- USDIndex up and currently settled at 96.25, after hawkish Fed Bullard and strong retail sales, production and trade prices.

- UK Inflation at the highest in a decade due to energy costs (4.2% y/y VS 3.9% y/y) & strong labour data adding pressure on the BoE to deliver the long flagged rate hike at the December meeting.

- US Treasury Yields rise on overinflation concerns after the data and as expectations were raised for the Fed to quicken monetary policy normalization. – 10-year Treasury rate is up 0.4 bp at 1.64%.

- Bund futures are fractionally lower, on central bank’s dovish stance. – ECB’s Rehn still sees inflation easing next year.

- FED, BoE and BoC seem to be on the same road to rate hikes sooner than many expected!

- China’s developers also remain in focus with local media reporting that Evergrande’s online sales platform has closed some units. Authorities could ease restrictions on funding of developer.

- Treasury Secretary Yellen warned there is little time left for lawmakers to agree on a debt limit deal, reiterating a possible December 3 drop-dead date.

- Equities: Asian shares, were dragged by worries about COVID-19 and higher costs. Topix lost -0.4%.The stronger the dollar the higher costs for imported material for manufacturers.

- Consumer discretion initially paced the gains after Walmart (-2%) and Home Depot beats (+6%), but the USA100 took the baton into the finish and rose 0.76%. The USA500 was up 0.39% with the USA30 0.15% higher. GER30 and UK100 futures are down -0.2% and -0.4% respectively.

- Solid data, along with bullish equity outlooks from Goldman Sachs and JP Morgan, all aided sentiment yesterday.

- USOil down to 78.86 floor from 80.66. after US gasoline stocks dropped more than expected last week, potentially heightening pressure on the Biden administration to release oil from emergency reserves to cap soaring fuel prices.

- Gold down to 1849.49.

- FX markets – EURUSD down to 1.1263, GBPUSD spiked to 1.3473 but currently in the mid of a 3-day channel, and USDJPY flirts with 115.00 (its strongest since March 2017)

- Focus today: The data calendar also includes the final reading for Eurozone HICP, US Housing starts and building permits and Canadian inflation.

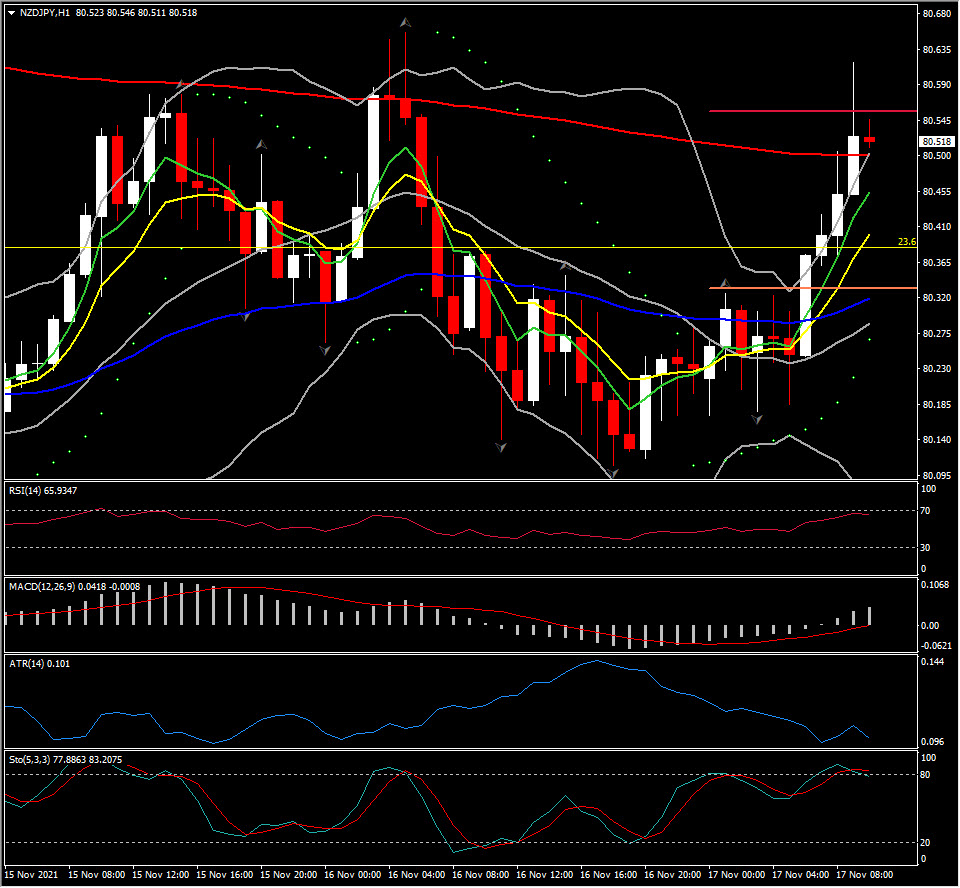

Biggest FX Mover @ (07:30 GMT) NZDJPY (+0.35%) topped to 80.61 above R1. Faster MAs aligned higher, MACD lines turn positive but signal line remains at 0, while RSI is at 67 and rising. H1 ATR 0.101, Daily ATR 0.696.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.