Alibaba Group Holding Limited is China’s leading e-commerce company, encompassing 18 subsidiaries including B2B sales portals, retail and consumer-to-consumer sales, online payment services (Alipay), a price comparison search engine and cloud data storage services (Alibaba Cloud). It has more than 117,600 employees and a market capitalization of $438,029,427,567.

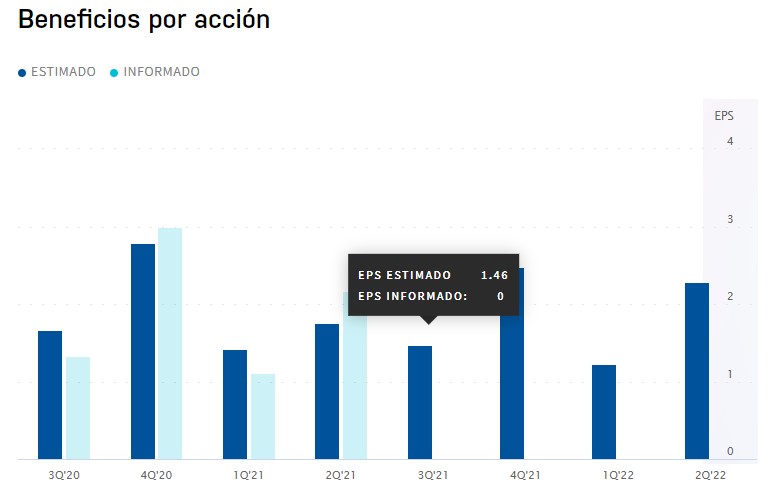

Alibaba plans to release its fiscal Q2 2022 report today (November 18) before the market opens. The company’s 2021 fiscal year (FY) ended in March, which means it is currently in its 2022 fiscal year.

https://www.zacks.com/stock/chart/BABA/price-consensus-eps-surprise-chart

Zacks Investment Research has Alibaba ranked #3 (HOLD). According to Zacks, consensus EPS is pegged at $1.87 per share, indicating a decline of 29.4% from the prior-year quarter’s reported figure. Earnings are expected to reflect the impacts of the strengthening cloud computing segment. In the last earnings report, revenues from the cloud computing segment increased 29% from the prior-year period to $2.5 billion, accounting for 8% of the total revenues. The Zacks estimate for Q2 FY 2022’s cloud computing segment revenues is pegged at $2.9 billion, indicating growth of 32% from the year-ago reported figure.

