The FOMC and BoE meetings are the highlights this week as tightening speculation has been scaled back somewhat and markets hedge their bets ahead of the banks’ announcements tomorrow and Thursday. In recent weeks, the market has developed expectations of a 15 basis point increase in bank interest rates from the BoE to 0.25%, while expectations from the market have contributed to the appreciation of Sterling against several currencies over the past few weeks.

As BoE chief economist Pill effectively confirmed, the meeting will be a ‘live’ one, which means officials will discuss whether to hike the Bank Rate, which currently stands at 0.10%. The updated quarterly policy report will bring new projections for growth and inflation outlooks and against the background of the latest developments it is likely to highlight the risk that the uptick in prices will be longer lasting than initially anticipated. As the BoE has made clear that it will hike rates before reducing asset holdings, speculation of an early move has picked up. Dovish comments from MPC member Tenreyro highlighted that not everyone is convinced that a rate hike is necessary at this point, but the tenor of comments from BoE governor Bailey and chief economist Pill has been quite hawkish and there is some risk of an early move, or at least a very clear signal of a hike in December.

So far the Pound has struggled against the Yen and Euro ahead of Thursday’s BoE meeting, and against a number of other major currencies, which could be a sign the market is recalibrating their expectations. Markets are concerned that an early lift off in rates could hamper a still fragile economy.

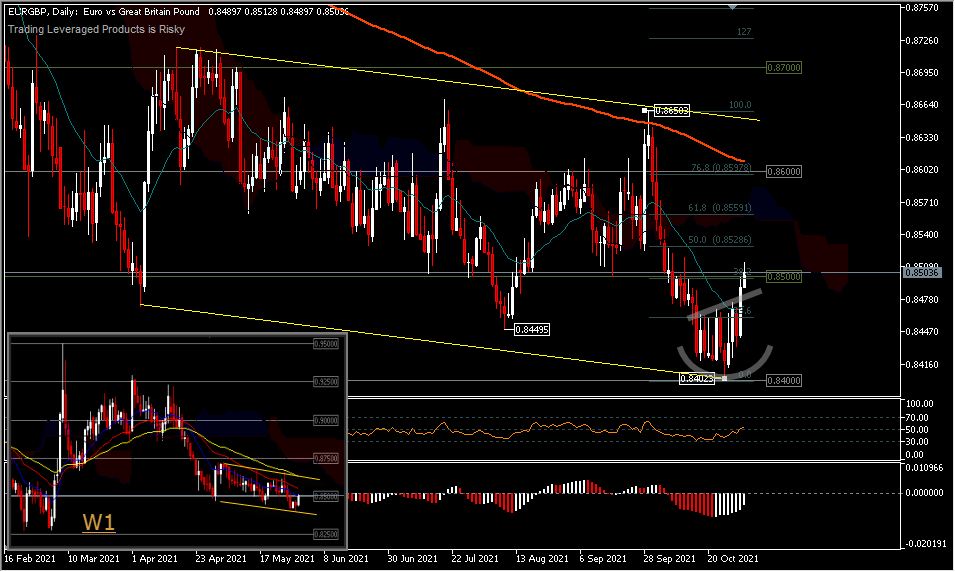

EURGBP, D1

The EURGBP seems to be forming the chart pattern of a series of price movements that graphically form the letter “U”. These patterns, known as the “rounding bottom”, are generally found at the end of an extended downtrend and signal a reversal in a long-term price movement. The time frame of this pattern can vary from a few weeks to several months and is considered by many traders to be a rare occurrence, but in the case of the EURGBP it only lasts a few days so it is likely only temporary, as the seller pressure is still visible below the 200-day MA. Ideally, volume and price would move in tandem, with volume confirming price action, and again in the case of EURGBP there hasn’t been a significant increase in daily volume.

EURGBP,H4

The EURGBP has broken the resistance formed from 2 weekly highs (neckline) which looks quite strong and crossed above the 200-period EMA by recovering the downside around the 38.2% FR level. Further movement possibly requires a retest of the neckline at the range 0.8475 to continue the temporary rebound at 0.8402 towards the 50.0% and 61.8% retracement levels. There are indications of the RSI entering the overbought level. A price move below the neckline will confirm the advance from the rebound only as a “dead cat bounce” pattern and the price will retest the 0.8402 low again.

However, the price pattern is only a picture of historical data that does not represent the same event in the future; it could be right or wrong considering the dynamics of transactions that develop along with various factors of economic data and bank policies that affect the point of view of market participants.

Click here to access our Economic Calendar

Andria Pichidi and Adi Phangestu

Market Analysts

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.