The markets were volatile through October as uncertainties over inflation, growth, and central bank reaction functions provided mixed directional signals. After early declines following record high inflation rates, both bonds and stocks ended in the green. Canada was an underperformer as the BoC trimmed QE and then ended it last week. The markets are looking for hawkish outcomes from the FOMC and BoE this week.The Reserve Bank of Australia also decides policy on Tuesday, with markets challenging the central bank’s contention that rates won’t rise until 2024.

Equities generally managed to rally as the massive amount of liquidity still in the system combined with good earnings results to overshadow concerns over growth amid headwinds from supply shortages, bottlenecks, Covid, and elevated costs.

- USD (USDIndex 93.45) jumped to a 3-week high against major peers on Monday as quickening inflation in the United States boosted the case for earlier Fed interest rate hikes ahead of a policy decision on Tuesday.

- Japan’s election boosted hopes for fiscal stimulus with PM Kishida managing to preserve an outright majority for his Liberal Democratic Party – Topix and JPN225 are up 2.2% and 2.6% respectively.

- China official manufacturing PMI slumped for a 7th consecutive monthly drop and leaves the index at its lowest level since October 2019. – Hang Seng and CSI 300 are currently down -0.95% and -0.33% respectively.

- German retail sales unexpectedly slumped -2.5 m/m in September.

- US Yields (10yr up at 1.56%).

- USOil steadied to $81.10.

- Gold – another volatile day (1810-1792), cannot hold $1800 and trades at $1794 now.

- FX markets – Strong USD, weak Yen – USDJPY rallied to 114.38, Cable capped by 1.3800 and trades at 1.3642, EURUSD 1. 1545. AUD also struggled as yields corrected.

Today – Another important week for central bank decisions that includes Fed and BoE announcements. Data releases today focus on final manufacturing PMIs for the Eurozone and the UK, which are likely to confirm that supply chain disruptions are weighing on output, while price pressures increase. US and Canadian Manufacturing PMI are also due.

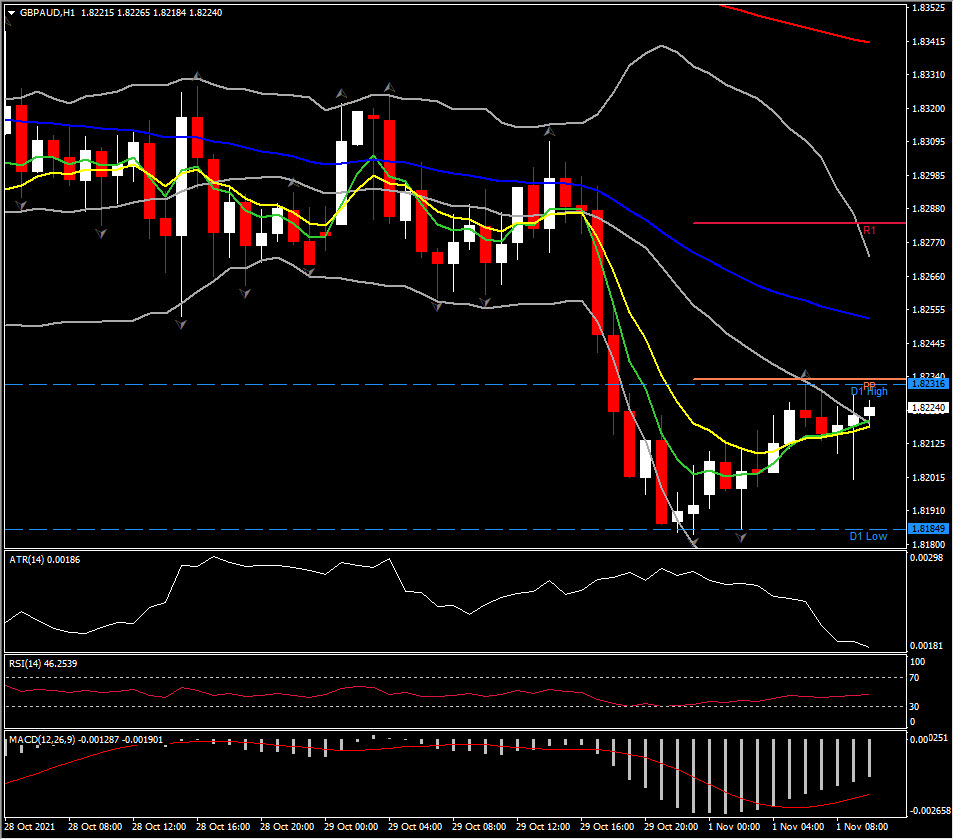

Biggest FX Mover @ (06:30 GMT) GBPAUD (+0.63%) GBP giving up some gains ahead of BoE meeting. Faster MAs steadied, MACD signal line & histogram cooling but still negative, RSI 46 and neutral. H1 ATR 0.0019, Daily ATR 0.01090.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.