- FOMC announced $15 bln QE tapering to begin in Nov, as expected! Chair Powell ended up taking a very neutral stance with respect to the next step in the FOMC’s policy moves, neither validating nor pushing back against expectations for a June tightening with 2 quarter point tightening on 2022.

- US Yields were measurably higher on the day but ended cheaper, as even a baby step toward normalization via the start of tapering brings the day of tightening that much closer. (10-yearat 1.60% and 30-year at 2.02%, while the 2-year cheapened 1.6 bps to 0.466%).

- Global stocks higher & Bonds firm as markets seem to have taken the Fed’s tapering schedule quite well and indeed as a sign that the recovery remains on track. Topixand JPN225 are up 1.2% and 0.9% respectively. The USA100 led the way with a 1.0% gain, with the USA50065% firmer, and the USA30 up 0.29% (record highs again).

- Data included better than expected results with a new historic peak on the ISM services index and near record high prices, a solid ADP print, and an uptick in factory orders.

- ECB’s Lagarde continued to try to tamp down rate hike speculation as she stressed that an undue tightening of financing conditions is not desirable.

- USD(USDIndex 94.00) steadied at 93.80-94.10 for a 4th day.

- USOil dropped back to $78.50 amid speculation that with Iran nuclear talks resuming the country could start boosting supply, although that remains a dubious assumption.

- FX markets – USD strengthened across the board, while AUD, NZD, EUR and GBP EURUSD at 1.1580 and Cable at 1.3650. USDJPY is at 114.24.

BoE Preview: The BoE has flagged that this month’s MPC meeting will be a “live” one, with chief economist Pill suggesting that the decision on rates will be “finely balanced”. Inflation is expected to pick up further in the coming months, before dropping back next year, but central bankers seem increasingly convinced that structural labour market shortages will push up wage growth further with the end of the furlough scheme apparently not really denting momentum. Not everyone is convinced though as dovish comments from MPC member Tenreyro highlighted. A tight decision then today, and likely a split one, which is also reflected in expectations, with Bloomberg consensus predicting unchanged rates, while money markets have fully priced in a move and more to come for 2022. However, market pricing also suggests that investors actually see the expected early lift-off as a mistake that the BoE will have to reverse in 2023. For bond markets it may ultimately not matter much if a move comes in November or December, but the updated projections on the growth and inflation outlook will be decisive for the question of how fast and how far the BoE expects to take rates over the next year.

Today – The focus is now turning to the BoE announcement, while the data calendar includes German manufacturing orders and the final Eurozone services and composite PMIs for October, US claims and productivity. The earnings slate is the heaviest of the week and features reports from Alibaba, Moderna, Illumina, Square, Airbnb, Zoetis, Anheuser-Busch Inbev, Uber, Duke Energy, Cigna, Beckton, Dickenson, Air Products, Regeneron, etc.

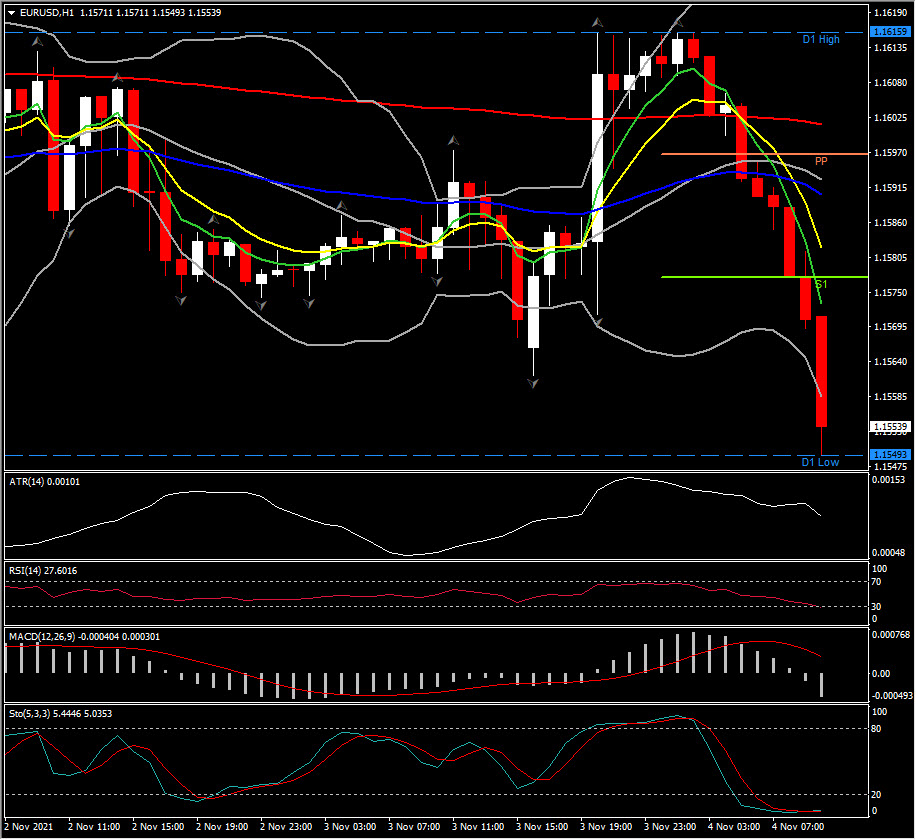

Interesting Mover @ (06:30 GMT) EURUSD (-0.50%) dips to 1.1549 with the nearest support at 1.1525 which is key (15-month support), Faster MAs aligned sharply lower, MACD turned negative but not signal line yet, RSI 28 and sloping, while Stochastic is OS. H1 ATR 0.0010, Daily ATR 0.0062.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.