USOil, H4

January WTI crude has remained overall under pressure and is currently at $78.44, with the slide in recent days owing much to speculation over the release of strategic reserves. China paved the way today with a spokeswoman saying “the bureau is carrying out crude oil release work at the moment”. China’s move comes shortly after the virtual summit between Biden and Xi, where both sides discussed the merits of releasing some of their respective country’s strategic reserves. No decision was made during the summit, but the announcement from China will fuel speculation of a similar move in Washington, as both sides share similar concerns over the state of the oil market.

Concerns over looming oversupply following an IEA warning, and potential for demand destruction as Covid spikes in much of Europe is adding to pressure. OPEC+ is expected to remain on course to gradually increase production, while US producers are forecast to increase production in 2022 as well.

Meanwhile Oil prices began to recover after being pressured at the beginning of the week by the appreciation of the US Dollar and the possibility of the US and China to release its crude oil reserves into the market, as discussed during a virtual meeting of the leaders of the US and China, alongside pressure from the continued rise in inflation.

However, after an initial recovery, oil prices began to ease again after the EIA report this week which showed that US crude inventories fell to the lowest since the week ending Sept. 17 at -2.1 million barrels, after an increase of 1 million barrels the week before. Meanwhile, the USDIndex also dropped back to 95.60 after hitting a new 15-month high of 96.24 on Tuesday’s US retail figures.

In addition, Biden’s signature on the Infrastructure Investment Bill and the continued good economic numbers of the US will remain an important background to support oil prices. The latest weekly US unemployment report showed it maintained its lowest number since the outbreak, at 268k from the previous week’s 269k (but slightly above market expectations) while the Philadelphia Fed Manufacturing Index for November came out the strongest since May at 39, up from 23.8 in October.

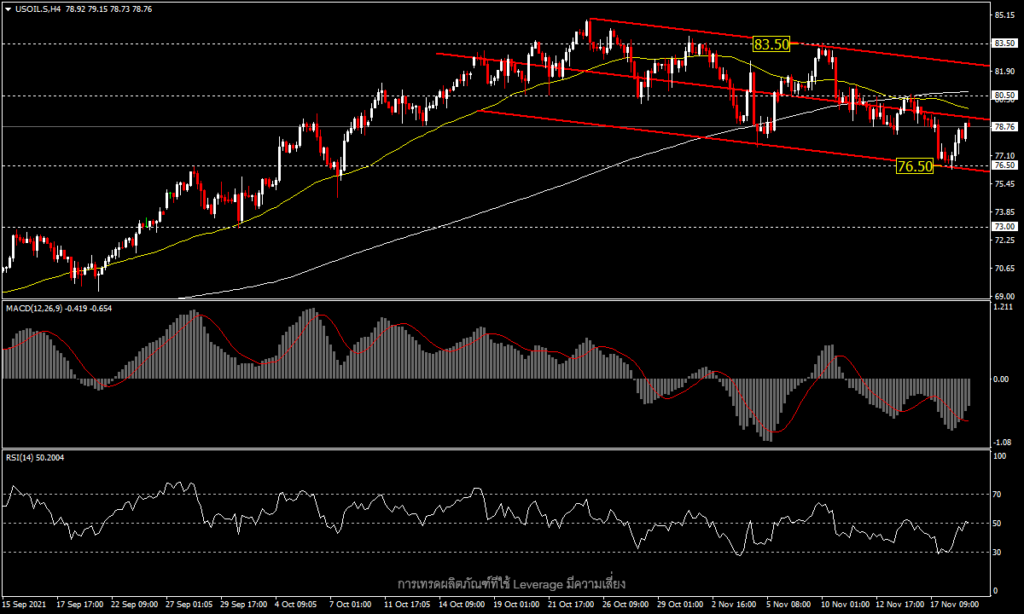

From a technical point of view USOIL prices are still on the cusp of a correction and further downward pressure. On H4, prices remain in the downtrend channel below the 50- and 200-period SMA, in line with the MACD which is in negative territory, while the RSI is still struggling to recover above 50 level. If the price continues to drop, it could retest the week low of 76.50 and it goes through, that means a correction could continue at the 73.00 support, and vice versa. Strong Resistance is at 80.50 at the 200-day SMA, which if passed will open the way to the opportunity to make a new year high again.

Chayut Vachirathanakit and Andria Pichidi

Market Analysts

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.