- USDIndexat 95.80.

- Prime Minister Kishidaconfirmed the new stimulus package has a size of 79 tln yen.

- Chinais looking into ways to cut taxes and government fees by up to 500 bln yuan.

- Yields:Treasuries continue to correct from some of the heavy selling pressures this month as angst over rising inflation and fear of aggressive Fed tightening next year abate slightly. Technicals have capped the upside in rates for now too. Treasury yields were generally in the green most of the session, with the benchmark 2-year just south of 0.50%, and the 10-year holding in the 1.58% vicinity, while the bond traded narrowly around 1.97%.

- Equities: All of the major indexes hit new historic highs Thursday, but only the USA100and USA500 closed at fresh peaks with the former advancing 0.45% to 15,993 and the latter rising 0.34% to 4706, while the USA30 slipped -0.17% to 35,870. Nikkei and Topix rose 0.4% and 0.5% respectively. GER30 and UK100 futures are up 0.5%.

- #AlibabaGroup Holding LTD weighed as the company slashed its outlook for fiscal revenue next year amid increased competition and China’s regulatory crackdown.

- Strong retail profits from #Macy’sand #Kohl’s helped sentiment, as the companies indicated strong consumer demand. On the tech side, #NVIDIA led the sector, rising 7% after upgrading guidance. The consumer discretionary and tech sectors led gainers, while utilities lagged.

- German PPI inflation jumped to 18.4% y/y.

- UK retail sales stronger than expected.

- USOil rose slightly to $78.44.

- Goldholds at $1,855 lows.

- FX markets – Yen sell off continues and USDJPYlifted to 40 again. AUD and NZD supported. EURUSD holds at 1.1330 area, GBPUSD steady below 1.3500.

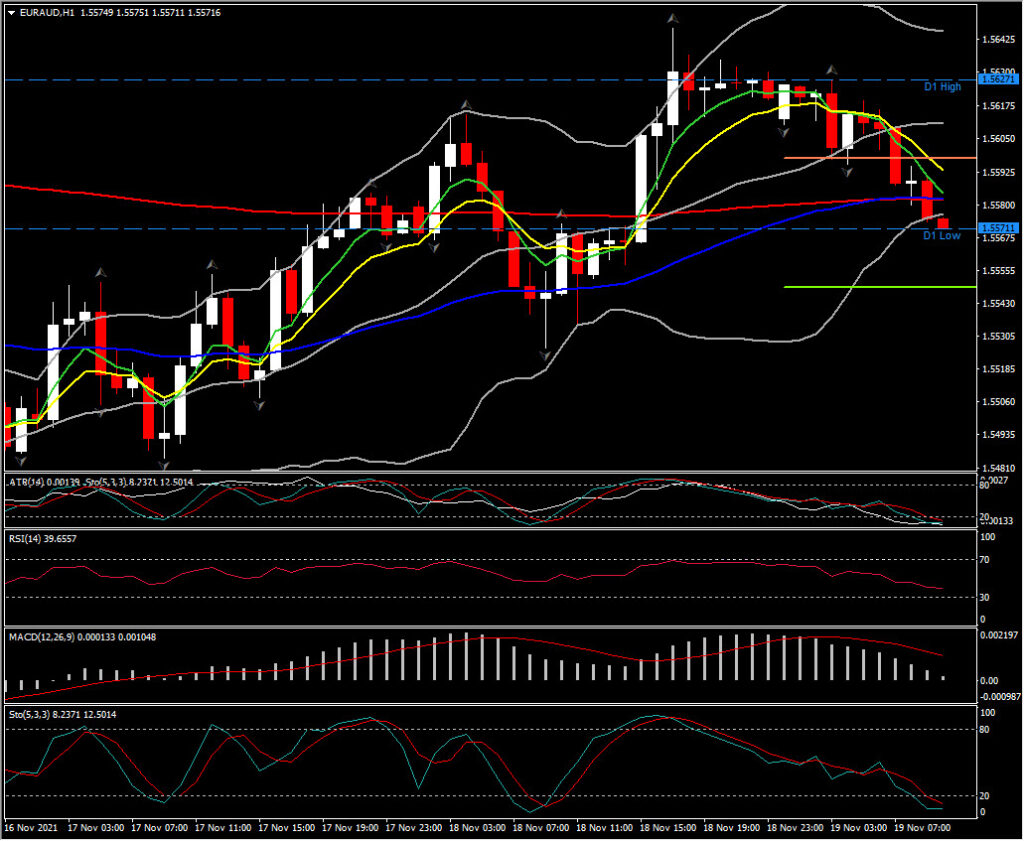

Biggest FX Mover @ (07:30 GMT) EURAUD (-0.32%) dips to 1.5559 below all hourly SMAs. Faster MAs still aligned lower, MACD lines zeroed, while RSI and Stochastic are at OS area and falling. H1 ATR 0.00147, Daily ATR 0.01063.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.