- USDIndex up and currently settled to 95.49.

- Further signs of rising inflation pressures from RBA, BoE and FOMC.

- RBA: Governor Lowe is stressing that he will not hike rates to control house prices and that even an underlying inflation rate of 2.5% would not be enough for a rate hike.

- Biden and Xi: Played down hopes of a big breakthrough.

- BoE’s Bailey said he is “very unease about the inflation situation”, after tight labour market. UK ILO unemployment dropped to 4.3% in September – He had fuelled speculation of an early rate hike.

- US Treasury Yields restored their safe haven allures, as the 30-year tested 2.00%, the highest since the November 3 FOMC selloff, and the 10-year rose to 1.62%, the highest since late October, while the 2-year jumped to challenge 0.54%, not seen since early 2020. Currently eased lower.

- Equities: USA30 holding on to small gains, largely due to component Boeing, which has surged nearly 5% following freighter orders received at the Dubai air show. USA100 down 0.2%, as higher Treasury yields weigh on big tech, while Tesla has dropped another 4%, after falling 15% last week on CEO Musk’s sale of nearly $7.0 bln of the stock. The USA500 is trading on either side of flat.

- China warns state firms on crypto mining.

- JPMorgan Chase & Co (JPM.N) on Monday sued Tesla Inc (TSLA.O) for $162.2 million, accusing Elon Musk’s electric car company of “flagrantly” breaching a contract related to stock warrants after its share price soared. – Renaissance, other big hedge funds increase stakes in Tesla in Q3.

- Turkey’s lira weakened nearly 0.8% on Tuesday to a new record low of 10.14 against the US dollar, weighed down by expectations of another unorthodox rate cut from the central bank this week.

- USOil up to 80.66. Gold steady within 1861.79-1868.87

- FX markets – EURUSD down to 1.1358, GBPUSD bounced to 1.3464, and AUDUSD down to 0.7342.

- Focus today:Geopolitical tensions remain in focus, as the calendar is focused on the second reading for EU Q3 GDP, US retail sales and industrial production and a lot of speeches.

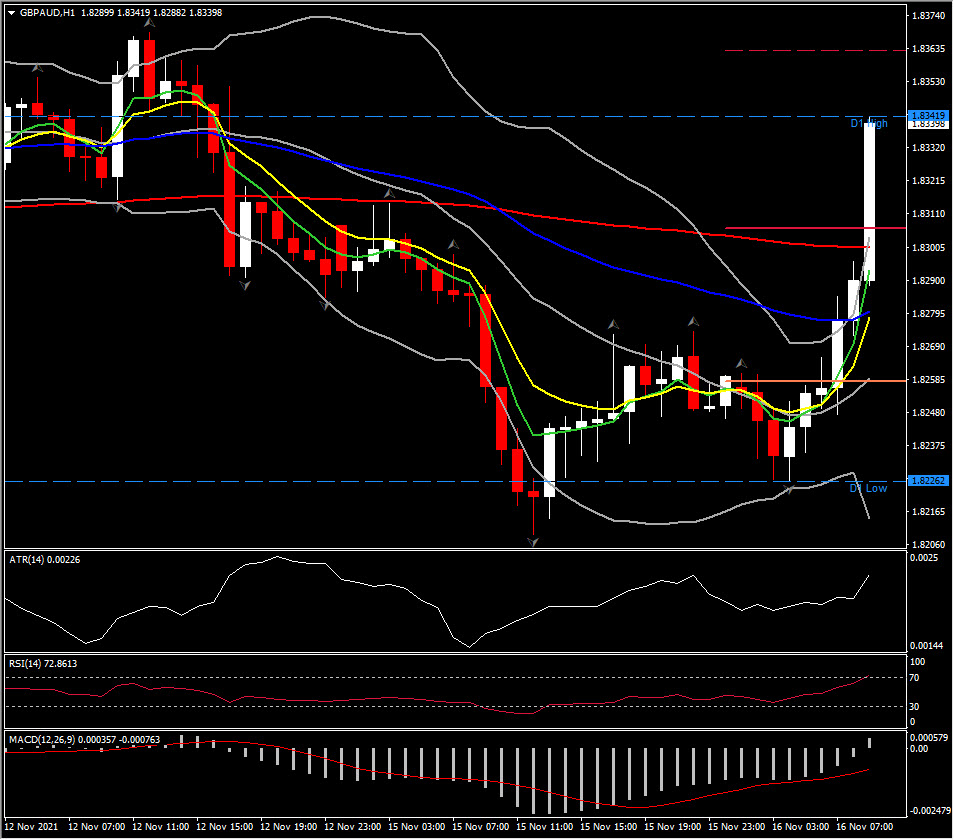

Biggest FX Mover @ (07:30 GMT) GBPAUD (+0.49%) topped to 1.8341. Faster MAs aligned higher, MACD lines turn positive but signal line remains below 0, while RSI is at 72 and rising. H1 ATR 0.00226, Daily ATR 0.01248.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.