https://www.nasdaq.com/market-activity/stocks/baba/earnings

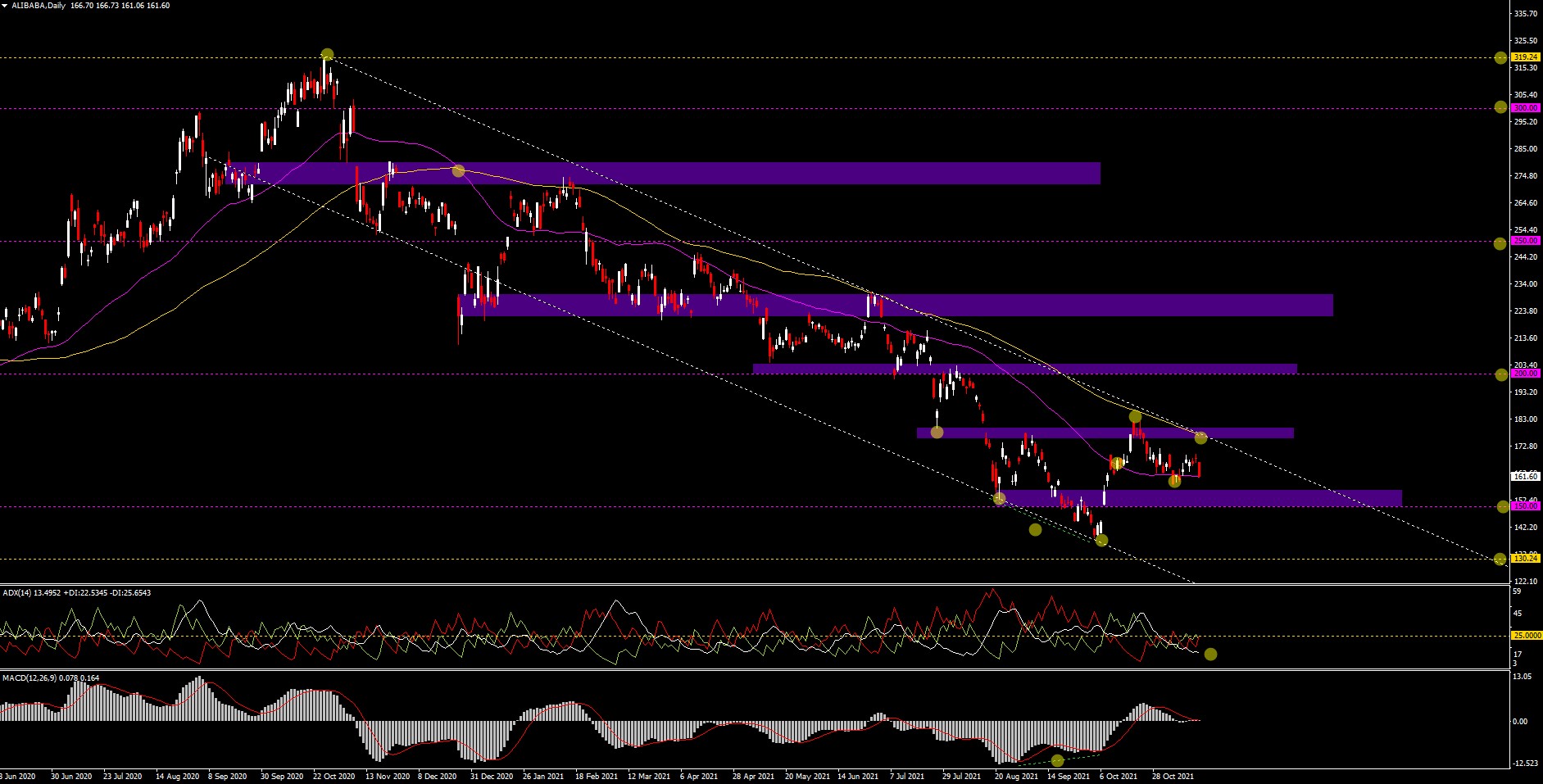

Technical Analysis – Alibaba D1

Fuente:https://www.marketwatch.com/investing/stock/baba

Alibaba maintains a bearish trend within its channel that started from its historical highs at $319.24 in October 2020, from which the price crossed the 50- amd 100-day SMA giving a “golden cross” in December 2020. Then it fall to its psychological support at $150 where it made a false breakout on September 2021 and recovered on October 2021 with a weekly morning star pattern. As of today the price remains above $150 leaving a lower high at $158.27. The current price is $161.60 after the break to the upside of the 50-day SMA but without breaking yet the 100-day SMA. Alibaba has a year-on-year range of $138.43-$ 280.61.

Supports: 50-day SMA is at $161.25, psychological level of $150, latest low at $138.38, 2018 low at $130.24, the psychological levels of $130 and $100.

Resistances: confluence of the 100-day SMA at $176.73, the previous highs at $182.06, round level of $200 and the resistance from June-July 2021 highs at $225 area.

ADX at 13.49 with bearish bias, +DI at 22.53 below -DI at 25.65 in crossover. MACD shows bullish divergence since August 2021.

Important factors to consider:

- On November 11, the “XIII Global Shopping Festival” (formerly “Singles Day”), Alibaba obtained a new sales record of $84.54 billion in orders during the 11 days of the event, more than +17.5% compared to the event the previous year. Alibaba raised $156,359.90 by “liking” a live broadcast to support an 81-hectare elephant reserve in rural southwestern China.

“In the early stages of 11/11, we focused on growth, in the same way that parents would focus on a child’s height and strength. But when a child becomes a teenager, parents change their focus to foster the child’s sense of responsibility – the role he plays in society. That’s what we’re doing now “- Chris Tung, Alibaba Director of Marketing.

“This 11/11 Global Shopping Festival, we achieved consistent, quality growth that is a reflection of the dynamic Chinese consumer economy. We also harnessed the power of 11/11 as a platform to fulfill our social responsibility. This year’s festival was a significant milestone as part of our commitment to building a sustainable future “- Guang Yang, Former General manager

-

- This November 16, Biden and Xi Jinping held a meeting of more than 3 hours to discuss the relations between the two countries. China has sought the “common good and the curb of consumerism” with limits, repressions and measures to its companies within China, putting strong pressure on Chinese actions. However, the government sees wealth creation as something positive for its population, giving capitalism a certain acceptance. This struggle between ideals, as well as the relationship between these countries, could have several results, including continuing with the repression or relaxation of regulations, giving a chance of recovery in Chinese stocks and US ETFs.

