The USDIndex closed the week sharply higher by +0.83%. The US Dollar found support from the recent acceleration of market expectations for a Fed rate hike by the end of 2022. Last summer, the market did not expect the Fed’s first rate hike until early 2023. However, now the market is fully expecting 2 rate hikes of +25 bps at the end of 2022. That’s even more than the +20 bp rate hike forecast from the ECB. The USDIndex closed October with a negligible total decline of -0.21%. This indicates that the economic recovery in the US is still much better compared to other countries.

Remaining supply chain problems, rising prices and still strong consumer demand continue. Growth in new home sales, the first rise in consumer confidence in three months and personal spending data are on a positive note, although the third quarter GDP growth was only 2.0%, due to the increasing trade deficit. Goods spending fell 9.2% in the third quarter as the PCE deflator rose to 4.4% y/y, the highest level in more than 30 years. This further strengthens the prospect of a rate hike sooner rather than later. This week’s slate include heavy data that the market is paying attention to including ISM Manufacturing, ISM Services, ADP, FOMC Statement on Interest Rates and Non-Farm Payrolls.

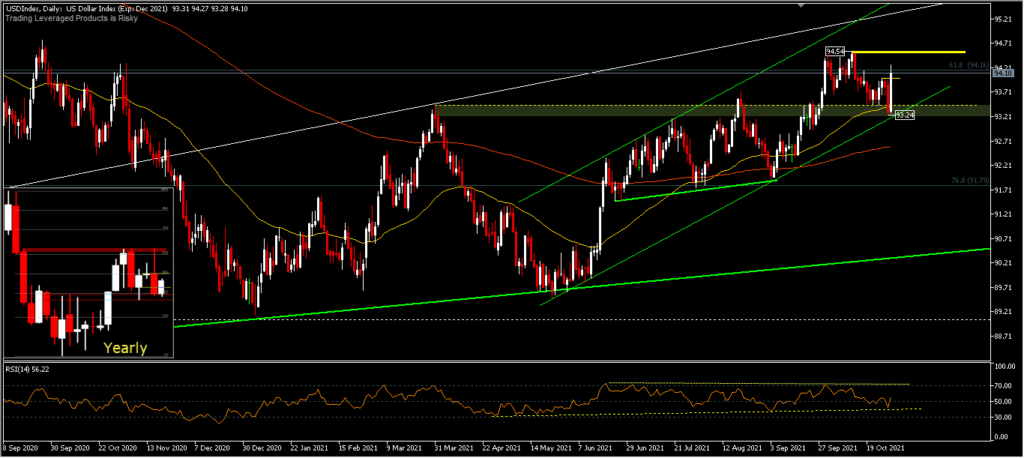

The USDIndex scored a fresh weekly high at 94.29 and closed the weekend at 94.10. Friday’s price move printed a Marubozu candle that completely covered the previous 11 trading days, with a significantly strong upside bias for the USD. The bullish support for USDIndex is seen from the 50-day moving average which remains below the price and the uptrend line acting as the dominant support diagonally. While the RSI is currently settling at 56.22 after the maneuver, overall the above confirms a bullish bias.

However the rally is still limited by the resistance at 94.54. A break of this price level will confirm the continuation of the second leg’s rebound of 89.49 to the 50.0% retracement target. On the downside, a failure at 94.54 will open the door for a retest of the 93.24 support area and a break of this level will target 91.91.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.