VR and AR devices. When this ambitious agenda becomes a reality, it may further release huge growth opportunities for the company.

September hasnt been friendly to Facebook. Whistleblower reports and antitrust litigation issues caused losses to the company, causing its stock price to plummet at the end of the month and to close down to -13%. Selling pressure continued until #Facebook’s stock price gained a foothold in mid-October, with an intraday low of $ 317.36. After breaking the previous resistance zone of $ 331-333, it continued to move higher.

As of yesterday’s close, $343 is a resistance level worth paying attention to in the near term. Bullish success may provide the next breakthrough continue to test resistance levels to 350, 351 , 360 and 370 levels. In addition, the K-line closing below the recent support are of 331-333 may encourage more selling pressure and push the price down to 315-317 area. Finally, the indicators are still mixed and there are no clear signs of direction, which shows that #Facebook share price needs a strong catalyst to get out of the current state.

Click here to view the economic calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.