- Migration of all its systems and operations to its public cloud (Alibaba Cloud), reducing computing resources by 50% for every 10k transactions, improving efficiency in technological implementation by 20% and 30% in CPU resources. This move is part of the company’s sustainable initiatives as it uses green technologies such as liquid cooling and wind power in its large-scale data centers.

- Platform improvements and innovations for clients with AI and Big Data.

- Creation of a program to help disabled people to buy.

- Efforts to use more environmentally friendly packaging as well as increase its recycling.

- The logistics arm of Alibaba Group (Cainiao Network) has enhanced its partnership with Atlas Air Worldwide Holidngs, to improve trade between China and Latin America, increasing weekly cargo volume by 144%, improving warehouse distribution and transportation efficiency by 40%.

- AliExpress and Lazada have had a good retail sales performance, which should help the company’s international trade.

- Announcing the creation of its own 5-nanometer Yitian 710 chip with 129 cores and 3.2Ghz speed for its servers to further push Alibaba Cloud into energy-efficient green cloud computing. This would be the 3rd chip created, being the first for IA and the second for IoT, reinforcing its position in the cloud market.

- Alibaba Cloud growth thanks to an increase in paid subscribers.

- Increase in paid subscribers on Alibaba.com and boost in border-related value-added services are beneficial for the growth of the international trade wholesale business.

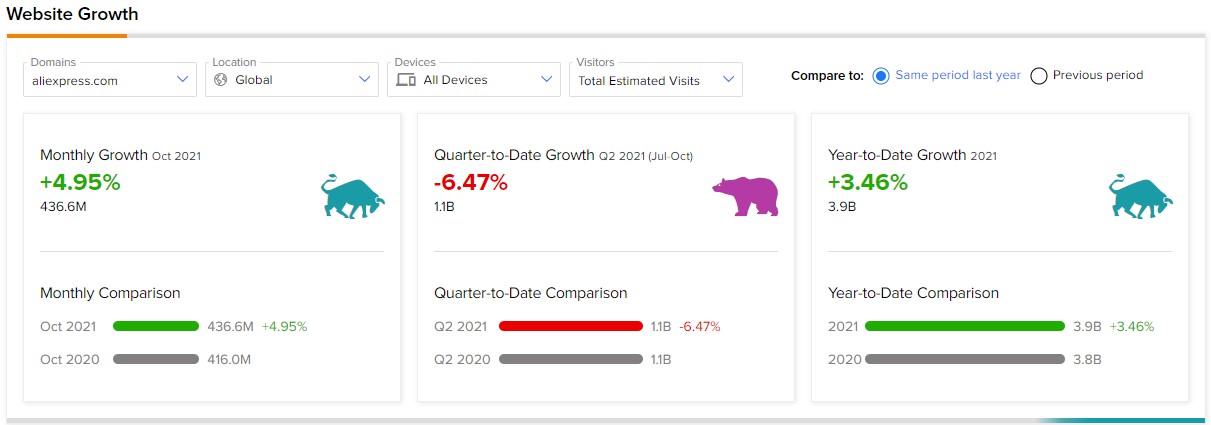

- Website growth of 4.95% y/y in global visits and increase of + 3.46% in traffic during the current year.

- Increased spending on business improvement: Online retail business, AI development, digital entertainment, and cloud enhancement.

• Rebound in Covid-19 cases, supply shortages and power outages.

• Repression and regulatory concerns by China for the slowdown in consumption. Marketing fines, restrictions and crackdowns: Antitrust (BABA received a $2.45 billion fine at the beginning of the year), forced spin-offs, actions for alleged anti-competitive practices, etc.

• “Supported” the Chinese Government with a “donation” of $15.5 billion for the initiative of common posterity and sustainable growth.

• China wants to dismantle Alipay to remove online loans, as reported by the Financial Times.

Click here to access our Economic Calendar

Aldo Zapien.

Market Analyst – HF Educational Office – Mexico

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.